Avios online banking partner Monese boosts its benefits – should you apply?

Links on Head for Points may support the site by paying a commission. See here for all partner links.

Back in February we wrote about the new partnership between online banking service Monese and Avios.

Avios Group joined a £60m funding round for Monese in December 2018, and this is now leading to various bits of Avios functionality appearing in the Monese app.

Monese has just revamped its benefits package, and it is now substantially more competitive alongside Revolut, Monzo, N26, Starling, Atom etc. Most importantly, the free plan now allows you to spend £2,000 per month in foreign currency with no foreign exchange fees.

What is Monese?

Monese, founded in 2013, aims to simplify the process of getting a bank account in Europe. It’s a ‘mobile app only’ bank that gives users a £ and a € account allowing them to bank like a local across the UK and Europe.

Accounts can be opened within two minutes with a photo ID and a video selfie. (This does work, I set up an account for myself in record time without leaving my desk.)

The company launched its banking product in 2015 and currently has over 1,000,000 users in 31 countries, supporting 12 languages. Customers are currently moving $3 billion through their Monese accounts each year.

How does Monese work?

You can find full details of how Monese works on its website.

In summary, there are three different plans to choose from.

- Simple – FREE

- Classic – £4.95 / month

- Premium – £14.95 / month

What has changed about Monese pricing?

The free ‘Simple’ plan is now substantially more attractive:

- There is no longer an ATM fee – you can now withdraw £200 per month without charge

- There is no longer a £5 delivery fee for getting a plastic debit card – this is now free

- There is no longer a charge for foreign currency spending – your first £2,000 per month is now free

- You can now make foreign currency transfers between Monese members for free

This makes Monese more comparable with Monzo etc.

Introducing the new Avios partnership

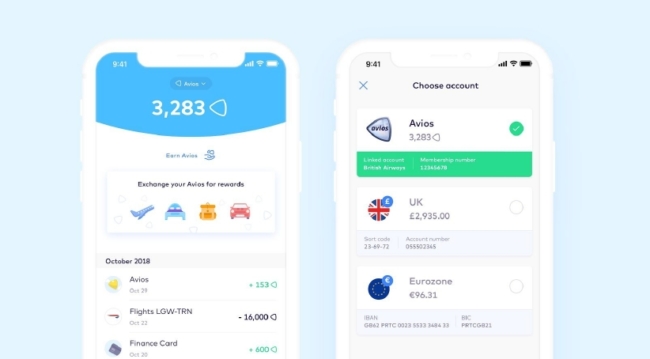

Monese users can link their Avios account to their Monese account and track their Avios earning in the same app as their banking balance. This includes Avios earned from flights, via the e-store and any Avios earned from credit cards.

The app currently lists your last five Avios transactions and Monese is working on increasing this.

There is a menu option, although it is not fully live yet, to earn bonus Avios when spending at specific retailers with your Monese debit card.

Is it worth getting a free Monese account?

Whilst being able to track your Avios balance from within the Monese app is a cool function, Monese still lacks any ‘killer’ Avios functionality which would make it a ‘must have’ for HfP readers.

It is getting there, however, and if you are looking to try an ‘online only’ bank then Monese may be more relevant to you than Monzo, Revolut etc. There is no need to close your existing High Street account – you can simply transfer money to and from your Monese account as you need it.

Remember that you can now spend £2,000 per month abroad without FX fees. Monese is a good card to take on holiday this Summer if you don’t have a dedicated ‘0% FX fees’ credit card. You can easily top up your Monese account before you fly and then transfer any remaining balance to your main current account on your return.

If you are reading this on a mobile device, you can get the Monese app by clicking here. Remember that signing up to the ‘Simple’ account is FREE and you can do it in a couple of minutes with a video selfie and a scan of some photo ID.

PS. If you are not a regular Head for Points visitor, why not sign up for our FREE weekly or daily newsletters? They are full of the latest Avios, airline, hotel and credit card points news and will help you travel better. To join our 70,000 free subscribers, click the button below or visit this page of the site to find out more. Thank you.

How to earn Avios from UK credit cards (July 2025)

As a reminder, there are various ways of earning Avios points from UK credit cards. Many cards also have generous sign-up bonuses!

In February 2022, Barclaycard launched two exciting new Barclaycard Avios Mastercard cards with a bonus of up to 25,000 Avios. You can apply here.

You qualify for the bonus on these cards even if you have a British Airways American Express card:

Barclaycard Avios Plus Mastercard

Get 25,000 Avios for signing up and an upgrade voucher at £10,000 Read our full review

Barclaycard Avios Mastercard

Get 5,000 Avios for signing up and an upgrade voucher at £20,000 Read our full review

There are two official British Airways American Express cards with attractive sign-up bonuses:

British Airways American Express Premium Plus Card

30,000 Avios and the famous annual Companion Voucher voucher Read our full review

British Airways American Express Credit Card

5,000 Avios for signing up and an Economy 2-4-1 voucher for spending £15,000 Read our full review

You can also get generous sign-up bonuses by applying for American Express cards which earn Membership Rewards points. These points convert at 1:1 into Avios.

American Express Preferred Rewards Gold Credit Card

Your best beginner’s card – 20,000 points, FREE for a year & four airport lounge passes Read our full review

The Platinum Card from American Express

50,000 bonus points and great travel benefits – for a large fee Read our full review

Run your own business?

We recommend Capital on Tap for limited companies. You earn points worth 0.8 Avios per £1 on the FREE standard card and 1 Avios per £1 on the Pro card. Capital on Tap cards also have no FX fees.

Capital on Tap Visa

NO annual fee, NO FX fees and points worth 0.8 Avios per £1 Read our full review

Capital on Tap Pro Visa

10,500 points (=10,500 Avios) plus good benefits Read our full review

There is also a British Airways American Express card for small businesses:

British Airways American Express Accelerating Business Card

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

There are also generous bonuses on the two American Express Business cards, with the points converting at 1:1 into Avios. These cards are open to sole traders as well as limited companies.

The American Express Business Platinum Card

50,000 points when you sign-up and an annual £200 Amex Travel credit Read our full review

The American Express Business Gold Card

20,000 points sign-up bonus and FREE for a year Read our full review

Click here to read our detailed summary of all UK credit cards which earn Avios. This includes both personal and small business cards.

Rob

Rob

Comments (64)