Is there any link between Marriott Bonvoy peak and off-peak dates and the hotel cash price?

Links on Head for Points may support the site by paying a commission. See here for all partner links.

We have recently spent a lot of time looking at the aggressive changes to IHG Rewards redemption pricing.

Using an allegedly ‘dynamic’ model, IHG reward pricing is now all over the place, whether you compare multiple hotels on the same day, or the same hotel over a period of time. There is minimal logic to it.

IHG Rewards isn’t the only programme to have a random approach to ‘dynamic’ pricing, of course ….

Marriott Bonvoy launched peak and off-peak pricing a couple of years ago.

When it was announced, we all assumed that it would look something like the peak and off-peak chart used for British Airways Avios flight redemptions. We thought we would see whole months, or at least chunks of weeks, marked as either peak, off-peak or standard. We were wrong.

What has actually happened is that hotels jump between peak, standard and off-peak reward pricing from day to day.

Redemption pricing at Marriott Canary Wharf

Marriott Canary Wharf is a good example because, as a Central London hotel, there are substantial swings in the cash price from day to day depending on what is going on. Anika’s review of Marriott Canary Wharf is here if you want to find out more about the hotel in general.

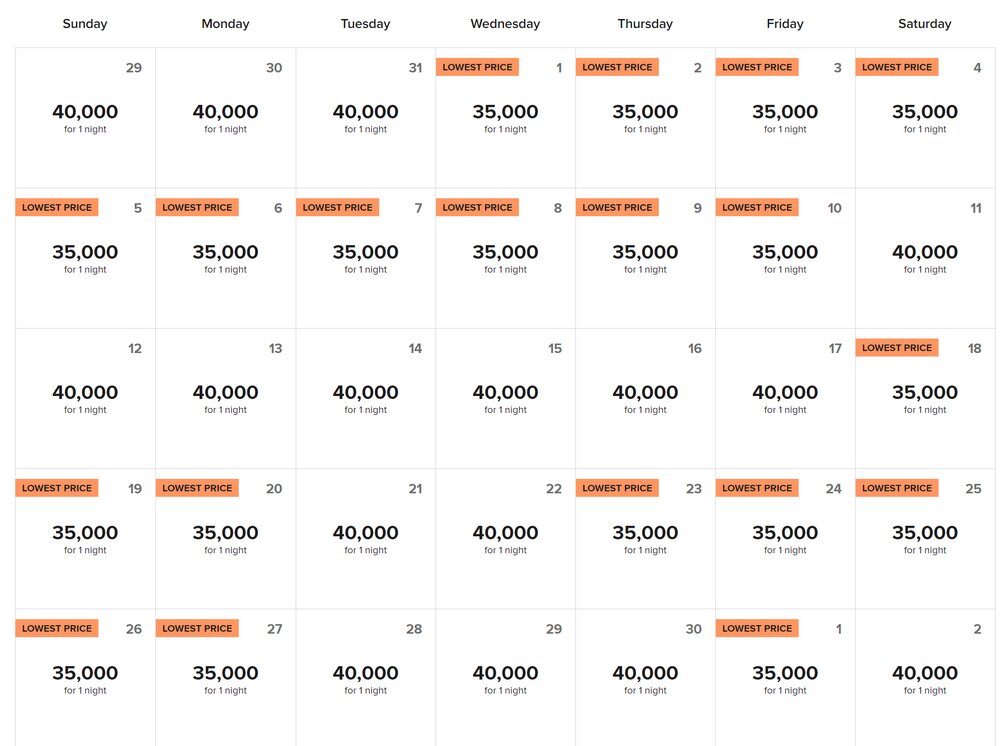

Here is the Bonvoy redemption pricing for 29th August to 2nd October 2021 (click to enlarge):

Of the 35 days covered, there is redemption availability on all of them:

Of the 35 days covered, there is redemption availability on all of them:

16 nights are ‘peak’ at 40,000 Bonvoy points

19 nights are ‘standard’ at 35,000 Bonvoy points

0 nights are ‘off-peak’ at 30,000 Bonvoy points

The distribution is fairly random, with Tuesday and Wednesday more likely to be peak. No day of the week is entirely peak or off-peak.

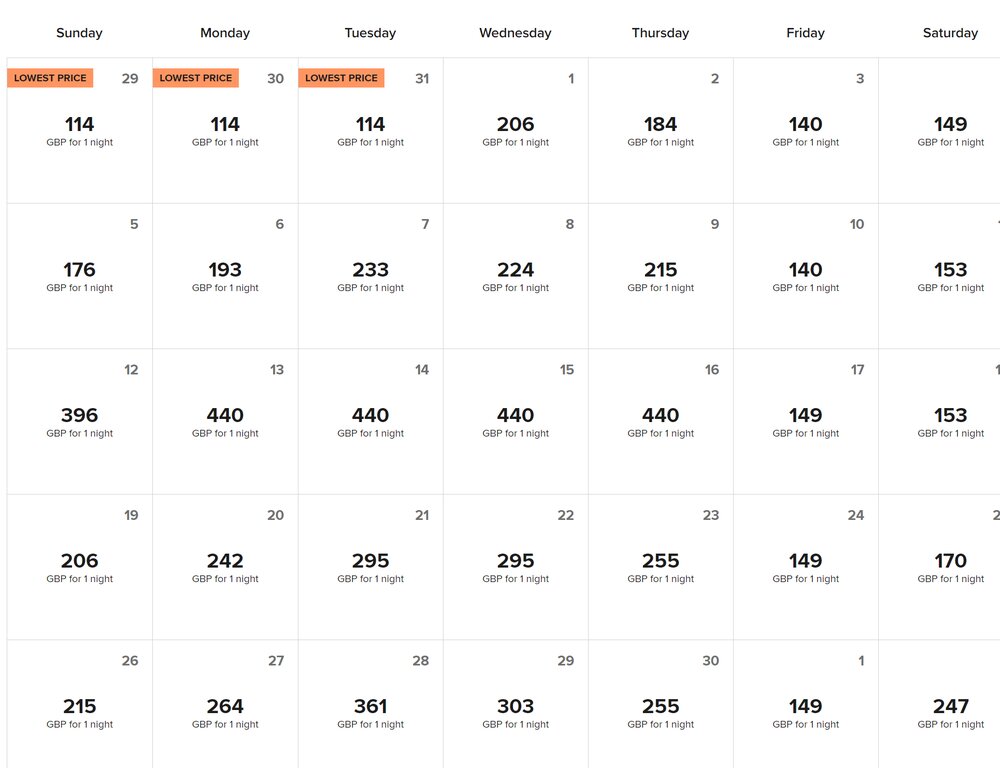

Let’s compare this to cash pricing:

Cash prices go from £114 to a whopping £440.

Is there any correlation between cash and points pricing?

Some, but not much:

The three cheapest nights for cash – all at £114 – are priced at the higher rate of 40,000 Bonvoy points per night. This is exceptionally poor value given that I target 0.5p per point when I redeem Marriott points.

The cheapest night selling at 40,000 points is £114

The most expensive night at 35,000 points is £264 – an impressive 0.75p per point

Saturday 11th is ‘peak’ with a £153 cash price, whilst Saturday 18th is also £153 but is priced at ‘standard’

No nights are off-peak, even though I doubt cash rates ever drop much below £114 at this hotel

All of the nights selling for £300+ are priced at 40,000 points, so there is some correlation between cash and points cost. Of course, there are also £114 nights at 40,000 points …..

What can we draw from this? Marriott Bonvoy, at least on this example, does not have a purely revenue-based redemption model. It is NOT as simple as saying ‘this hotel charges peak points when cash rates are above £xxx and off-peak points when cash rates are below £yyy’.

Is this good or bad? Is it actually better for members that the allocation is fairly random? I’m honestly not sure. The more random it is, the more chance of being able to get ‘outsized’ value on a redemption, but it also means that there will be more occasions when points look like bad value.

As with IHG, you need to take extra care to compare points rates and cash rates when planning a redemption to ensure you are getting good value.

PS. If you are not a regular Head for Points visitor, why not sign up for our FREE weekly or daily newsletters? They are full of the latest Avios, airline, hotel and credit card points news and will help you travel better. To join our 70,000 free subscribers, click the button below or visit this page of the site to find out more. Thank you.

How to earn Marriott Bonvoy points and status from UK credit cards (July 2025)

There are various ways of earning Marriott Bonvoy points from UK credit cards. Many cards also have generous sign-up bonuses.

The official Marriott Bonvoy American Express Card comes with 20,000 points for signing up, 2 points for every £1 you spend and 15 elite night credits per year.

SPECIAL OFFER: Until 15th July 2025, the sign-up bonus on the Marriott Bonvoy American Express Card is TRIPLED to 60,000 Marriott Bonvoy points. This would convert into 25,000 Avios or into 40 other airline schemes. It would also get you at least £300 of Marriott hotel stays based on our 0.5p per point low-end valuation. Other T&C apply and remain unchanged. Click here for our full card review and click here to apply.

You can apply here.

Marriott Bonvoy American Express Card

60,000 points (to 15th July) and 15 elite night credits each year Read our full review

You can also earn Marriott Bonvoy points by converting American Express Membership Rewards points at the rate of 2:3.

Do you know that holders of The Platinum Card from American Express receive FREE Marriott Bonvoy Gold status for as long as they hold the card? It also comes with Hilton Honors Gold, Radisson Rewards Premium and MeliaRewards Gold status.

We reviewed The Platinum Card from American Express in detail here and you can apply here.

The Platinum Card from American Express

50,000 bonus points and great travel benefits – for a large fee Read our full review

You can also earn Marriott Bonvoy points indirectly:

- American Express Preferred Rewards Gold Credit Card (20,000 bonus Amex points)

- The American Express Rewards Credit Card (10,000 bonus Amex points)

and for small business owners:

- The American Express Business Gold Card (20,000 bonus Amex points)

- The American Express Business Platinum Card (50,000 bonus Amex points)

The conversion rate from American Express to Marriott Bonvoy points is 2:3.

Rob

Rob

Comments (15)