IHG reduces Spire Elite qualifying points target, making the Premium credit card interesting

Links on Head for Points may support the site by paying a commission. See here for all partner links.

As we wrote on Friday, IHG Rewards Club has reduced the qualification threshold for its top tier Spire Elite status.

Spire Elite usually requires you to earn 75,000 base points in a calendar year. For 2020, this is reduced to 55,000 base points. Alternatively, you can qualify with 55 nights vs the usual 75 nights.

Before I go on, remember these two points:

when you qualify or requalify for Spire Elite, you receive a bonus of 25,000 IHG Rewards Club points

points earned for spending on the IHG credit cards – except for sign-up bonuses – count towards status

The IHG Rewards Club Premium Mastercard is now a good deal

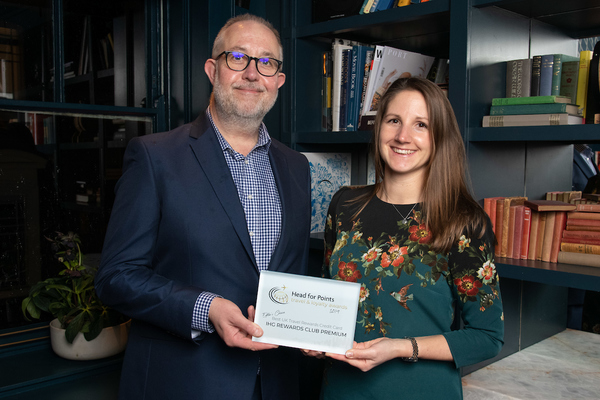

I think the £99 IHG Rewards Club Premium Mastercard is a fantastic product. That’s why we gave it an ‘Editor’s Choice’ award in the Head for Points 2019 Travel & Loyalty Awards.

Here is the IHG and Creation team collecting it at our winner’s dinner:

The application page for the IHG Rewards Club Premium Mastercard is here.

The headline features of this card are:

£99 annual fee

20,000 IHG Rewards Club points for joining and spending £200 in the first three months – these are worth about £80 of free hotel rooms or transferable to 4,000 Avios points or other airline miles

Platinum Elite status in IHG Rewards Club for as long as you hold the card. This is mid-tier, with Spire Elite being the top level. However, if you do a few Holiday Inn, Holiday Inn Express, Crowne Plaza or Indigo stays then it is worth having. It is occasionally enough for a Club room upgrade at a Crowne Plaza.

2 IHG Rewards Club point per £1 spent. I value IHG points at 0.4p so this is a 0.8% return.

4 IHG Rewards Club points per £1 when you pay at IHG hotels. This would be roughly a 1.6% return which is very good.

4 IHG Rewards Club points per £1 when you use the card abroad. As the card has a 2.99% FX fee you would be better off using a card without FX fees instead. The only reason to use the card abroad would be to work towards your free night voucher or earn additional IHG elite status points.

A free night voucher for any IHG hotel for spending £10,000. Use it at the InterContinental Paris, London, New York etc and you could be looking at £250 of value.

Representative APR is 45.1% variable including the £99 fee, based on a notional £1200 credit limit

Note that the free night voucher only appears at the end of your card year, irrespective of how quickly you spend £10,000. If you want to cancel the card without paying for a 2nd year, you need to ensure that NO transactions are made on the card between your anniversary date and the date the voucher appears. You can then call Creation to cancel and the £99 fee will be waived.

There are two minor restrictions on the free night voucher – it can’t be used at the handful of Regent hotels and it can’t be used at the Las Vegas or Macau casino InterContinental Alliance properties.

Let’s look at how you can get Spire Elite status

Let’s assume that you are keen to get Spire Elite status in IHG Rewards Club. In the most extreme scenario, you won’t do a single IHG cash stay this year and will earn all of your base points from the Premium Mastercard.

You spend £27,500 on the Premium Mastercard before the end of 2020

This gets you 55,000 IHG Rewards Club points

This triggers Spire Elite status

This triggers the bonus of 25,000 IHG Rewards Club points

£27,500 of spending has earned you 80,000 IHG Rewards Club points.

I value an IHG point at a conservative 0.4p. This means 80,000 points are worth £320.

You are getting a return of (£320 / £27,500) 1.16% on your £27,500. This is very good for a Mastercard or Visa.

That’s not all, of course.

Because you have spent over £10,000, you will also receive a free night voucher at the end of the year. Let’s assume you redeem this at an InterContinental on a peak night and get £250 of value. This is an extra 2.5% return on the first £10,000 of spending.

If you blend the two rewards together, you are getting £320 of points plus £250 of free room, total £570, for spending £27,500. This is an overall return of 2.1%.

This ignores the value of having Spire Elite status for the remainder of 2020 and all of 2021.

Note that the points must hit your IHG Rewards Club account in 2020 to trigger your status upgrade. This means that you need to be aware of when your final statement of the year is generated.

There is, of course, the £99 annual fee to consider. However, you receive a sign-up bonus of 20,000 IHG Rewards Club points (which do not count towards status) which virtually offsets the fee.

Conclusion

This isn’t a strategy for everyone. However:

if you can easily spend £27,500 on a Mastercard by the end of 2020 and

you fancy the idea of having top-tier IHG Rewards Club Spire Elite status

….. then this is something you should think about.

You can apply for the IHG Rewards Club Premium Mastercard here.

PS. If you are not a regular Head for Points visitor, why not sign up for our FREE weekly or daily newsletters? They are full of the latest Avios, airline, hotel and credit card points news and will help you travel better. To join our 70,000 free subscribers, click the button below or visit this page of the site to find out more. Thank you.

Want to earn more points from credit cards? – July 2025 update

If you are looking to apply for a new credit card, here are our top recommendations based on the current sign-up bonuses.

In 2022, Barclaycard launched two exciting new Barclaycard Avios Mastercard cards with a bonus of up to 25,000 Avios. You can apply here.

You qualify for the bonus on these cards even if you have a British Airways American Express card:

Barclaycard Avios Plus Mastercard

Get 25,000 Avios for signing up and an upgrade voucher at £10,000 Read our full review

Barclaycard Avios Mastercard

Get 5,000 Avios for signing up and an upgrade voucher at £20,000 Read our full review

You can see our full directory of all UK cards which earn airline or hotel points here. Here are the best of the other deals currently available.

SPECIAL OFFER: Until 14th August 2025, the sign-up bonus on the Hilton Honors Plus debit card is TRIPLED to 30,000 Hilton Honors points. You will also receive Gold Elite status in Hilton Honors for as long as you hold the card. Click here for our full card review and click here to apply.

American Express Preferred Rewards Gold Credit Card

Your best beginner’s card – 20,000 points, FREE for a year & four airport lounge passes Read our full review

British Airways American Express Premium Plus Card

30,000 Avios and the famous annual Companion Voucher voucher Read our full review

The Platinum Card from American Express

50,000 bonus points and great travel benefits – for a large fee Read our full review

Virgin Atlantic Reward+ Mastercard

18,000 bonus points and 1.5 points for every £1 you spend Read our full review

Earning miles and points from small business cards

If you are a sole trader or run a small company, you may also want to check out these offers:

The American Express Business Platinum Card

50,000 points when you sign-up and an annual £200 Amex Travel credit Read our full review

The American Express Business Gold Card

20,000 points sign-up bonus and FREE for a year Read our full review

Capital on Tap Pro Visa

10,500 points (=10,500 Avios) plus good benefits Read our full review

Capital on Tap Visa

NO annual fee, NO FX fees and points worth 0.8 Avios per £1 Read our full review

British Airways American Express Accelerating Business Card

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

Comments (46)