NEW: get a 25% bonus on HSBC Premier credit card points conversions to Avios

Links on Head for Points may support the site by paying a commission. See here for all partner links.

HSBC has launched a new 25% bonus on conversions of HSBC Premier credit card points to Avios.

Surprisingly, this bonus is not a secret for once – at least for some! Readers are reporting a message when you log in to your HSBC Premier rewards account promoting the offer. I don’t see it though ….

We even have terms and conditions for once, including a closing date.

What are the rules for the HSBC Premier Avios bonus?

It’s a simple one.

The offer runs from 3rd July to 3rd August 2023.

You will receive a 25% bonus on all transfers from HSBC Premier credit cards to Avios.

Your base Avios will arrive instantly, as with all other HSBC airline and hotel transfers. In theory the bonus Avios take 14 days to arrive, but in reality they are turning up instantly or very quickly.

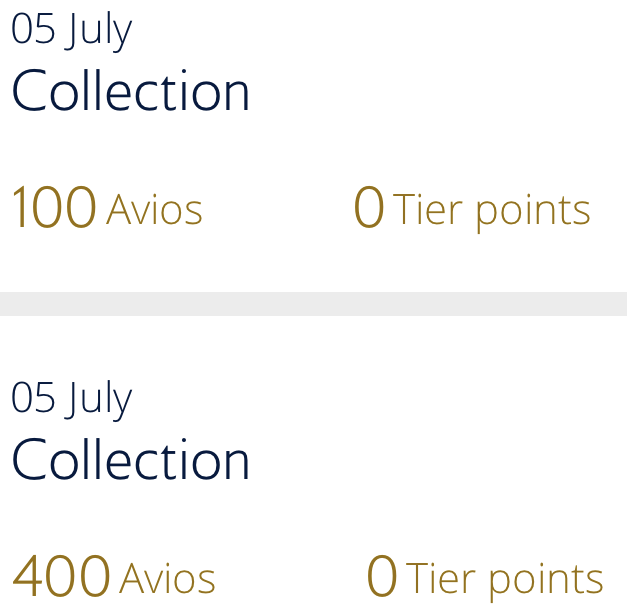

I did a dummy transfer last night and got my 25% bonus immediately:

Are the HSBC Premier credit cards a good way of earning Avios?

The two HSBC Premier credit cards are very generous. The snag is that you need to have a HSBC Premier current account to get them. Whilst Premier is free, the income and/or savings requirements are high as you can see here.

The free HSBC Premier Mastercard, reviewed here, earns 1 HSBC point per £1 spent (2 HSBC points per £1 spent abroad) and these convert at 2:1 into airline or hotel points. This means that you are getting 0.5 airline miles or hotel points per £1 spent in the UK. Don’t get confused by the HSBC earning rate and the equivalent airline miles and hotel points earning rate.

The £195 per year HSBC Premier World Elite Mastercard, reviewed here, earns 2 HSBC points per £1 spent in the UK (1 airline mile or hotel point per £1) and double this when abroad.

You can transfer your HSBC Premier points into the following airline schemes:

- Asia Miles

- British Airways Executive Club

- Emirates Skywards

- Etihad Guest

- EVA Air MileageLands

- Finnair Plus

- Flying Blue (Air France KLM)

- Qantas Frequent Flyer

- Singapore Airlines KrisFlyer

- TAP Miles&Go

There are two hotel partners:

- IHG One Rewards (which has reappeared)

- Wyndham Rewards

All conversion rates are 2:1 from HSBC points. This means that the IHG and Wyndham transfer rates are terrible value. A hotel point is generally worth about 2/3rd less than an airline mile, but HSBC requires 2 HSBC points irrespective of which partner you choose.

The World Elite £195 credit card also comes with airport lounge access via LoungeKey. The World Elite card is less good for families who want lounge access than American Express Platinum as your HSBC card only gets the main cardholder into an airport lounge.

You can pay £60 to give your partner a supplementary card for a year to get them in, but there is no way to get children into airport lounges for free. American Express Platinum, on the other hand, gets a family of four into a lounge.

You also get comprehensive travel insurance as part of the HSBC Premier current account, which makes this an interesting alternative to The Platinum Card from American Express for couples or solo travellers.

Conclusion

HSBC Premier’s semi-regular annual Avios conversion bonus is on! If you had been waiting for this before you transferred any points, now is the time.

Remember that there is a ‘hard’ 3-year expiry on HSBC credit card points. If you have any coming up for expiry, this is one way of using them up.

How to earn Avios from UK credit cards (April 2024)

As a reminder, there are various ways of earning Avios points from UK credit cards. Many cards also have generous sign-up bonuses!

In February 2022, Barclaycard launched two exciting new Barclaycard Avios Mastercard cards with a bonus of up to 25,000 Avios. You can apply here.

You qualify for the bonus on these cards even if you have a British Airways American Express card:

Barclaycard Avios Plus Mastercard

Get 25,000 Avios for signing up and an upgrade voucher at £10,000 Read our full review

Barclaycard Avios Mastercard

5,000 Avios for signing up and an upgrade voucher at £20,000 Read our full review

There are two official British Airways American Express cards with attractive sign-up bonuses:

British Airways American Express Premium Plus

25,000 Avios and the famous annual 2-4-1 voucher Read our full review

British Airways American Express

5,000 Avios for signing up and an Economy 2-4-1 voucher for spending £15,000 Read our full review

You can also get generous sign-up bonuses by applying for American Express cards which earn Membership Rewards points. These points convert at 1:1 into Avios.

American Express Preferred Rewards Gold

Your best beginner’s card – 20,000 points, FREE for a year & four airport lounge passes Read our full review

The Platinum Card from American Express

40,000 bonus points and a huge range of valuable benefits – for a fee Read our full review

Run your own business?

We recommend Capital on Tap for limited companies. You earn 1 Avios per £1 which is impressive for a Visa card, along with a sign-up bonus worth 10,500 Avios.

SPECIAL OFFER: Until 12th May 2024, the Capital on Tap Business Rewards Visa card is offering a bonus of 30,000 points, convertible into 30,000 Avios. You must have a Limited Company to apply. Click here to learn more and click here to apply.

Capital on Tap Business Rewards Visa

Huge 30,000 points bonus until 12th May 2024 Read our full review

You should also consider the British Airways Accelerating Business credit card. This is open to sole traders as well as limited companies and has a 30,000 Avios sign-up bonus.

British Airways Accelerating Business American Express

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

There are also generous bonuses on the two American Express Business cards, with the points converting at 1:1 into Avios. These cards are open to sole traders as well as limited companies.

American Express Business Platinum

40,000 points sign-up bonus and an annual £200 Amex Travel credit Read our full review

American Express Business Gold

20,000 points sign-up bonus and FREE for a year Read our full review

Click here to read our detailed summary of all UK credit cards which earn Avios. This includes both personal and small business cards.

Rob

Rob

Comments (48)