It’s 60 years since American Express UK launched its £ cards – we look back …. and reveal C F Frost

Links on Head for Points may support the site by paying a commission. See here for all partner links.

You probably haven’t given much thought to the history of the plastic in your wallet, but after American Express told us that today was 60 years since it launched its first Sterling card in the UK we thought it was worth taking a trip down memory lane.

American Express wasn’t always a financial services company. Founded in 1850 in Buffalo, New York, American Express was initially a freight forwarding company (hence the ‘Express’).

Around the turn of the century (the 20th century, that is), Amex diversified and started offering money orders, travellers cheques and foreign currency exchange. It opened its first UK office in London’s 3 Waterloo Place in 1896. The first European office of any sort was in Paris, opening in 1895.

According to Amex:

“From 1914 – 1918 during World War I, American Express helped 150,000 stranded travellers in Europe by cashing Travellers Cheques and booking passage to America, at a time when customers had been unable to withdraw funds from their banks.”

Following the US nationalisation of express industry after the first World War in 1918, American Express focused wholly on its banking and travel services.

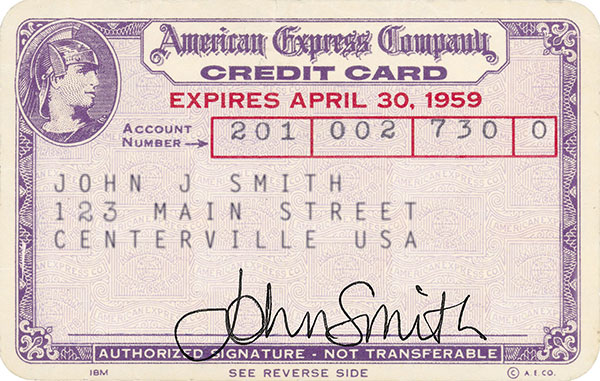

The first American Express Card was launched in 1958. It was a paper card in purple (photo above); embossed plastic cards followed in 1959. In 1969 the colour of the card changed to “money green” to match the colour of the US dollar.

It was another five years before the company would introduce its first pound sterling American Express Card (technically a charge card) in 1963.

Upon its launch, the BBC noted that:

“There will be an annual fee of £3 12s, but supplementary cards can be obtained at half price for immediate family members. Companies can also apply for cards and issue them to members of staff.”

Adjusted for inflation, £3 12s is around £90; average weekly earnings in 1963 were around £10 according to the Office for National Statistics. The BBC continues:

“American Express Vice President Maxwell Elliot said the people most likely to take up the new card would be managers and sales executives earning £2,000 a year or more.”

Whilst often synonymous with credit and charge cards, American Express was not the first provider in the UK; that was Finders Services, which launched in 1951 and merged with Credit Card Services to form Diners Club UK in 1962.

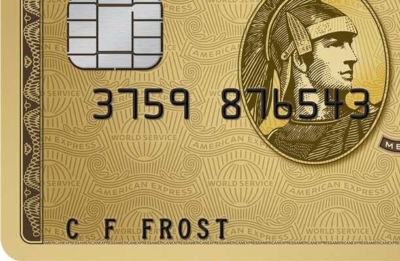

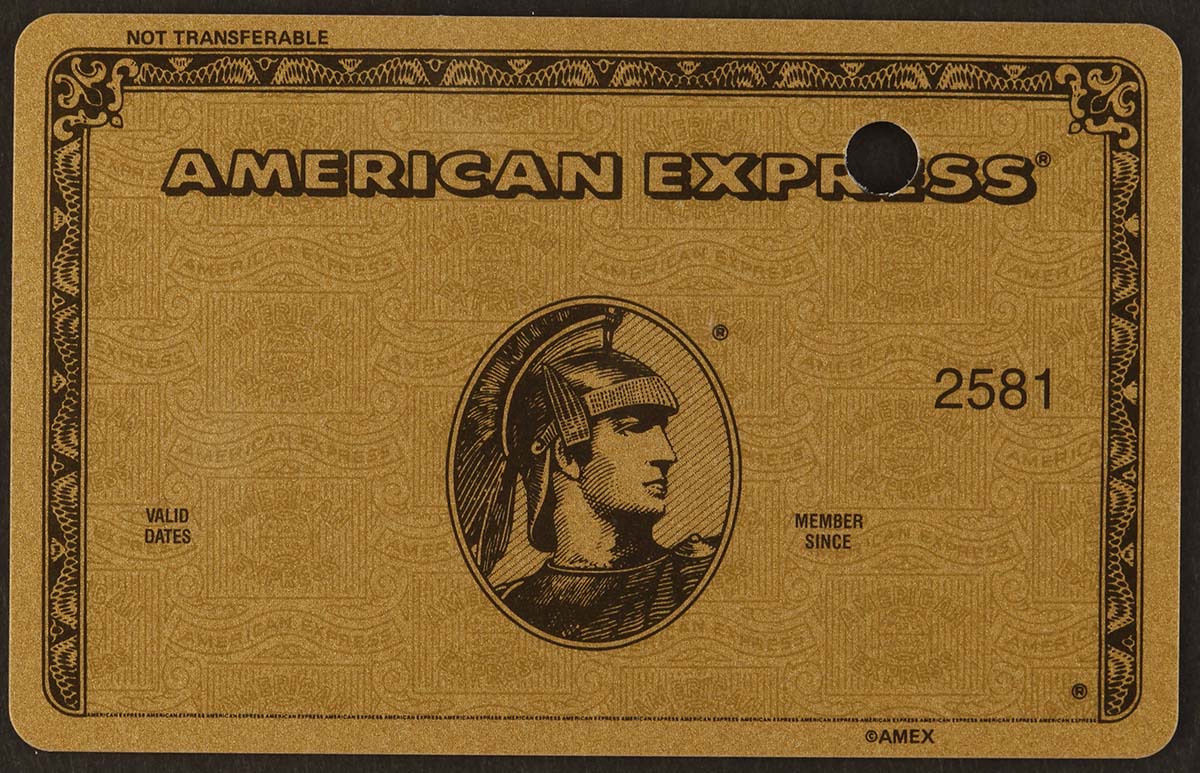

It was almost 20 years until Amex launched the Gold Card in 1981, with the Platinum Card following 10 years later in 1991. The card designs haven’t changed much in that time.

Membership Rewards, then known as Membership Miles, were introduced in 1993 and the first ‘proper’ American Express credit card was launched in 1995.

In 2000, American Express partnered with British Airways to launch the he British Airways American Express cards.

The rest, as they say, is history.

PS. Things you never knew you never knew ….

And finally ….

“Charles F. Frost was an Oglivy & Mather advertising executive who worked on the American Express account in the 1960s, and his name was kept alive by being featured on credit cards displayed in ads for American Express.”

Thanks to Adweek for this nugget.

PS. If you are not a regular Head for Points visitor, why not sign up for our FREE weekly or daily newsletters? They are full of the latest Avios, airline, hotel and credit card points news and will help you travel better. To join our 70,000 free subscribers, click the button below or visit this page of the site to find out more. Thank you.

Want to earn more points from credit cards? – July 2025 update

If you are looking to apply for a new credit card, here are our top recommendations based on the current sign-up bonuses.

In 2022, Barclaycard launched two exciting new Barclaycard Avios Mastercard cards with a bonus of up to 25,000 Avios. You can apply here.

You qualify for the bonus on these cards even if you have a British Airways American Express card:

Barclaycard Avios Plus Mastercard

Get 25,000 Avios for signing up and an upgrade voucher at £10,000 Read our full review

Barclaycard Avios Mastercard

Get 5,000 Avios for signing up and an upgrade voucher at £20,000 Read our full review

You can see our full directory of all UK cards which earn airline or hotel points here. Here are the best of the other deals currently available.

SPECIAL OFFER: Until 14th August 2025, the sign-up bonus on the Hilton Honors Plus debit card is TRIPLED to 30,000 Hilton Honors points. You will also receive Gold Elite status in Hilton Honors for as long as you hold the card. Click here for our full card review and click here to apply.

American Express Preferred Rewards Gold Credit Card

Your best beginner’s card – 20,000 points, FREE for a year & four airport lounge passes Read our full review

British Airways American Express Premium Plus Card

30,000 Avios and the famous annual Companion Voucher voucher Read our full review

The Platinum Card from American Express

50,000 bonus points and great travel benefits – for a large fee Read our full review

Virgin Atlantic Reward+ Mastercard

18,000 bonus points and 1.5 points for every £1 you spend Read our full review

Earning miles and points from small business cards

If you are a sole trader or run a small company, you may also want to check out these offers:

The American Express Business Platinum Card

50,000 points when you sign-up and an annual £200 Amex Travel credit Read our full review

The American Express Business Gold Card

20,000 points sign-up bonus and FREE for a year Read our full review

Capital on Tap Pro Visa

10,500 points (=10,500 Avios) plus good benefits Read our full review

Capital on Tap Visa

NO annual fee, NO FX fees and points worth 0.8 Avios per £1 Read our full review

British Airways American Express Accelerating Business Card

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

Rob

Rob

Comments (55)