How much money will British Airways lose running the ‘Avios only’ flight to Dubai?

Links on Head for Points may support the site by paying a commission. See here for all partner links.

This is a guest post by Oliver Ranson, who runs the fascinating Airline Revenue Economics blog on Substack.

You can read Oliver’s previous HfP articles, “How we built the first business case for the award-winning Qatar Airways Qsuite“, here and “Why the disappearance of First Class is down to bad marketing, not lack of demand” here.

You can sign up to receive Oliver’s future articles by email here. There is no charge. You can also find a longer and more technical version of this article over there – we have edited it to reflect our broader readership. Over to Oliver …..

On Tuesday, Avios collectors got a present from British Airways (see this HfP article). For the first time in IAG’s history a whole long-haul aircraft has been made available exclusively for people paying with points.

BA had experimented with Avios-only flights before, but limited it to pint-sized trips to European destinations like ski-snow-slopes Geneva, sun-sea-sand Ibiza and, for culture vultures, Florence.

This time it is different. Every fully-flat bed – and non-flat seat – on a wide-body will be occupied by a points booker. The late overnight flight to Dubai on 26th October 2024 and the lunchtime return on 2nd November 2024 will be full of leisure travellers pleased to have grabbed a bargain.

These flights are normally expensive as they are timed for the autumn half-term break (or, to avoid confusing First Class passengers, Michaelmas exeat .…).

Comparable flights from London on the same day are £1,082 in World Traveller with a bag, £1,870 in World Traveller Plus, £3,520 in Club World and £4,820 in First. The prices might go down a bit in one of BA’s inevitable red-banner sales. But for these peak-of-the-peak services, probably not by much.

It must be the case that seats sold for a fixed mix of Avios and cash are less valuable to an airline than selling seats for cash. If this were not so, many more seats would be available for points.

This means that I would expect IAG to be losing money on the Avios-only flights. The question is, how much? Read on to find out.

I apologise in advance for some of the terminology about fare classes used below. You can skip over some of the more technical paragraphs and jump to the conclusion if you wish!

Rack ‘em up

I have a technique I use that takes published fares and calculates a “best-guess” estimate of how much revenue particular flights and routes can generate for airlines. I call it the “shelf” principle.

Imagine you are in a shop looking at the things for sale. Items on the bottom shelf are often the cheapest. You need to look for them and reach down to pick them up, but because they are cheap and the laws of economics apply, many people will. Items on the bottom shelf sell at low prices but in high volume.

Now consider the top shelf. That is where the specialist magazines priciest items tend to be. Everyone can see them, but not everyone wants them. So the shop puts them above your eye line and you need to reach up if you want one. The top shelf has low volume but high prices.

Finally, imagine the middle shelf. It is eye level and in easy reach – desirable real estate. It has all your favourite brands on, but maybe you do not always buy your favourite. The middle shelf has mid-range volume and mid-range prices.

So:

- Bottom shelf – high volume, low prices

- Top shelf – low volume, high prices

- Middle shelf – mid-range volume, mid-range prices

All three shelves probably generate the same revenue. Or margin, since this is retail. The key idea is that each shelf contributes equally.

It is the same with a well-run airline fare structure. Our best guess as observers is that each fare class, or revenue booking designator as we say in the trade, contributes an equal amount of revenue within a cabin.

Imagine an airline with only three Economy fares:

- £1,000 for fully flexible

- £800 for semi flexible

- £600 for non-refundable

If revenue management has optimised the fares so that each contributes equally, how many seats will be sold at each price point to generate £100,000?

- £100,000 / £1,000 = 100 seats

- £100,000 / £800 =125 seats

- £100,000 / £600 = 166 seats

Total seats sold = 100 + 125 + 166 = 391. These sort of proportions are realistic in my experience.

What does BA charge for cash to fly to Dubai?

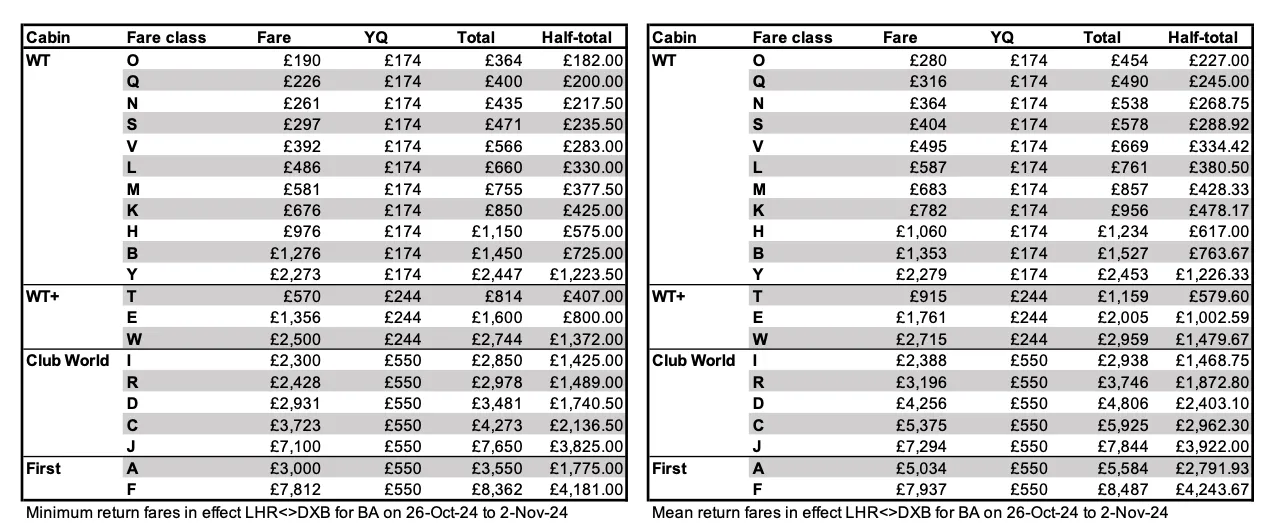

The first of the two tables below shows the minimum fare in each fare class on London to Dubai for BA on the day when the Avios-only flight operates. The second table shows the mean fare.

To each fare I have added the rip off taxes YQ carrier surcharge to see how much BA collects when it sells the seat. Then I divided by two to get the equivalent one-way rate.

It is important to note that the fares actually for sale on BA’s website are not what the airline is expecting to receive for a flight. Not just on this Dubai pair, but on every flight.

There are various reasons for this. Corporates and travel agents often have access to special deals, and some passengers will be connecting, leading to complex rules about apportioning revenue. Connecting tickets are worth less per segment than a direct booking ex-London but still worthwhile if the total ticket value is worth having.

What would BA have made selling these flights for cash?

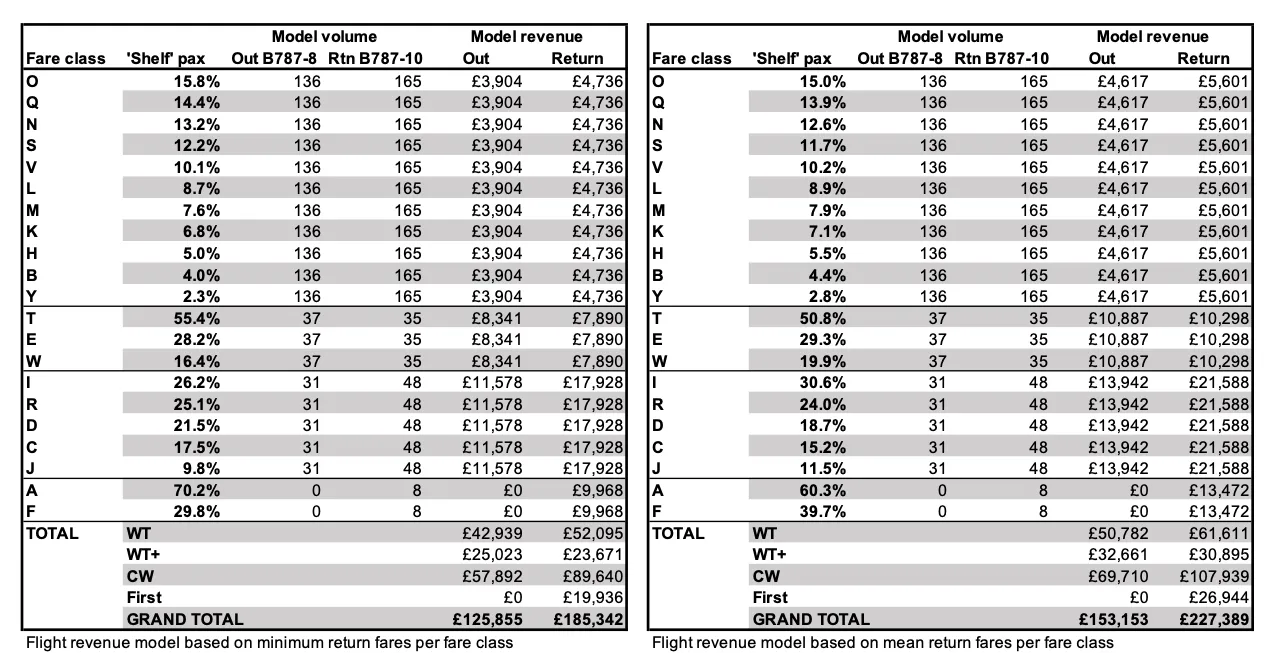

Using my ‘shelf’ principle of each fare type (flexible, semi flexible, non-refundable) contributing the same overall total revenue, I can work out my best-guess estimate of ‘lost’ revenue for the Avios-only flight.

Since this is half-term to Dubai, I think it is fair to say that under normal conditions British Airways would have sold every seat. I haven’t adjusted for the ‘guaranteed’ 14 Avios seats that would have been available regardless of this offer.

The table on the left assumes that every seat is sold for minimum price in that particular fare class. The table on the right uses the mean price.

There is no First cabin on the outbound service and the outbound flight has lower capacity overall.

The outbound flight would have been expected to produce £125,855 to £153,153 of revenue and the inbound flight £185,342 to £227,389.

Is this more or less money than you expected a long-haul BA flight to generate?

Note how much revenue is estimated to come just from Club World: 45% to 48%.

What will BA make selling these flights for Avios?

So how much will BA earn from the Avios-only flight? BA will get paid in full – or at least I find it hard to believe they will not.

They will be paid by their sister company IAG Loyalty, which collects revenue from selling Avios and buys seats from BA to be used by Avios collectors, who return their points to IAG Loyalty in return.

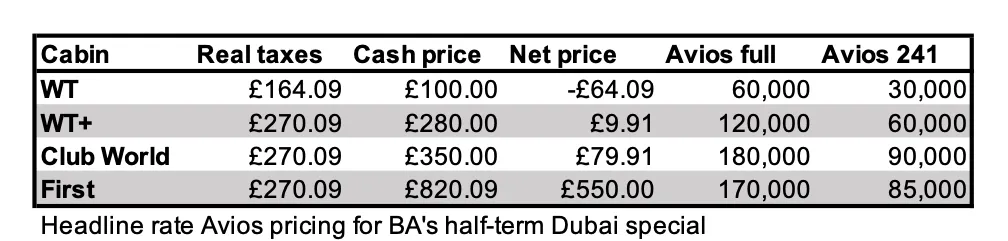

Let’s have a look at the Avios prices. At the time of writing the ‘real’ taxes and charges were £164 for World Traveller tickets and £270 for tickets in other cabins. This is money that BA has to pay to the British government in Air Passenger Duty (APD) and the various airport operators and agencies along the way. The difference is down to APD, which is charged at a ‘reduced’ rate for passengers travelling in economy cabins like BA’s World Traveller.

BA’s redemption pricing is quite complex and there are various ways to optimise the scheme. The headline pricing is as shown in the table below.

Not all passengers will pay the full price. Many will use an American Express 2-4-1 voucher, giving the holder two-for-the-Avios-of-one or a half-Avios price for somebody flying solo.

Some scenario modelling ….

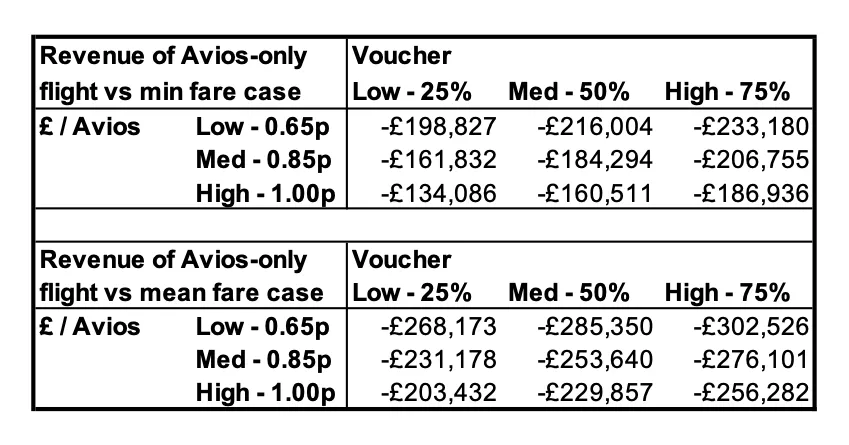

I used two sets of variables – three different guesses for what BA is paid per Avios, and three different guesses on the percentage of seats booked with 2-4-1 companion vouchers.

The Avios values feel about right to me. 1p is my own target value and so far I have almost always done a lot better. 0.65p could represent the ‘mate’s rates’ scenario for pricing within IAG, if they have one. 0.85p is a middle-way scenario.

There are enough 2-4-1 vouchers around and a dedicated enough community of points collectors (remember that Head for Points readers had advance notice that these seats would be available) that I would be surprised if most seats were not bought using 2-4-1 vouchers.

My calculations assume that British Airways is not paid an extra fee by American Express or IAG Loyalty when a 2-4-1 voucher is used.

How much money will BA lose on these flights?

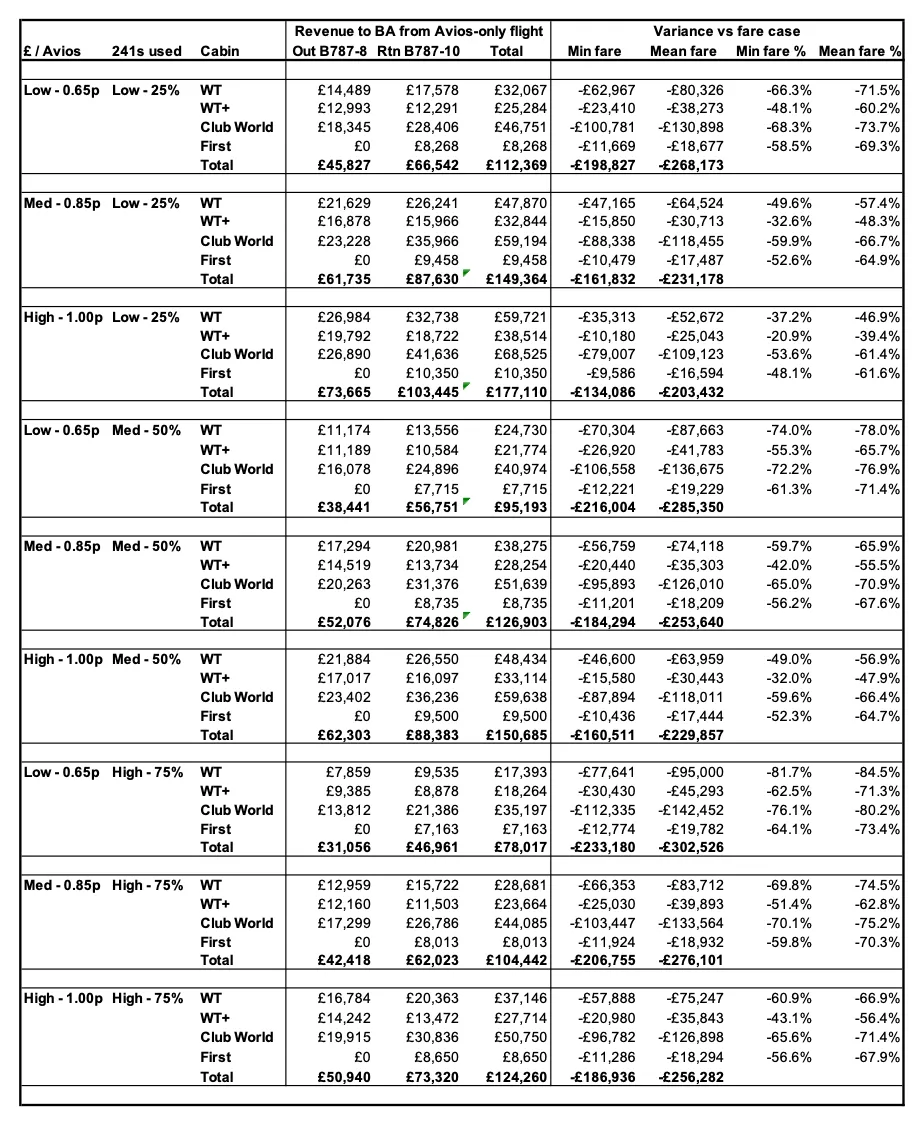

Here is the ‘executive summary’ table. Pick whichever scenario of ‘pence BA gets per Avios’ and ‘% of seats going to 2-4-1’ holders that you think is most realistic.

The number below is the loss that British Airways will take on this ‘Avios only’ flight compared to what it would expect to make selling the flight for cash.

Here are the results of the model in full (feel free to skip!):

On my calculations British Airways is going to lose between £134,000 and £302,000, return, by offering these Avios-only flights. Of course in reality BA will probably be paid their model of the market value of the flight and IAG Loyalty will take any hit for accounting purposes.

Notice how much higher the loss is for Club World and First than for World Traveller and World Traveller Plus. Club World and First will lose up to 80.2% and 73.4% of the revenue respectively that we would expect these flights to generate. No wonder premium cabin redemption seats are scarce.

Are you surprised that World Traveller Plus has the lowest loss? You shouldn’t be. Avios tickets are twice the Avios price of World Traveller, but cash fares at the top end (semi flexible, flexible) are relatively similar.

Club World, on the other hand, requires only 50% more Avios than World Traveller Plus but cash prices are roughly 3x higher.

Will it be worth it for IAG to lose this money? You bet. Loyalty programmes are a cash cow for airlines. A flight where every seat goes for points is great marketing for British Airways and IAG Loyalty. More collectors will come in and existing collectors will keep building their balances as a result.

When I checked on Thursday night almost every economy class seat had been sold for Avios on the way out, not just higher cabins. This is powerful marketing at work.

PS. If you are not a regular Head for Points visitor, why not sign up for our FREE weekly or daily newsletters? They are full of the latest Avios, airline, hotel and credit card points news and will help you travel better. To join our 70,000 free subscribers, click the button below or visit this page of the site to find out more. Thank you.

How to earn Avios from UK credit cards (August 2025)

As a reminder, there are various ways of earning Avios points from UK credit cards. Many cards also have generous sign-up bonuses!

In February 2022, Barclaycard launched two exciting new Barclaycard Avios Mastercard cards with a bonus of up to 25,000 Avios. You can apply here.

You qualify for the bonus on these cards even if you have a British Airways American Express card:

Barclaycard Avios Plus Mastercard

Get 25,000 Avios for signing up and an upgrade voucher at £10,000 Read our full review

Barclaycard Avios Mastercard

Get 5,000 Avios for signing up and an upgrade voucher at £20,000 Read our full review

There are two official British Airways American Express cards with attractive sign-up bonuses:

British Airways American Express Premium Plus Card

30,000 Avios and the famous annual Companion Voucher voucher Read our full review

British Airways American Express Credit Card

5,000 Avios for signing up and an Economy 2-4-1 voucher for spending £15,000 Read our full review

You can also get generous sign-up bonuses by applying for American Express cards which earn Membership Rewards points. These points convert at 1:1 into Avios.

American Express Preferred Rewards Gold Credit Card

Your best beginner’s card – 20,000 points, FREE for a year & four airport lounge passes Read our full review

The Platinum Card from American Express

50,000 bonus points and great travel benefits – for a large fee Read our full review

Run your own business?

We recommend Capital on Tap for limited companies. You earn points worth 0.8 Avios per £1 on the FREE standard card and 1 Avios per £1 on the Pro card. Capital on Tap cards also have no FX fees.

Capital on Tap Visa

NO annual fee, NO FX fees and points worth 0.8 Avios per £1 Read our full review

Capital on Tap Pro Visa

10,500 points (=10,500 Avios) plus good benefits Read our full review

There is also a British Airways American Express card for small businesses:

British Airways American Express Accelerating Business Card

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

There are also generous bonuses on the two American Express Business cards, with the points converting at 1:1 into Avios. These cards are open to sole traders as well as limited companies.

The American Express Business Platinum Card

50,000 points when you sign-up and an annual £200 Amex Travel credit Read our full review

The American Express Business Gold Card

20,000 points sign-up bonus and FREE for a year Read our full review

Click here to read our detailed summary of all UK credit cards which earn Avios. This includes both personal and small business cards.

Rob

Rob

Comments (73)