British Airways now lets you pay 100% of any CASH flight with Avios – but is it a good deal?

Links on Head for Points may support the site by paying a commission. See here for all partner links.

For a number of years now, British Airways has allowed you to use Avios to reduce the price of a cash flight.

A similar structure is used by Vueling and Aer Lingus, BA’s two low cost sister carriers, but there were key differences.

Have these BA changes made things better or worse?

Vueling and Aer Lingus always allowed you to pay for the entire cost of your flight with Avios, down to the last penny.

British Airways did not allow this. You had to pay the taxes and charges element in cash. This was confusing for customers, because the ‘taxes and charges’ element isn’t obvious when booking a cash flight. Customers didn’t understand why they had to pay a seemingly random element in cash despite having enough Avios.

The second difference was that Aer Lingus and Vueling let you use Avios at a flat rate to part-pay a flight. This is usually in the 0.5p-0.55p per Avios range. Whether you pay 1% or 100% of the flight cost with Avios, the value per point is the same.

British Airways took a different approach. You would get a generous offer for using a small number of Avios – often £10 off for using 1,000 points – but for larger sums the value was very poor, often well under 0.5p per Avios.

Let’s take a look at what has changed

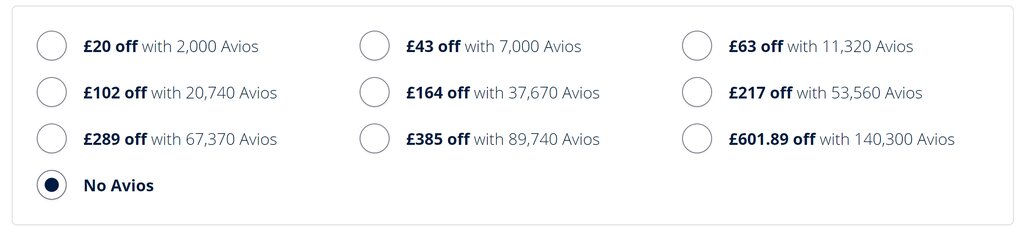

Here is an example of a cash economy flight to New York under the new pricing.

The cash cost is £602.89. I am offered:

- £20 off for 2,000 Avios = 1p per Avios

- £43 off for 7,000 Avios = 0.61p per Avios

- £63 off for 11,320 Avios = 0.56p per Avios

- £102 off for 20,740 Avios = 0.49p per Avios

- £164 off for 37,670 Avios = 0.44p per Avios

- £217 off for 53,560 Avios = 0.41p per Avios

- £289 off for 67,370 Avios = 0.43p per Avios

- £385 off for 89,740 Avios = 0.43p per Avios

- £601.89 off for 140,300 Avios = 0.43p per Avios

You’ll note that £1 must be paid in cash. I suspect that this is for security reasons. It makes it slightly riskier to use a hacked British Airways account to book an ‘all Avios’ flight when a credit card is required to pay a nominal sum.

This is NOT a good deal

‘Part Pay With Avios’ was always a bad deal, apart from the nominal 1p per Avios saving for using the smallest possible amount. (If I am booking a cash BA flight for myself, I always take the £10 or £20 saving.) Nothing has changed.

It makes no sense, at all, to accept under 0.5p per Avios. Even after two devaluations, you will still get 0.5p per Avios when transferring your points into Nectar. You can spend this money at Sainsburys, Argos or eBay. Taking as little as 0.41p per Avios via ‘Part Pay With Avios’ is crazy.

If you do nothing else, pay the full cash rate and use Avios to pay for seat selection or extra baggage. You will get 0.5p per Avios this way.

For HfP readers, you shouldn’t settle for less than 1p per Avios. Our recently revised article on what an Avios is worth showed that you can easily get well above 1p, especially with a credit card companion or upgrade voucher.

Here are three things to remember

There are three things to remember when using ‘Part Pay With Avios’:

- These are still cash tickets which operate under cash ticket rules. I get too many emails from HfP readers who don’t realise this. They book a flight using ‘Part Pay With Avios’, decide to cancel it a few weeks later and don’t understand why they lost everything. If you are booking a non-refundable cash flight, it remains non-refundable even if you pay for 100% of it with Avios.

- Because it is a cash ticket, even if you pay 100% with Avios, you will still earn Avios and tier points as if you had used 100% cash

- You cannot use ‘Part Pay With Avios’ on partner airlines, except for transatlantic American Airlines flights and some British Airways codeshare flights

Conclusion

‘Part Pay With Avios’ was never a good use of your points, and nothing has changed. However, there are plenty of people out there who don’t fully understand how to get full value for their Avios, and BA has now made ‘Part Pay’ more attractive and easier to understand for this group.

And, at the end of the day, it is probably beneficial for HfP readers to have more Avios used sub-optimally, leaving less pressure to devalue the options that offer real value.

PS. If you are not a regular Head for Points visitor, why not sign up for our FREE weekly or daily newsletters? They are full of the latest Avios, airline, hotel and credit card points news and will help you travel better. To join our 70,000 free subscribers, click the button below or visit this page of the site to find out more. Thank you.

How to earn Avios from UK credit cards (July 2025)

As a reminder, there are various ways of earning Avios points from UK credit cards. Many cards also have generous sign-up bonuses!

In February 2022, Barclaycard launched two exciting new Barclaycard Avios Mastercard cards with a bonus of up to 25,000 Avios. You can apply here.

You qualify for the bonus on these cards even if you have a British Airways American Express card:

Barclaycard Avios Plus Mastercard

Get 25,000 Avios for signing up and an upgrade voucher at £10,000 Read our full review

Barclaycard Avios Mastercard

Get 5,000 Avios for signing up and an upgrade voucher at £20,000 Read our full review

There are two official British Airways American Express cards with attractive sign-up bonuses:

British Airways American Express Premium Plus Card

30,000 Avios and the famous annual Companion Voucher voucher Read our full review

British Airways American Express Credit Card

5,000 Avios for signing up and an Economy 2-4-1 voucher for spending £15,000 Read our full review

You can also get generous sign-up bonuses by applying for American Express cards which earn Membership Rewards points. These points convert at 1:1 into Avios.

American Express Preferred Rewards Gold Credit Card

Your best beginner’s card – 20,000 points, FREE for a year & four airport lounge passes Read our full review

The Platinum Card from American Express

50,000 bonus points and great travel benefits – for a large fee Read our full review

Run your own business?

We recommend Capital on Tap for limited companies. You earn points worth 0.8 Avios per £1 on the FREE standard card and 1 Avios per £1 on the Pro card. Capital on Tap cards also have no FX fees.

Capital on Tap Visa

NO annual fee, NO FX fees and points worth 0.8 Avios per £1 Read our full review

Capital on Tap Pro Visa

10,500 points (=10,500 Avios) plus good benefits Read our full review

There is also a British Airways American Express card for small businesses:

British Airways American Express Accelerating Business Card

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

There are also generous bonuses on the two American Express Business cards, with the points converting at 1:1 into Avios. These cards are open to sole traders as well as limited companies.

The American Express Business Platinum Card

50,000 points when you sign-up and an annual £200 Amex Travel credit Read our full review

The American Express Business Gold Card

20,000 points sign-up bonus and FREE for a year Read our full review

Click here to read our detailed summary of all UK credit cards which earn Avios. This includes both personal and small business cards.

Rob

Rob

Comments (97)