Your introduction to Zing, HSBC’s new multi-currency and FX payments app

Links on Head for Points may support the site by paying a commission. See here for all partner links.

This article has been sponsored by Zing

Zing was launched by HSBC earlier this year, and is aiming to become a key player in the money transfer and travel spend sectors.

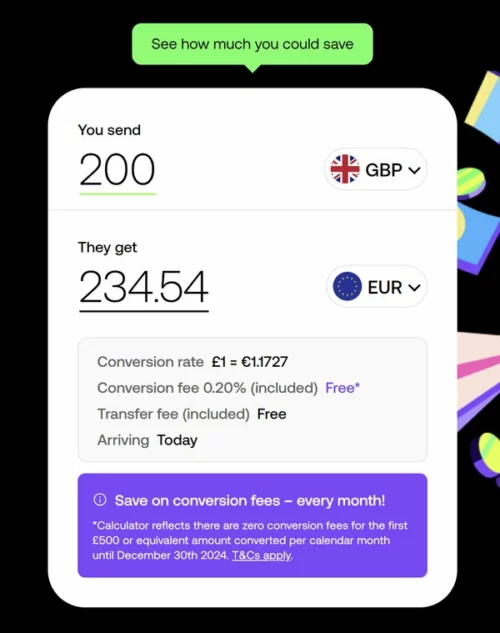

If you sign up to Zing now, you will receive a £500 per month allowance of fee-free currency conversion until the end of 2024.

This applies to transfers made to bank accounts (with any institution), to any other Zing member, between your own currency wallets within your Zing account, physical or virtual payments made with your Zing card and to cash withdrawals at ATMs made with your Zing card for any supported currencies.

Zing is a smartphone app that can be connected to Apple Pay or Google Pay, although you can also order a physical Zing Visa debit card for ATM use.

It is free to sign up (18+, UK residents only) and you do NOT need to be an existing HSBC customer to join.

(In terms of security, Zing is not a bank. Zing is an e-money institution, regulated by the FCA, with your money ring-fenced in a secure account. Deposits with Zing do not count towards your £85,000 of statutory Financial Services Compensation Scheme protection across all HSBC entities. Find out more here.)

What can Zing do?

Zing aims to free you from much of the cost and complexity of making foreign currency transactions, whether for spending or for transfers.

You can:

- hold a balance in the app in over 20 different currencies

- send money with no international payment fees in over 30 countries

- spend with your Zing card in virtually every country and territory

Fees are low and clear

Zing is focused on low fees and, importantly, clarity and transparency.

As I mentioned above, all Zing members receive £500 of fee-free currency conversion each month until the end of 2024.

Outside of that offer, the headline fees are:

- NO outbound transfer fees

- FX conversion fees from 0.2%, (once the monthly £500 allowance is used up) which do not change based on the amount or day of the week (unlike some competitors!)

- Real time, mid-market currency conversion rates

- free UK ATM cash withdrawals (unless the ATM itself adds a fee)

- one free withdrawal per month for international ATMs (further withdrawals cost £2 or equivalent)

- no charge to receive a physical plastic card – and no charge for your first replacement if you lose or damage it!

You operate your Zing account via the app. You can track payments and transactions with in-app notifications.

Pre-load funds to lock in the exchange rate

Because you can hold funds in over 20 currencies in your Zing account, you can lock in the exchange rate for your trip in advance if you are concerned about rates moving against you.

You can load funds to your account in Sterling and then move it (at real time rates) to another currency wallet. When you make a purchase in the future in that currency, it will take your funds from that particular currency wallet first before taking funds from your Sterling wallet.

Which currencies are supported?

You can add money to your Zing account by debit card or bank transfer. You can also receive non-SWIFT payments from non-Zing accounts in £ and €.

The currency wallets you can have are: GBP, USD, EUR, CAD, HKD, JPY, SGD, AUD, NZD, AED, CHF, CZK, DKK, HUF, MXN, NOK, POL, RON, SAR, SEK, THB and ZAR.

You can make payments to non-Zing accounts in: GBP, EUR, USD, AED, AUD, BHD, CAD, CHF, CZK, DKK, HKD, HUF, IDR, ILS, INR, JPY, KES, KWD, MYR, MXN, NOK, NZD, OMR, PHP, PLN, QAR, RON, SAR, SEK, SGD, THB, TRY, UGX and ZAR

Other key features include ….

There is a lot more to Zing. This includes:

- the ability to freeze and unfreeze your card in the app

- the ability to use Apple Pay or Google Pay

- 24/7 human support

- unique reward offers

- an environmentally friendly card made from 85% recycled plastic

Earn up to £400 by referring your friends

If you sign up to Zing, you can earn up to £400 by referring your friends until 08:59 on 1st October 2024.

You can send invitations via the Zing app. For each friend that signs up and makes a £5 transaction (or equivalent) using their Zing card, you will receive £20 within 30 days. Your friend will also receive £20. Terms and conditions apply.

Conclusion

There are many money transfer apps on the market, but Zing offers good value, simplicity, an easy-to-use user interface and the knowledge that HSBC is behind it.

You won’t earn any miles or points when you use it, but you also won’t be paying the 2.99% FX fee that comes with most overseas transactions made on a travel rewards credit card.

You can sign up to Zing here. The app can be downloaded for free from your usual app store.

Remember that new customers will receive £500 per month of fee-free currency conversion until the end of 2024. Terms and conditions apply.

Rob

Rob

Comments (145)