Get a 30% Virgin Points bonus when you convert American Express Membership Rewards points

Links on Head for Points may support the site by paying a commission. See here for all partner links.

This article is sponsored by Virgin Red

Virgin Atlantic Flying Club has launched a 30% bonus when you transfer American Express® Membership Rewards® points into Virgin Points.

It is very, very rare to see an American Express airline transfer bonus in the UK so this is worth serious consideration.

The usual transfer rate is 1 Virgin Point per 1 Membership Rewards point. Under this offer, you will receive 1.3 Virgin Points per Membership Rewards point.

Given our 1p valuation of a Virgin Point when used for premium cabin flights, this means you are getting 1.3p per Membership Rewards point.

Before we get into the details, here is the small print:

- the offer only applies to UK-domiciled Membership Rewards Accounts, for both personal and business American Express Cards

- the offer runs to 21st November 2024

- there is no minimum transfer to receive the bonus, apart from the usual ‘Amex to Virgin Points’ minimum of 1,000 Membership Rewards points

- you can receive the bonus on multiple transfers

- the bonus should post alongside the standard points, and transfers from American Express to Virgin Points are usually instant unless additional security checks are required

This offer can be found on the Virgin Red website

This offer is not listed on the Membership Rewards website.

You can verify it exists, however, from this page of the Virgin Red website or by looking in the Virgin Red app where you should see it in the activity section in your account.

If you want to test the offer for yourself, do the smallest 1,000 Membership Rewards points transfer. This should post immediately as 1,300 Virgin Points instead of the usual 1,000. You can then go back and do a larger transfer.

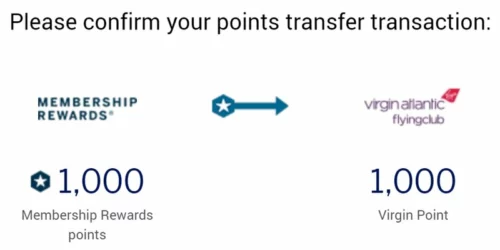

Here is a test transaction I did yesterday which shows it works. Here is a screenshot from the Amex website showing a 1,000 Membership Rewards points transfer to Virgin Atlantic Flying Club:

I then went into my Virgin Atlantic Flying Club account and could immediately see the 1,300 Virgin Points showing:

Is this a good deal?

We value airline miles at 1p when used for a premium cabin redemption, so this bonus would increase our estimated value per Membership Rewards point to 1.3p.

As it happens, we have just finished a 13-part series of articles on how to spend Virgin Points. Click through to read:

- How does Virgin Red differ from Virgin Flying Club?

- How many Virgin Points do you need to fly to ….?

- How to redeem Virgin Points on Virgin Atlantic flights

- How to redeem Virgin Points on SkyTeam flights

- How to redeem Virgin Points on ANA and other partners

- How to upgrade your Virgin Atlantic flight with Virgin Points

- How to convert Virgin Points to Hilton or IHG hotel points

- How to use Virgin Points for a Virgin Holidays discount

- How to redeem Virgin Points for hotel rooms via Kaligo

- Is Virgin Atlantic’s ‘Points Plus Money’ feature a good deal?

- What’s the best non-flying use of Virgin Points?

- What is the cheapest way to top up your Virgin Points?

- Get cheaper Virgin Atlantic redemptions with a credit card voucher

How to use this offer alongside Virgin Atlantic’s big changes

As we have covered extensively, Virgin Atlantic is making substantial changes to Virgin Atlantic Flying Club on 30th October.

The key change is that reward pricing for Virgin Atlantic flights is switching to a new model.

Instead of the current fixed price reward chart, subject to peak and off-peak dates, the scheme is moving entirely to ‘dynamic pricing’.

There will be two levels of dynamic pricing. ‘Saver’ rewards will be available in every cabin and priced at no more than current reward pricing, with flights to New York from 6,000 points one-way, but there will no longer be a guarantee that any particular flight, class or route will have ‘Saver’ seats.

All other seats – every seat in every cabin – will be available for points, albeit at a higher price point than a ‘Saver’ reward. Virgin Atlantic has not released any information on what the ‘pence per point’ ratio will be.

Top up your account now and redeem before 30th October

If you want to guarantee a planned redemption of a certain points value, as per the current existing pricing chart on Virgin Atlantic, you should aim to book before 30th October.

Here are a few selected redemptions priced off the current reward chart:

- an Upper Class return flight redemption on Virgin Atlantic to New York is 95,000 Virgin Points off-peak (plus taxes and charges) – this would only require a transfer of 73,077 American Express Membership Rewards points

- a Premium cabin return flight redemption on Virgin Atlantic to Las Vegas is 55,000 Virgin Points off-peak (plus taxes and charges) – this would only require a transfer of 42,308 American Express Membership Rewards points

- a Business Class return flight redemption on ANA to Tokyo is 120,000 Virgin Points (plus taxes and charges) – this would only require a transfer of 92,308 American Express Membership Rewards points

- upgrading a return Premium ticket to Upper Class to New York on Virgin Atlantic is 60,000 Virgin Points (plus taxes and charges) – this would only require a transfer of 46,154 American Express points

And from 30th October ….

We don’t know what will happen to Virgin Atlantic reward pricing from 30th October.

However, the American Express 30% conversion bonus will run until 21st November.

If you want a certain flight but cannot book it at present due to lack of availability, it WILL be bookable from 30th October – albeit we don’t know what the pricing will look like.

If you find yourself short of the points you need after 30th October, you will have three weeks to make a transfer of American Express Membership Rewards points and get the 30% bonus. You don’t need to transfer now before you know what the post-30th October pricing will look like.

Keen to use your points for something other than a reward flight?

If you don’t fancy a flight, that’s not a problem!

Here are some examples of the many other redemptions available with Virgin Points via Virgin Red:

- two tickets to see James Blunt in the Virgin Red Room at The O2 in London (image above) on 16th February are 50,000 Virgin Points – this would only require a transfer of 38,147 American Express Membership Rewards points

- a £200 Eurostar voucher is 40,000 Virgin Points – this would only require a transfer of 30,770 American Express Membership Rewards points

- a two-night off-peak stay at Sir Richard Branson’s Mont Rochelle resort in the Western Cape in South Africa is 60,000 Virgin Points – this would only require a transfer of 46,154 American Express Membership Rewards points

- a Virgin Voyages sailing starting from 140,000 Virgin Points – this would require a transfer of 107,692 American Express Membership Rewards points and gets you a 4-nighter in the Caribbean. This one is a limited time offer so may not be around for long!

Note that transfers from American Express must be made in multiples of 1,000 points.

Conclusion

It is very rare to see a conversion bonus from UK American Express Membership Rewards to an airline, so this offer is worth serious consideration.

If you’re not familiar with what you can do with Virgin Points, the articles I listed above are a good place to start.

The offer runs for a month, so if you have a credit card earning American Express Membership Rewards points you may wish to push more spending onto it for the next few weeks. You receive your Membership Rewards points as soon as the transaction clears so you would be able to transfer the points quickly.

If you had a large spend coming up, you may even be able to apply for a new American Express Card, receive the sign-up bonus and then transfer it in time to receive the 30% bonus. Here are our reviews of American Express® Preferred Rewards Gold (20,000 points bonus), The Platinum Card® (50,000 points bonus), American Express® Business Gold (20,000 points bonus) and American Express® Business Platinum (50,000 points bonus).

Remember that the pricing system for Virgin Atlantic reward flights changes on 30th October, so you will need to transfer your Membership Rewards and book by that date in order to lock in the current reward pricing. It’s also worth remembering that taxes, fees and surcharges apply on top for reward flights.

You can find out more about the 30% transfer bonus to Virgin Points on the Virgin Red website here or in the app.

You need to transfer your points by 21st November before midnight to receive the 30% bonus.

PS. Don’t forget that you will not see the offer showing on the American Express Membership Rewards website. If you are unsure, do a test transfer of 1,000 Membership Rewards points first, check that 1,300 Virgin Points have arrived in your account and then follow up with a larger transfer.

Rob

Rob

Comments (67)