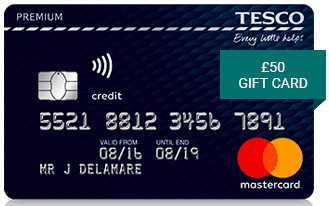

Get a £50 gift card with the £150 Tesco Premium Credit Card – worth it?

Links on Head for Points may support the site by paying a commission. See here for all partner links.

Back in June 2016, Tesco launched the Tesco Premium Credit Card.

You can check out the details here. The representative APR is 56.5% variable, including the £150 fee, assuming a £1200 credit limit.

In my experience, HfP readers tend to run hot or cold when looking at the benefits of this card compared with the £150 annual fee. I expected this – I did write originally that “Tesco has created a product which could work really well for some people but not for others.”

The ground has now moved a little:

Until 31st August, Tesco Bank is offering a £50 Tesco gift card for signing up – this takes the net cost for Year 1 down to £100

Changes to other travel Visa and Mastercard products, such as the closure of the bmi cards, has left a lot of people without a decent Visa or Mastercard product for earning Avios or other miles

With this new offer, you are paying £100 (after knocking off the £50 gift card) to receive a decent Avios or Virgin Flying Club earning rate plus other card benefits. You really need to look at these other benefits to decide if the card is worth it.

Let’s go through them one by one:

1 Clubcard point for every £1 you spend plus a 5,000 point bonus if you spend £5,000

This card would pay you 2.4 Avios points or 2.5 Virgin Flying Club on every £1 you spend at Tesco. This is a very decent return if you spend a lot of money with them, even if you don’t spend £5,000 per year.

Let’s imagine that you DO spend £5,000 per year in Tesco. This may be possible if you always buy your fuel there or shop for a large family.

On that basis, you would earn 8,750 more Clubcard points (21,000 Avios) per year using the Premium Credit Card than you would with the free Tesco Clubcard credit card which gives 1 point for every £4 you spend in Tesco and has no bonus.

Don’t forget, though, that the free Tesco debit card which comes with the Tesco Bank current account also now gives 1 Clubcard point per £1 spent in Tesco. This means that the points advantage over the debit card is only the 5,000 Clubcard points (12,000 Avios) annual bonus per year.

Comprehensive travel insurance

This covers immediate family members under the age of 70 and includes 17 days of Winter Sports cover. Some HfP readers have commented that the rules on pre-existing conditions appear strict but I am not an expert on this.

If you currently pay for travel insurance then this would have some value. If you have it via another source – mine comes from American Express Platinum – then you won’t.

Depending on your age and whether you do ‘winter sports’, a bargain basement family policy will cost between £50 and £70. If you are not leaving Europe, you will pay less. That said, the moneysavingexpert.com ‘top pick’ (based on generosity of terms and payout history) is from LV and costs around £200 for global cover and just over £100 for European cover.

You need to decide what value, if any, you place on this benefit.

1% enhanced exchange rate when you buy travel money

I would value this at nothing, as I believe that I would still get a better deal using my 0% FX fee Post Office credit card or my 1% fee Curve Card for purchases abroad. To get a small amount of cash, using an ATM using a normal debit card with a 3% fee is still likely to be a better deal.

Whilst currency purchases made using the card at Tesco Travel Money are treated as purchases and not cash advances, they do NOT earn Clubcard points.

1 Clubcard point for every £4 you spend

The current Mastercard and Visa offers on travel credit cards are weak which enhances this offer. Converted to Avios, you would be getting 0.6 Avios per £1 based on 0.25 Clubcard points.

However, remember that Tesco rounds down every transaction to the nearest £4, so a £7.99 transaction only earns 1 point and a £3.99 transaction earns nothing.

The free Tesco Clubcard Mastercard has an earning rate of half this (0.3 Avios per £1 based on one Clubcard point per £8 spent) but you are not paying an annual fee. The Lloyds Avios Rewards Mastercard earns only 0.25 Avios per £1. It is also worth remember that the ASDA Money credit card is free and pays you 0.5% back in ASDA shopping vouchers which you may value the same as 0.6 Avios.

Annual fee cards such as Virgin Flying Club Black or Emirates Elite earn 1 mile per £1 spent on the MasterCard / Visa element whilst the Lufthansa Miles & More card is free and earns 0.75 miles per £1. These are decent options for high spenders.

Conclusion

As I said initially, there is no easy answer here. This new deal offering a £50 gift card as a sign-up bonus may make it more attractive:

If you spend £5,000 per year in Tesco, get the card – you will do well with it. For these people it is a decent deal even if you pay the full annual fee.

If you currently buy stand-alone travel insurance, it may work for you

All in all, the card compares poorly with the new HSBC Premier World Elite Mastercard. Your £195 fee currently gets you 45,000 Avios for spending £12,000 in the first year, airport lounge access, 1 Avios per £1 spent and (via the HSBC Premier current account) travel insurance.

However, with HSBC Premier restricted to people with large sums invested with HSBC or a high salary, you may not have the option. If you can justify the fee because of the benefits – mainly the travel insurance – the Tesco Premium Credit Card may be worth a look. The application form is here.

Want to earn more points from credit cards? – April 2024 update

If you are looking to apply for a new credit card, here are our top recommendations based on the current sign-up bonuses.

In February 2022, Barclaycard launched two exciting new Barclaycard Avios Mastercard cards with a bonus of up to 25,000 Avios. You can apply here.

You qualify for the bonus on these cards even if you have a British Airways American Express card:

Barclaycard Avios Plus Mastercard

Get 25,000 Avios for signing up and an upgrade voucher at £10,000 Read our full review

Barclaycard Avios Mastercard

5,000 Avios for signing up and an upgrade voucher at £20,000 Read our full review

You can see our full directory of all UK cards which earn airline or hotel points here. Here are the best of the other deals currently available.

British Airways American Express Premium Plus

25,000 Avios and the famous annual 2-4-1 voucher Read our full review

American Express Preferred Rewards Gold

Your best beginner’s card – 20,000 points, FREE for a year & four airport lounge passes Read our full review

The Platinum Card from American Express

40,000 bonus points and a huge range of valuable benefits – for a fee Read our full review

Virgin Atlantic Reward+ Mastercard

18,000 bonus points and 1.5 points for every £1 you spend Read our full review

Earning miles and points from small business cards

If you are a sole trader or run a small company, you may also want to check out these offers:

SPECIAL OFFER: Until 12th May 2024, the Capital on Tap Business Rewards Visa card is offering a bonus of 30,000 points, convertible into 30,000 Avios. You must have a Limited Company to apply. Click here to learn more and click here to apply.

British Airways Accelerating Business American Express

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

American Express Business Platinum

40,000 points sign-up bonus and an annual £200 Amex Travel credit Read our full review

American Express Business Gold

20,000 points sign-up bonus and FREE for a year Read our full review

Capital on Tap Business Rewards Visa

Huge 30,000 points bonus until 12th May 2024 Read our full review

For a non-American Express option, we also recommend the Barclaycard Select Cashback card for sole traders and small businesses. It is FREE and you receive 1% cashback on your spending.

Barclaycard Select Cashback Business Credit Card

1% cashback uncapped* on all your business spending (T&C apply) Read our full review

Comments (46)