What Jamie did right – and very, very wrong – when he booked his Indonesia holiday on Avios

Links on Head for Points may support the site by paying a commission. See here for all partner links.

Over the last couple of weeks we have run a series of flight reviews from Jamie’s recent month-long holiday in Asia. The majority of the international flights were booked with Avios.

Before we go on, I should say that I wasn’t involved in the booking of this trip and didn’t know he was going until I got an email offering me the reviews. You’ll see why I said that in a minute!

As a reminder, this is what he flew:

Heathrow – Kuala Lumpur, British Airways Club World – reviewed here – 105,000 Avios one-way (peak date)

Kuala Lumpur – Jakarta, Malaysia Airlines Business – reviewed here – 15,000 Avios one-way

Bali – Doha, Qatar Airways Business – reviewed here – 75,000 Avios one-way

Doha – Gatwick, Qatar Airways Business – reviewed here – 60,000 Avios one-way

In theory, this itinerary should have cost him 255,000 Avios. In reality, Jamie only paid 200,000 Avios.

This is why.

Welcome to the Avios multi-partner redemption chart

99% of British Airways Avios collectors do not know that BA also has a second redemption chart.

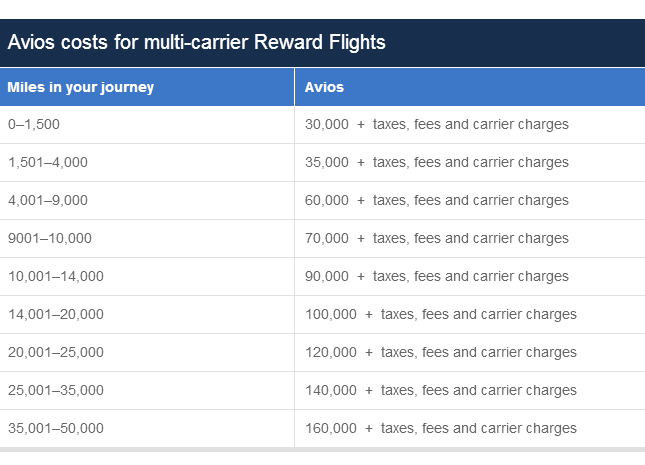

I bet that most of you have never seen this chart before (click to enlarge):

You can see the original by clicking here to ba.com and scrolling down to click on ‘Partner Airlines’ and then ‘Avios costs for booking on two or more oneworld airlines’.

This is the reward chart that British Airways uses to price redemptions which include two or more oneworld partner airlines, excluding British Airways (although BA can be included on an itinerary).

The chart is for economy travel. Multiply by two for business class and by three for first class.

Let’s take a look at Jamie’s itinerary

Because Jamie’s itinerary used two oneworld airlines, plus British Airways, he could use the multi-partner Avios redemption chart to price his trip.

Let’s look at the flights again:

- Heathrow – Kuala Lumpur (6593 miles)

- Kuala Lumpur – Jakarta (699 miles)

- Bali – Doha (4873 miles)

- Doha – Gatwick (3244 miles)

This is a total of 15,409 miles. You can get exact distance figures from gcmap.com – click on ‘Distance’ and use airport codes, eg ‘LHR-KUL’.

Look at the multi-carrier Avios reward chart. 15,409 miles falls into the 100,000 Avios band (14,000 – 20,000 miles flown) for Economy. We double that for Business Class.

This is why Jamie only paid 200,000 Avios for his trip, and not the 255,000 Avios that it would otherwise have cost if he had booked it one flight at a time.

Except:

He made a BIG mistake

Look again at the reward chart.

Jamie’s trip was 15,409 miles. He paid 200,000 Avios, which was the cost for trips of between 14,001 and 20,000 miles.

This means he could have added an additional trip of up to 4,591 miles for FREE.

Well, not quite free because taxes and charges would have been due, but no additional Avios would have been required. He could have added on:

a one-way in Club World from London to Miami (4425 miles)

or

a return in Club Europe to Athens (3020 miles) AND a return in Club Europe to Berlin (1180 miles)

or

a one-way in Club World to Delhi (4191 miles)

….. or many other options – for no additional Avios!

So …. well done to Jamie for remembering to ring BA and book his itinerary via the multi-carrier redemption chart, which saved him 55,000 Avios. But a slap on the wrist for missing out on the chance to add a couple of future trips onto his itinerary for no extra Avios ….

PS. If you are not a regular Head for Points visitor, why not sign up for our FREE weekly or daily newsletters? They are full of the latest Avios, airline, hotel and credit card points news and will help you travel better. To join our 70,000 free subscribers, click the button below or visit this page of the site to find out more. Thank you.

How to earn Avios from UK credit cards (July 2025)

As a reminder, there are various ways of earning Avios points from UK credit cards. Many cards also have generous sign-up bonuses!

In February 2022, Barclaycard launched two exciting new Barclaycard Avios Mastercard cards with a bonus of up to 25,000 Avios. You can apply here.

You qualify for the bonus on these cards even if you have a British Airways American Express card:

Barclaycard Avios Plus Mastercard

Get 25,000 Avios for signing up and an upgrade voucher at £10,000 Read our full review

Barclaycard Avios Mastercard

Get 5,000 Avios for signing up and an upgrade voucher at £20,000 Read our full review

There are two official British Airways American Express cards with attractive sign-up bonuses:

British Airways American Express Premium Plus Card

30,000 Avios and the famous annual Companion Voucher voucher Read our full review

British Airways American Express Credit Card

5,000 Avios for signing up and an Economy 2-4-1 voucher for spending £15,000 Read our full review

You can also get generous sign-up bonuses by applying for American Express cards which earn Membership Rewards points. These points convert at 1:1 into Avios.

American Express Preferred Rewards Gold Credit Card

Your best beginner’s card – 20,000 points, FREE for a year & four airport lounge passes Read our full review

The Platinum Card from American Express

50,000 bonus points and great travel benefits – for a large fee Read our full review

Run your own business?

We recommend Capital on Tap for limited companies. You earn points worth 0.8 Avios per £1 on the FREE standard card and 1 Avios per £1 on the Pro card. Capital on Tap cards also have no FX fees.

Capital on Tap Visa

NO annual fee, NO FX fees and points worth 0.8 Avios per £1 Read our full review

Capital on Tap Pro Visa

10,500 points (=10,500 Avios) plus good benefits Read our full review

There is also a British Airways American Express card for small businesses:

British Airways American Express Accelerating Business Card

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

There are also generous bonuses on the two American Express Business cards, with the points converting at 1:1 into Avios. These cards are open to sole traders as well as limited companies.

The American Express Business Platinum Card

50,000 points when you sign-up and an annual £200 Amex Travel credit Read our full review

The American Express Business Gold Card

20,000 points sign-up bonus and FREE for a year Read our full review

Click here to read our detailed summary of all UK credit cards which earn Avios. This includes both personal and small business cards.

Rob

Rob

Comments (168)