Is the ‘use more Avios but just pay £1 of taxes’ pricing policy a mistake?

Links on Head for Points may support the site by paying a commission. See here for all partner links.

During 2019, British Airways announced a shake-up of Avios pricing on short-haul flights.

Since Avios was introduced, short-haul flights had come with a flat £17.50 one-way / £35 return added on. This was termed ‘Reward Flight Saver’ and is a contribution towards the taxes and charges due on the flight.

Our full Avios pricing chart shows these numbers. A return flight to Amsterdam on an off-peak day is 9,500 Avios + £35 return. Budapest would be 14,500 Avios + £35.

Under the new 2019 pricing system, British Airways cut the headline taxes and charges figure to £1 return. In return, it increased the headline number of Avios needed.

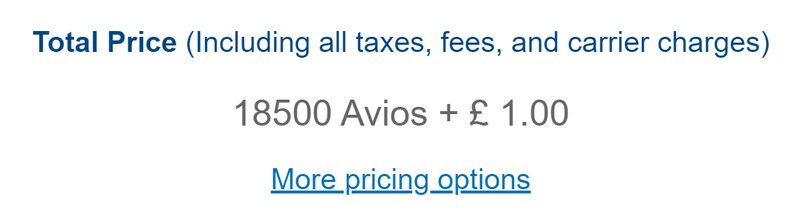

Instead of 9,500 Avios return, you now see a headline price on ba.com for Amsterdam of 18,500 Avios + £1:

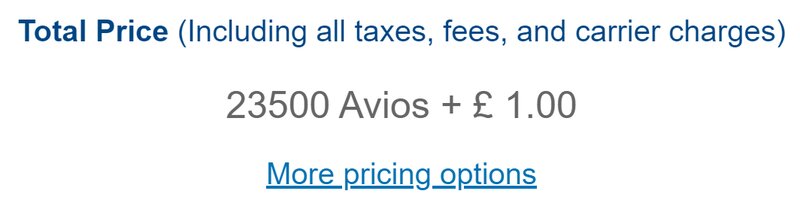

and for Budapest, instead of 14,500 Avios + £35 you see:

Here is the important bit. The old pricing hasn’t gone away. When you click to the final payment screen, you see a range of options. One of them will be very close to, if not the same as, the original option.

See Amsterdam here:

…. where the 9,500 Avios + £35 option is still there, half way down.

Importantly, you will usually find that the best value deal is the one nearest to the old pricing. The £1 deal is usually a bad deal.

For Amsterdam, for example, British Airways is asking for 9,000 extra Avios (from 9,500 to 18,500) – which I’d value at £90 if used properly – in return for cutting £34 off the taxes and charges (from £35 to £1).

Has this change weakened the value perception of Avios?

When BA started offering this, I thought it could backfire. I was sure that pushing up the ‘headline’ price would make Avios look less attractive.

And yet …. IAG people kept telling me that the new pricing was very popular. Perhaps this is true. If it IS true, it simply proves that the average (generally well educated) Avios collector has the maths ability of a gnat, because the £1 deal is a bad deal.

This is why I think there is a problem

If you are thinking about collecting Avios, the obvious thing to do is to look at some typical redemptions and see what they cost, and whether earning that amount is realistic for you or not.

So …. off you go to ba.com and you look up the price of a return Economy flight to Budapest. The headline price you see is the one in the picture above ….. 23,500 Avios + £1.

Your brain then goes …. whoa ….:

“I need to spend £23,500 on the free BA Amex credit card to get one off-peak Economy flight to Budapest?”

“I need to spend £37,600 at Sainsbury’s to earn 37,600 Nectar points to get 23,500 Avios for an off-peak Economy flight to Budapest?”

“I need to take 188 one-way Economy flights to/from Amsterdam, earning 125 Avios each way, to get 23,500 Avios for a return Economy flight to Budapest?”

You wouldn’t blame someone for thinking like this. British Airways thinks that 23,500 Avios + £1 looks more attractive than 14,500 Avios + £35. I disagree.

To me, 14,500 Avios + £35 appears a lot more achievable than 23,500 Avios + £1.

And it’s not just me.

The reason I wrote this article, and the reason I use Budapest in this example, is because of an email I received last year. This person is perhaps not the typical HfP reader in terms of her background, but I think her thoughts are closer to the way that the average person looks at Avios than many of us.

I’m not going to comment on the email, but I’d like you to read it and then decide for yourself if British Airways is making a mistake by focusing on ‘£1 taxes’. Obviously I corrected this reader and let her know that the ‘old’ pricing was still there.

“I hope you are well. I have read a lot of your advice on Head for Points, and I find it really useful. I have now a problem though with BA and their redemption tickets.

I am a single mother on low wages with 2 kids, working hard, converting my Tesco shopping to Avios, using cashback programs to earn Avios, spending on Amex, etc. I even bought some when they offered a 50% bonus.

My family lives in Hungary and we visit them 3 times a year. Unfortunately I am not a businesswoman with Gold status and upgrade vouchers, etc.

Until recently it cost 15,000 miles [now 15,750] peak for a business class one way per person. So I collected and collected and now have 40,000 miles, just 5,000 short.

I logged into my account to see availability and other pricing options, and I was shocked to see that it now cost 21,500 per person for a one-way in business class? For 3 people that is a HUGE difference.

I would understand a raise from 15,000 to 17,500 miles, but to over 21,000??? I am now years away from that little treat which was within reach. I am heartbroken, I am devastated.

Is this a computer error, or the result of Covid19 or everybody is after reward tickets to Budapest? I am sure you are busy, but it would mean a lot, if you could look into it. Can you imagine your dreams being shattered in front of your eyes? I know this is a short route, business class is not as fancy as on a long haul flight, but we don’t go anywhere else. A little treat, some excitement to collect for and look forward to. But for 21,500 per person it us no longer worth it. Unachievable.”

PS. If you are not a regular Head for Points visitor, why not sign up for our FREE weekly or daily newsletters? They are full of the latest Avios, airline, hotel and credit card points news and will help you travel better. To join our 70,000 free subscribers, click the button below or visit this page of the site to find out more. Thank you.

How to earn Avios from UK credit cards (August 2025)

As a reminder, there are various ways of earning Avios points from UK credit cards. Many cards also have generous sign-up bonuses!

In February 2022, Barclaycard launched two exciting new Barclaycard Avios Mastercard cards with a bonus of up to 25,000 Avios. You can apply here.

You qualify for the bonus on these cards even if you have a British Airways American Express card:

Barclaycard Avios Plus Mastercard

Get 25,000 Avios for signing up and an upgrade voucher at £10,000 Read our full review

Barclaycard Avios Mastercard

Get 5,000 Avios for signing up and an upgrade voucher at £20,000 Read our full review

There are two official British Airways American Express cards with attractive sign-up bonuses:

British Airways American Express Premium Plus Card

30,000 Avios and the famous annual Companion Voucher voucher Read our full review

British Airways American Express Credit Card

5,000 Avios for signing up and an Economy 2-4-1 voucher for spending £15,000 Read our full review

You can also get generous sign-up bonuses by applying for American Express cards which earn Membership Rewards points. These points convert at 1:1 into Avios.

American Express Preferred Rewards Gold Credit Card

Your best beginner’s card – 20,000 points, FREE for a year & four airport lounge passes Read our full review

The Platinum Card from American Express

50,000 bonus points and great travel benefits – for a large fee Read our full review

Run your own business?

We recommend Capital on Tap for limited companies. You earn points worth 0.8 Avios per £1 on the FREE standard card and 1 Avios per £1 on the Pro card. Capital on Tap cards also have no FX fees.

Capital on Tap Visa

NO annual fee, NO FX fees and points worth 0.8 Avios per £1 Read our full review

Capital on Tap Pro Visa

10,500 points (=10,500 Avios) plus good benefits Read our full review

There is also a British Airways American Express card for small businesses:

British Airways American Express Accelerating Business Card

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

There are also generous bonuses on the two American Express Business cards, with the points converting at 1:1 into Avios. These cards are open to sole traders as well as limited companies.

The American Express Business Platinum Card

50,000 points when you sign-up and an annual £200 Amex Travel credit Read our full review

The American Express Business Gold Card

20,000 points sign-up bonus and FREE for a year Read our full review

Click here to read our detailed summary of all UK credit cards which earn Avios. This includes both personal and small business cards.

Rob

Rob

Comments (166)