If you think you’re too smart for fake websites, this Vueling one may change your mind

Links on Head for Points may support the site by paying a commission. See here for all partner links.

An impressive fake Vueling Facebook page is out there, conning money out of people looking for refunds for Vueling flights. And, of course, there are a lot of people out there who are struggling to get refunds from Vueling for flights cancelled during the pandemic …..

I’d say that 99% of the spam emails I get are so poor as to be laughable. The problem is that this makes you immune to the other 1% which are being run by someone with a decent brain.

My wife was only saved from a dodgy ‘you need to pay us to redeliver this parcel’ scam recently because she had to ask me for her bank account number. When my iPhone was stolen last year, I received a hugely convincing set of ‘find my phone’ messages, allegedly from Apple, which asked for my log-in ID.

Take a look at this Facebook page, called Vueling Response. (EDIT: Facebook has now removed the page after our article was published.)

It looks realistic. It IS realistic, to the extent that all of the content and images are cut and pasted from the official Vueling Facebook page.

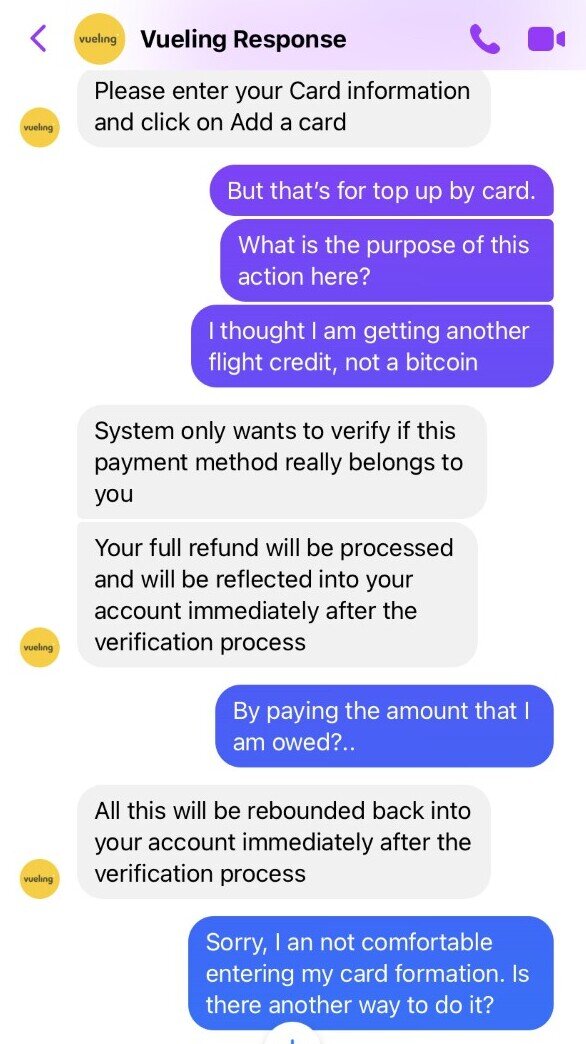

Here is our reader’s story when he messaged that Facebook page to enquire about a refund:

“I bought a flight by mistake recently and, as I did numerous times in the past, I requested a refund as a flight credit. Usually, flight credit requests are processed within minutes. This time it took hours, then days. I got a bit puzzled and thought that it was time to involve Vueling’s customer service team.

I wrote to them on Facebook via the Vueling Response page. All looked legit. I was surprised to hear that my transaction was flagged up for some reason (maybe because I bought the flight and decided to request a refund in a few minutes? Not sure). The customer service agent was very efficient and somewhat even demanding / borderline pushy. She said I need to verify my identity with their payment provider Mercuryo which also seems legit – I googled them before proceeding.

The agent told me to register and to verify my identity: code via email/phone, then upload ID and take a selfie – the usual stuff that internet banks like Monzo, Monese, etc do when they want to verify their clients’ identity. I did all that, while the agent was chasing me with status updates, asking me to send her screenshots of where I am.

After I got everything confirmed (phone/email, selfie, and ID – a snap of the photo page of the British passport in my case) I saw a weird screen with various cryptocurrencies and fields to enter my bank card and options to top up or withdraw funds. The agents asked me to enter my bank card and to buy crypto!

I asked her if this is a scam – she said no of course not. What next? She wanted to me buy crypto for the amount I am owed by Vueling (46.99 Euros) I told them that first, it doesn’t make any sense for me to buy something for the amount owed to me, and second I am not buying such volatile assets as crypto for Vueling! Sounds absurd! 🙂

At that moment my account page on the Mercuryo.io website was showing that my account is verified. I did provide one of my electronic cards with a few Euros on it and the system took 1 Euro to authorize the card. So from my point of view, it was enough to verify who I am, but Vueling was not convinced and was pushing me to buy crypto! I asked if there is another way to verify my identity, but she said no. As soon as I buy crypto, the system will refund me the purchase amount plus what I am owed for the flight credit.”

Here is a screenshot from the call (click to enlarge):

Our reader didn’t lose any money in the end. He has, of course, provided a scan of his passport, a selfie, his email address, mobile number and his bank card details to the scammers, so this is unlikely to end well.

Whilst not strictly ‘miles and points’, I thought this story was worth flagging. Because of the inability of most airlines to answer the telephone at the moment, they are exposing customers to scams like this as they try to seek alternative methods of contact.

Rhys

Rhys

Comments (101)