Bits: £500 for joining HSBC Premier, new Marriott Algarve options, good Jo’burg deal

Links on Head for Points may support the site by paying a commission. See here for all partner links.

News in brief:

Get £500 for switching to HSBC Premier

On Friday we updated our review of the free HSBC Premier Mastercard and our review of the £290 HSBC Premier World Elite Mastercard.

These cards are a good choice for many people, primarily those who want to earn miles at a good rate with airlines other than British Airways. The Avios transfer rate is also excellent if HSBC continues to offer its regular conversion bonuses, such as this one in February.

The snag, of course, is that you have to move your current account to HSBC Premier to get the credit cards.

If you earn £100,000 (the HSBC Premier threshold) you might as well use a ‘premium’ current account service. HSBC Premier is free and comes with comprehensive travel insurance, so it’s worth thinking about.

(Of course, most HfP readers will prefer Barclays Premier with Barclays Avios Rewards, which costs £12 per month but gives you 1,500 Avios per month and an annual Avios upgrade voucher. Click here to learn more about that.)

To persuade you to join HSBC Premier, HSBC is currently offering a whopping £500, in the form of a Selfridges gift card, to switch.

You need to do a full switch (moving your salary and at least two direct debits) by 12th August. Existing HSBC and first direct customers cannot apply.

Note that, if you are self employed or otherwise paid gross, you should be able to get away with earning less than £100,000. HSBC only looks to see that the NET equivalent of £100,000 gross goes into your account, which would be £70,000.

Full details are on the HSBC Premier website here.

Two new Marriott options open in the Algarve

Marriott has gained two new options in the Algarve in the Herdade dos Salgados region.

Algarve Marriott Salgados Golf Resort & Conference Centre has 228 rooms and suites. To quote:

The interior design incorporates natural materials, soothing colour palettes inspired by the Algarve coastline, and subtle Portuguese design elements that create a sense of place while maintaining the modern, timeless quality that Marriott guests expect.

The hotel has four outdoor pools – two for adults and two for children – and four restaurants. It is “steps away” from Praia dos Salgados beach.

This hotel is a conversion of the former NAU Salgados Palace resort.

Marriott Residences Salgados Resort has 192 rooms with one to three bedrooms. The property includes ten outdoor pools, tennis courts, mini-golf, volleyball and football facilities, a kids club for children aged 3 to 12 and indoor and outdoor fitness areas.

This was previously NAU Salgados Palm Village.

The two properties are separated by Wellness Hub Salgados, a comprehensive spa, fitness and leisure facility.

You can find out more about both hotels on marriott.com here.

PS. Two other resorts under the NAU banner have also been rebranded recently:

- NAU Salgados Dunas Suites becomes Westin Salgados Beach Resort, Algarve

- NAU São Rafael Atlântico becomes Kimpton Atlântico Algarve

Good Ethiopian Airlines deal to Johannesburg

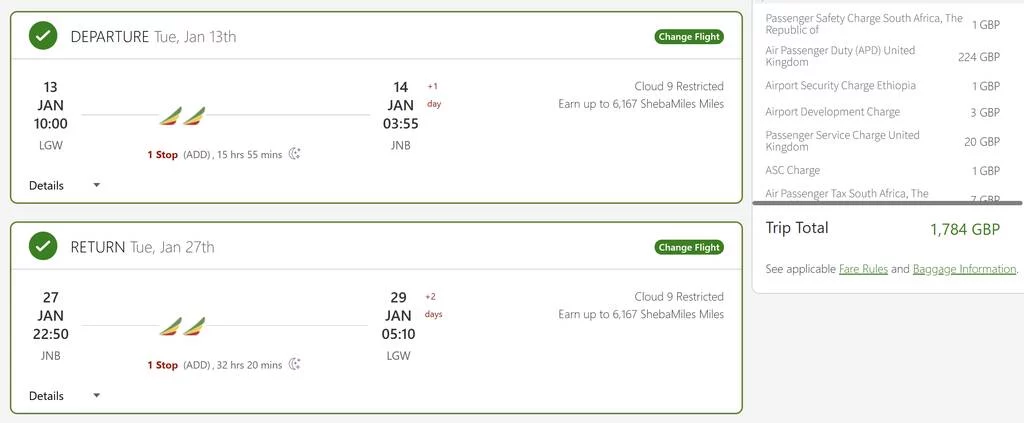

Ethiopian Airlines has a very decent £1,784 business class fare from London Gatwick to Johannesburg.

It is widely available until next April.

You can pay a little less by starting in Europe (€1,646 from Rome for example) but the saving may not be worth it for people in the Gatwick catchment area.

Here’s an example for January:

Ethiopian Airlines is a member of Star Alliance so you will earn a chunk of miles and status points which can be credited to any Star Alliance scheme such as Lufthansa’s Miles & More or United MileagePlus. Check the booking class at wheretocredit.com to see the best option.

Rhys reviewed Ethiopian Airlines from Gatwick on a trip to Addis Ababa – click here to see what he thought.

You can check out pricing and dates on the Ethiopian Airlines website here.

The best credit card to pay with is American Express Preferred Rewards Gold, which offers double points – for a total of 2 points per £1 – for spending made directly with an airline. Your payment would also help you trigger your next Amex Gold spend bonus, since you receive 2,500 bonus points for every £5,000 spent, to an annual total of 12,500 points.

Hat-tip to Luxury Flight Club.

Comments (44)