How to earn Avios or Virgin Flying Club miles via a Tesco current account

Links on Head for Points may support the site by paying a commission. See here for all partner links.

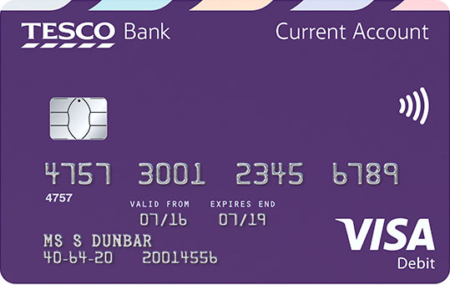

Since 2014, when Tesco launched its current account, it has been possible to earn Avios or Virgin Flying Club miles with your day-to-day debit card banking.

The main reason we don’t cover it much is that Tesco never offers bonuses for moving your banking across.

Barclays Premier is currently offering 25,000 Avios if you switch, whilst HSBC Premier is offering £175 – and you can then get the Avios-earning HSBC Premier credit cards. The current M&S offer is £180 if you keep your account for 12 months.

It seemed logical to me that Tesco Bank could afford to offer 10,000 Clubcard points (24,000 Avios or 25,000 Virgin miles) at some point. But, apart from a couple of very tightly targeted trials, there has never been an incentive to sign up in the five years that the account has been running.

Here is the Tesco Bank website promoting the current account.

The account is totally free.

How do you earn Avios with the Tesco current account?

You will earn Clubcard points on all of your debit card transactions:

1 point per £1 spent in Tesco (2.4 Avios per £1 / 2.5 Virgin miles per £1)

1 point per £8 spent elsewhere (0.3 Avios per £1 / 0.31 Virgin miles per £1)

The ‘1 point per £1’ spent in Tesco is a very generous benefit. If you are spending £100 per week in Tesco, which includes Tesco Fuel, you would earn 12,480 Avios or 13,000 Virgin Flying Club miles per year if you put all of this spending onto your debit card. That is on top of the base Clubcard points you would receive irrespective of how you pay. This is a pretty attractive deal.

Even the ‘1 point per £8 spent elsewhere’ is attractive. Whilst you would be better off in most circumstances using a loyalty credit card instead, it is not always possible to avoid using a debit card.

There is ‘small print’ attached to the ‘1 Clubcard point per £8 spent on the debit card’. All payments to ‘banks and financial institutions’ are exempt. This means that you cannot pay your mortgage, pay off a credit card bill or pay money into a savings account.

It DOES work with payments to the Inland Revenue but that is not something that most people can benefit from. If you DO pay HMRC, you will get a better deal by getting a Curve Card and linking it to a generous Visa or Mastercard credit card.

As with the Tesco Clubcard Mastercard, it is worth noting that debit card spending is rounded down to the nearest multiple of £8. A £7.99 lunch payment will earn you exactly zero Clubcard points. This is a major deterrent unless you are using the card for large transactions.

A little bit of interest too

Current account holders receive 1% interest on the first £3,000 in the account.

To earn this interest rate, you must pay in at least £750 and have at least three direct debits paid from your account per statement month.

Foreign exchange use of the debit card incurs a 2.75% fee.

Conclusion

The Tesco Bank current account was not competitive when it launched but it has improved. If we’re honest, it has also benefited from competitors reducing the benefits on their products.

The lack of a moving bonus remains problematical. If you are fed up with your existing bank, turning down £180 from M&S or 25,000 Avios from Barclays Premier in order to earn a few Avios in the future is not necessarily a great deal.

Curve Card has also changed the game a little. Curve Card is a free debit card (in fact, they pay you £5 for trying it) which recharges your purchases to most linked points-earning credit Visa or Mastercard. Making your debit card payments, such as HMRC or council tax, with Curve allows you to earn points on whatever Visa or Mastercard you wish. You can find out more about Curve and how to get your free £5 sign-up credit in this article.

Is it worth the trouble of moving your current account to Tesco Bank? For me, I’m not sure.

I have VAT, PAYE and income tax payments but I can put some of these – not all, due to Curve’s transaction limits – through Curve and earn miles and points that way. I have no other major debit card payments.

I don’t spend a lot in Tesco – perhaps £5 per week at our Tesco Express – so ‘1 point per £1 on the debit card’ isn’t worth much

I would have no problem keeping a £3,000 balance on the account, but £30 of annual interest (which is £30 more than I get from HSBC at present) – less income tax – is not a big enough incentive

For some people, however, this package may well stack up. If you’re sick of your current account provider it may be time to switch – although, for clarity, you can keep your old bank account open and still take advantage of this deal as long as you move your salary and three direct debits across.

You can find out more about the Tesco Bank current account here.

PS. If you are not a regular Head for Points visitor, why not sign up for our FREE weekly or daily newsletters? They are full of the latest Avios, airline, hotel and credit card points news and will help you travel better. To join our 70,000 free subscribers, click the button below or visit this page of the site to find out more. Thank you.

How to earn Avios from UK credit cards (July 2025)

As a reminder, there are various ways of earning Avios points from UK credit cards. Many cards also have generous sign-up bonuses!

In February 2022, Barclaycard launched two exciting new Barclaycard Avios Mastercard cards with a bonus of up to 25,000 Avios. You can apply here.

You qualify for the bonus on these cards even if you have a British Airways American Express card:

Barclaycard Avios Plus Mastercard

Get 25,000 Avios for signing up and an upgrade voucher at £10,000 Read our full review

Barclaycard Avios Mastercard

Get 5,000 Avios for signing up and an upgrade voucher at £20,000 Read our full review

There are two official British Airways American Express cards with attractive sign-up bonuses:

British Airways American Express Premium Plus Card

30,000 Avios and the famous annual Companion Voucher voucher Read our full review

British Airways American Express Credit Card

5,000 Avios for signing up and an Economy 2-4-1 voucher for spending £15,000 Read our full review

You can also get generous sign-up bonuses by applying for American Express cards which earn Membership Rewards points. These points convert at 1:1 into Avios.

American Express Preferred Rewards Gold Credit Card

Your best beginner’s card – 20,000 points, FREE for a year & four airport lounge passes Read our full review

The Platinum Card from American Express

50,000 bonus points and great travel benefits – for a large fee Read our full review

Run your own business?

We recommend Capital on Tap for limited companies. You earn points worth 0.8 Avios per £1 on the FREE standard card and 1 Avios per £1 on the Pro card. Capital on Tap cards also have no FX fees.

Capital on Tap Visa

NO annual fee, NO FX fees and points worth 0.8 Avios per £1 Read our full review

Capital on Tap Pro Visa

10,500 points (=10,500 Avios) plus good benefits Read our full review

There is also a British Airways American Express card for small businesses:

British Airways American Express Accelerating Business Card

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

There are also generous bonuses on the two American Express Business cards, with the points converting at 1:1 into Avios. These cards are open to sole traders as well as limited companies.

The American Express Business Platinum Card

50,000 points when you sign-up and an annual £200 Amex Travel credit Read our full review

The American Express Business Gold Card

20,000 points sign-up bonus and FREE for a year Read our full review

Click here to read our detailed summary of all UK credit cards which earn Avios. This includes both personal and small business cards.

Rob

Rob

Comments (13)