Is the Avios Multi-Currency Cash Passport worth getting?

Links on Head for Points may support the site by paying a commission. See here for all partner links.

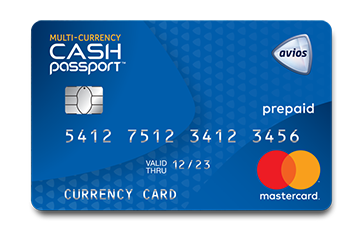

This is our review of the Avios Multi-Currency Cash Passport.

With fintech start-ups such as Curve, Revolut, Starling Bank and Monzo targetting the travelling public with cards offering 0% foreign exchange fees and multi-currency wallets, is there any future for increasingly ‘old school’ products such as the Avios Multi-Currency Cash Passport? I thought it was worth taking another look.

Our recent review of Starling Bank is here if you want to compare their 0% FX fees product.

The Avios Multi-Currency Cash Passport card is a more complex version of a standard pre-loaded currency card. It can carry simultaneous balances in ten different currencies – £, €, $, Australian Dollars, New Zealand Dollars, Canadian Dollars, South African Rand, Turkish Lira, Swiss Franc and Emirati Dirham.

You can use it to withdraw money from cash machines as well as buying goods anywhere that accepts Mastercard.

The fees on this card are bordering on reasonable but I still fail to see the attraction over using even a standard credit card with a 3% FX fee. In particular, I strongly fail to see the attraction over a ‘no FX fees’ payment card such as the Curve card.

Here is the fee schedule for the Avios Multi-Currency Cash Passport card.

Loading the card is FREE, as long as you load in a currency other than £ and you earn 1 Avios point per £1 equivalent loaded (minimum £50 load).

The fee schedule does not make clear is how generous (or not) their exchange rate is. You cannot tell, without applying for a card and setting it up, how bad the exchange rates are. This seems unfair.

As you now need an active card to look up the exchange rates, I couldn’t do a test. Looking at the comments below, the exchange rate is the same as it always was – around 3.5% away from the spot rate.

In itself, a 3.5% fee does not make the card substantially worse – although it clearly is worse – than a standard credit card with its 2.99% foreign exchange fee. Why bother though? Why not just use a rewards credit card, pay 2.99%, earn some points and get up to 56 days interest free credit to settle the bill? And, of course, why not use a 0% FX card in the first place?

Extra fees start to kick in later:

Load your card in £ – 2% loading fee

Come back from holiday with a balance in one currency and want to convert to another? 3.5% (presumably) built into the margin.

Forget to convert your balance into a different currency before you travel again? There is a 5.75% FX fee per transaction.

Don’t use your card for a year? £2 per month will be deducted from the balance.

There are other fees, such as cash machine fees, but these do seem to be ‘industry standard’.

The real problem with the card is that it is fiddly. Let’s imagine that you are heading to Dubai and you load £500 in Dirham onto your card, paying the 3.5% fee.

You only spend £350. This leaves £150 in Dirham. If your next trip is to France, you need to go online and move the Dirham into Euro – incurring another FX fee. If you don’t spend the entire £150 of Euro in France and then head to the US, you will be paying another fee to convert the remaining funds in $.

You need to know the balance of the card at all times to avoid rejection. You also cannot use it at a hotel or car hire company where an authorisation is taken at check-in, although you can use it to settle a final balance.

It is both time consuming and expensive. And, to my mind, pointless.

Is the Avios Multi-Currency Cash Passport worth it?

I’m not sure that there was ever a market for cards like this. A lot of companies wished there was, because of the fat margins, but it never materialised.

The cheapest way to spend abroad is a 0% FX fee credit card – Curve (free), Halifax Clarity (free), Tandem (free, with 0.5% cashback).

With the Multi-Currency Cash Passport, whilst you earn 1 Avios per £1, this is entirely offset by the poorer foreign exchange rate you will be getting compared to using a standard 3% FX fee credit card.It doesn’t even begin to compete with 0% fee credit or debit cards.

To be honest, I thought that this card and its ilk would have been withdrawn by now due to lack of interest. In some ways, it is a little worrying that they still exist. There is no sensible reason for any HfP reader to take one out as far as I can tell.

PS. If you are not a regular Head for Points visitor, why not sign up for our FREE weekly or daily newsletters? They are full of the latest Avios, airline, hotel and credit card points news and will help you travel better. To join our 70,000 free subscribers, click the button below or visit this page of the site to find out more. Thank you.

How to earn Avios from UK credit cards (July 2025)

As a reminder, there are various ways of earning Avios points from UK credit cards. Many cards also have generous sign-up bonuses!

In February 2022, Barclaycard launched two exciting new Barclaycard Avios Mastercard cards with a bonus of up to 25,000 Avios. You can apply here.

You qualify for the bonus on these cards even if you have a British Airways American Express card:

Barclaycard Avios Plus Mastercard

Get 25,000 Avios for signing up and an upgrade voucher at £10,000 Read our full review

Barclaycard Avios Mastercard

Get 5,000 Avios for signing up and an upgrade voucher at £20,000 Read our full review

There are two official British Airways American Express cards with attractive sign-up bonuses:

British Airways American Express Premium Plus Card

30,000 Avios and the famous annual Companion Voucher voucher Read our full review

British Airways American Express Credit Card

5,000 Avios for signing up and an Economy 2-4-1 voucher for spending £15,000 Read our full review

You can also get generous sign-up bonuses by applying for American Express cards which earn Membership Rewards points. These points convert at 1:1 into Avios.

American Express Preferred Rewards Gold Credit Card

Your best beginner’s card – 20,000 points, FREE for a year & four airport lounge passes Read our full review

The Platinum Card from American Express

50,000 bonus points and great travel benefits – for a large fee Read our full review

Run your own business?

We recommend Capital on Tap for limited companies. You earn points worth 0.8 Avios per £1 on the FREE standard card and 1 Avios per £1 on the Pro card. Capital on Tap cards also have no FX fees.

Capital on Tap Visa

NO annual fee, NO FX fees and points worth 0.8 Avios per £1 Read our full review

Capital on Tap Pro Visa

10,500 points (=10,500 Avios) plus good benefits Read our full review

There is also a British Airways American Express card for small businesses:

British Airways American Express Accelerating Business Card

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

There are also generous bonuses on the two American Express Business cards, with the points converting at 1:1 into Avios. These cards are open to sole traders as well as limited companies.

The American Express Business Platinum Card

50,000 points when you sign-up and an annual £200 Amex Travel credit Read our full review

The American Express Business Gold Card

20,000 points sign-up bonus and FREE for a year Read our full review

Click here to read our detailed summary of all UK credit cards which earn Avios. This includes both personal and small business cards.

Rob

Rob

Comments (62)