Having trouble with a refund? Here’s how to dispute a charge with Amex under Section 75

Links on Head for Points may support the site by paying a commission. See here for all partner links.

If you’ve been reading the Head for Points comments section, you will know that many readers have been discussing how ‘Section 75’ can help get them refunds from airlines or hotel groups which are not rushing to return their money.

What is Section 75?

‘Section 75’ is industry shorthand for part of the Consumer Credit Act 1974 that makes your credit card provider jointly and severally liable for any breach of contract or misrepresentation by a retailer.

It allows you to make a claim against your credit card company to get your money back if a retailer does not honour their side of the purchase, whatever that may entail. This includes failure to perfom due to bankruptcy.

Under the Consumer Credit Act 1974, the credit card company is jointly liable with the retailer for anything you buy as long as you spend over £100 and under £30,000. You can charge as little as £1 to a credit card to get the coverage, but the total purchase must be over £100. You can claim up to six years after the original purchase.

There is a quirk to the rules which will apply to flight transactions. If your total spend for your family was over £100 but each individual airline ticket cost under £100, Section 75 will not apply. The same applies if you bought four shirts for £30 each from a clothes shop.

This is one of the most consumer friendly pieces of legislation around. I’m never sure if the credit card companies are pleased it exists, but it is a great advertisement for using a credit card instead of cash or a debit card for major purchases.

Does Section 75 only apply to credit cards?

Yes.

Section 75 only applies to credit cards. This includes the British Airways American Express cards, the Amex Preferred Rewards Gold Card, the American Express Rewards Credit Card (ARCC) and the Marriott Bonvoy American Express card.

American Express charge cards are not covered – including the The Platinum Card. However, Amex chooses to voluntarily match Section 75 protection although it is not legally obliged to.

Section 75 only applies if you paid directly. If you used an intermediary such as PayPal or Curve then you cannot claim under Section 75 although both companies have similar, but not as legally strong, remediation schemes.

What happens if I paid with a debit card?

There is a separate mechanism called ‘chargeback’ which can be used if you made a payment with a debit card or if your credit card payment was for less than £100 per ticket.

A chargeback allows your card issuer to reverse your payment. You receive a refund and the money is taken back from the airline, hotel etc involved.

Visa, Mastercard and American Express have signed up the chargeback process. However, you need to understand that this is a voluntary scheme and you have no legal right to receive a refund.

How do you make a Section 75 claim against American Express?

Given current events we thought it would be helpful to have an article about the process of initiating a claim on an American Express card, as many people are unfamiliar with the process.

Unfortunately nobody on the HfP team has ever needed to process a chargeback on Amex, so we asked regular commenter Dean to help us out. Over to Dean:

“Firstly, decide whether you have a valid basis for the refund, i.e. did British Airways cancel your flight and so under EC 261/2004 make you legally entitled to a cash refund? Has the retailer promised a refund but they’re saying you’ll have to wait six months? If so, it might be time to raise a dispute.

Note that with American Express, the dispute raising process is the same for both credit cards and charge cards. However, credit cards have legal force under Section 75 of the Consumer Credit Act (1974), whilst charge cards only have Amex’s own voluntary process.

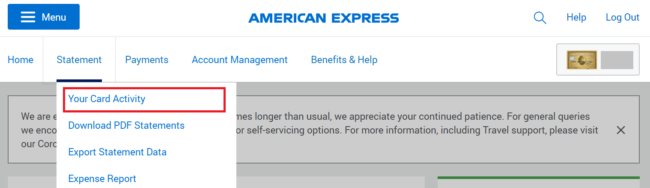

To raise a dispute you need to login to the Amex website on a desktop computer and not the app. Navigate across the top menu to ‘Statement’ and then to ‘Your Card Activity’ (click to enlarge):

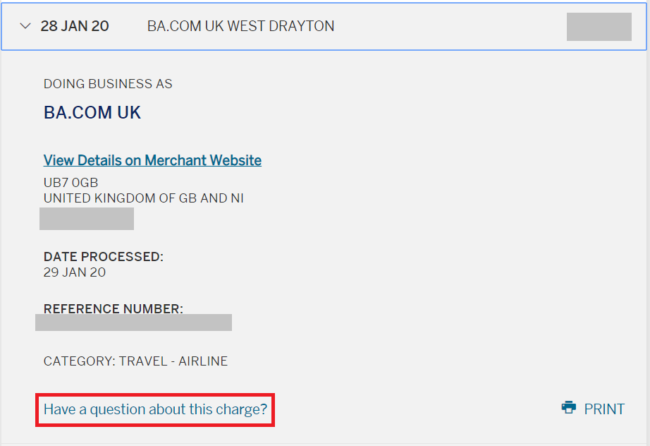

Next, navigate to the transaction that you would like to dispute, using the ‘Date Range’ to go back to the month in which the transaction was made if needed.

Click into the transaction and then click on the text at the bottom, ‘Have a question about this charge?’.

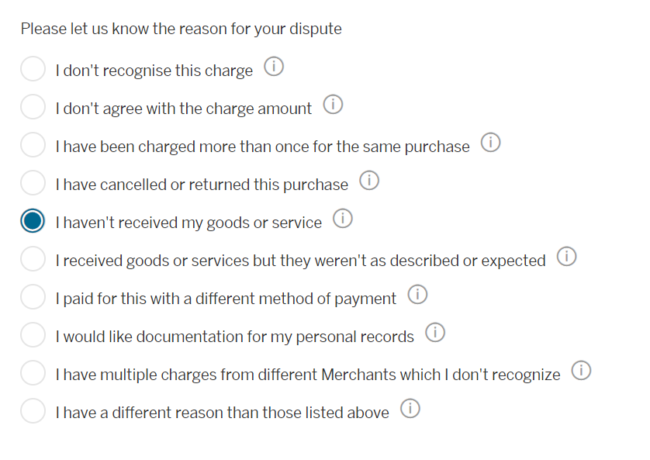

You’ll then need to answer a number of questions related to the dispute.

If Amex asks for it, you will need to upload any evidence you have, e.g. any correspondence with the retailer, notes from any calls, any refund promised etc.

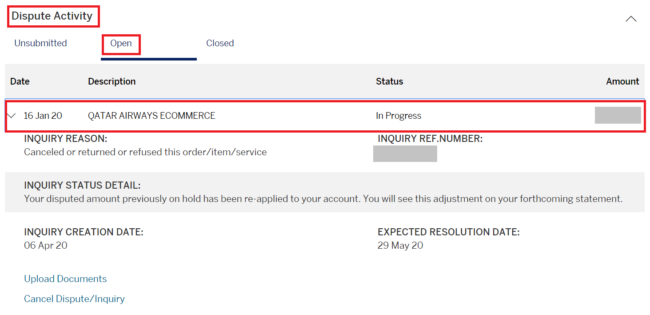

The dispute you’ve raised appears on the ‘Your Card Activity’ page. Clicking on ‘Dispute Activity’, on ‘Open’ and then the dispute itself displays details related to the dispute along with an expected resolution date.

I created a dispute for a Qatar Airways flight on 6 April and a ‘Credit for Disputed Charge’ amount hit my Amex statement three days later. I still have to wait potentially until 29 May for Amex to investigate with the retailer and to receive a final decision on the dispute. American Express will reclaim the money from my account if they refuse my claim.

Amex appear to have a risk based approach to such disputes. For smaller disputed amounts I have found that the case was closed straight away with no investigation. You will receive a letter in the post once the dispute is closed.

You could of course call American Express or use the chat function to open a case, but the self-service option I outline above is likely to be much quicker these days.”

Thanks Dean.

Please remember, before initiating a Section 75 claim, that it creates a lot of work for both American Express and the airline or hotel company involved. Virgin Atlantic, for example, is quoting 100 days at present to refund money from cancelled tickets.

If you are in immediate need of the money then you can raise a Section 75 case and you will receive it more quickly, but if you can sit it out then you are doing everyone a favour. Your money is not risk at the end of the day – if a company which owes you a refund does fail, you are still entitled to your money under Section 75.

PS. If you are not a regular Head for Points visitor, why not sign up for our FREE weekly or daily newsletters? They are full of the latest Avios, airline, hotel and credit card points news and will help you travel better. To join our 70,000 free subscribers, click the button below or visit this page of the site to find out more. Thank you.

Want to earn more points from credit cards? – July 2025 update

If you are looking to apply for a new credit card, here are our top recommendations based on the current sign-up bonuses.

In 2022, Barclaycard launched two exciting new Barclaycard Avios Mastercard cards with a bonus of up to 25,000 Avios. You can apply here.

You qualify for the bonus on these cards even if you have a British Airways American Express card:

Barclaycard Avios Plus Mastercard

Get 25,000 Avios for signing up and an upgrade voucher at £10,000 Read our full review

Barclaycard Avios Mastercard

Get 5,000 Avios for signing up and an upgrade voucher at £20,000 Read our full review

You can see our full directory of all UK cards which earn airline or hotel points here. Here are the best of the other deals currently available.

SPECIAL OFFER: Until 15th July 2025, the sign-up bonus on the Marriott Bonvoy American Express Card is TRIPLED to 60,000 Marriott Bonvoy points. This would convert into 25,000 Avios or into 40 other airline schemes. It would also get you at least £300 of Marriott hotel stays based on our 0.5p per point low-end valuation. Other T&C apply and remain unchanged. Click here for our full card review and click here to apply.

SPECIAL OFFER: Until 14th August 2025, the sign-up bonus on the Hilton Honors Plus debit card is TRIPLED to 30,000 Hilton Honors points. You will also receive Gold Elite status in Hilton Honors for as long as you hold the card. Click here for our full card review and click here to apply.

American Express Preferred Rewards Gold Credit Card

Your best beginner’s card – 20,000 points, FREE for a year & four airport lounge passes Read our full review

British Airways American Express Premium Plus Card

30,000 Avios and the famous annual Companion Voucher voucher Read our full review

The Platinum Card from American Express

50,000 bonus points and great travel benefits – for a large fee Read our full review

Virgin Atlantic Reward+ Mastercard

18,000 bonus points and 1.5 points for every £1 you spend Read our full review

Earning miles and points from small business cards

If you are a sole trader or run a small company, you may also want to check out these offers:

The American Express Business Platinum Card

50,000 points when you sign-up and an annual £200 Amex Travel credit Read our full review

The American Express Business Gold Card

20,000 points sign-up bonus and FREE for a year Read our full review

Capital on Tap Pro Visa

10,500 points (=10,500 Avios) plus good benefits Read our full review

Capital on Tap Visa

NO annual fee, NO FX fees and points worth 0.8 Avios per £1 Read our full review

British Airways American Express Accelerating Business Card

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

Comments (170)