My 1p rule for picking the best ‘Avios and cash’ combination to book

Links on Head for Points may support the site by paying a commission. See here for all partner links.

We receive many emails from people who struggle to make sense of the different cash vs Avios pricing options.

I occasionally mention my ‘1p rule’ for getting my preferred option, and I thought I’d re-run a longer explanation of this today.

If your job involves dealing with numbers all day then you might find this a bit basic, but not everyone sees numbers in the same way.

Which Avios pricing option is best?

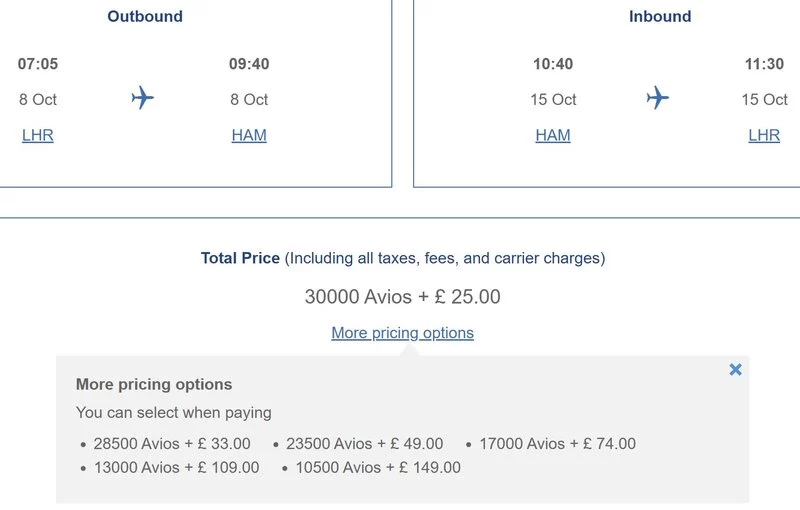

When you are booking an Avios redemption, you will – unless booking certain partner airlines which do not allow it – be presented with something like this.

This example is for a Club Europe return Avios redemption to Hamburg:

Your options are:

- 30,000 Avios + £25

- 28,500 Avios + £33

- 23,500 Avios + £49

- 17,000 Avios + £74

- 13,000 Avios + £109

- 10,500 Avios + £149

Which of these is best? The way I work it out is to assume that I value an Avios at 1p.

In this scenario, the six pricing options above work out at, in order:

- £325

- £318

- £284

- £244

- £239

- £254

This means, in my example, that the best option is ‘13,000 Avios + £109’, the fifth on the list, although the last three options all offer similar value.

However, it is only the best choice because I used a 1p valuation for an Avios.

Is 1p the right valuation to use for an Avios?

The main reason I like to use 1p per Avios is that it is simple. I can do the maths in my head. Don’t underestimate the value of simplicity.

I did a long article here on what an Avios point is worth. Personally, I have a spreadsheet of the nine million I have redeemed since 2013 and based on my ‘fair’ value of each redemption I get to around 1.2p.

(What is ‘fair’ value? The fair value of a redemption flight, to me, is what I would realistically have been willing to pay in cash. This isn’t usually what BA would have sold it for, but I make an assumpton based on what I might pay for an indirect flight or a flight at less sociable times if I needed to pay.)

It is VERY unlikely that your value of an Avios will be the same as mine at 1.2p. If you only redeem for 2-4-1 Companion Voucher tickets then it will be higher – as we are a family of four, we don’t generate enough 2-4-1 vouchers to book every ticket for every trip on a 2-4-1. If you only redeem for upgrades, it will be higher. If you only redeem for short notice European flights in Economy, it will be higher.

You also need to consider ‘replacement value’

There is another factor to think about which may impact which option you pick.

Whilst I may value Avios at 1p, I cannot buy them at that price if I suddenly find out that I don’t have enough. New features like ‘Avios Boost’ (read more here) and ‘Avios Subscription’ (read more here) can help but can’t deliver a large amount of points quickly.

This means that it may make sense to use fewer Avios for my current booking in order to keep my supply high enough for the next redemption.

In the Hamburg example, based on 1p per Avios, the best three options are:

- 17,000 Avios + £74 = £244

- 13,000 Avios + £109 = £239

- 10,500 Avios + £149 = £254

It’s possible, if my Avios pot was looking a little low, that I would choose the 10,500 Avios option. This is purely to retain more Avios in my account for future use, even though this is not the cheapest option.

(If you are Avios rich and cash poor, the opposite applies. With the three options above being of similar value, if you are ‘cash poor’ then the version which requires a £74 cash payment may be preferable. I would still avoid the option which requires £25 of cash because this is terrible value, despite the cash saved.)

Conclusion

Irrespective of the exact value you put on an Avios point – and you should also factor in your views on potential devaluation risk – I find that ‘the 1p rule’ is the quickest and easiest way to get my head around the multiple Avios pricing options presented.

PS. If you are not a regular Head for Points visitor, why not sign up for our FREE weekly or daily newsletters? They are full of the latest Avios, airline, hotel and credit card points news and will help you travel better. To join our 70,000 free subscribers, click the button below or visit this page of the site to find out more. Thank you.

How to earn Avios from UK credit cards (July 2025)

As a reminder, there are various ways of earning Avios points from UK credit cards. Many cards also have generous sign-up bonuses!

In February 2022, Barclaycard launched two exciting new Barclaycard Avios Mastercard cards with a bonus of up to 25,000 Avios. You can apply here.

You qualify for the bonus on these cards even if you have a British Airways American Express card:

Barclaycard Avios Plus Mastercard

Get 25,000 Avios for signing up and an upgrade voucher at £10,000 Read our full review

Barclaycard Avios Mastercard

Get 5,000 Avios for signing up and an upgrade voucher at £20,000 Read our full review

There are two official British Airways American Express cards with attractive sign-up bonuses:

British Airways American Express Premium Plus Card

30,000 Avios and the famous annual Companion Voucher voucher Read our full review

British Airways American Express Credit Card

5,000 Avios for signing up and an Economy 2-4-1 voucher for spending £15,000 Read our full review

You can also get generous sign-up bonuses by applying for American Express cards which earn Membership Rewards points. These points convert at 1:1 into Avios.

American Express Preferred Rewards Gold Credit Card

Your best beginner’s card – 20,000 points, FREE for a year & four airport lounge passes Read our full review

The Platinum Card from American Express

50,000 bonus points and great travel benefits – for a large fee Read our full review

Run your own business?

We recommend Capital on Tap for limited companies. You earn points worth 0.8 Avios per £1 on the FREE standard card and 1 Avios per £1 on the Pro card. Capital on Tap cards also have no FX fees.

Capital on Tap Visa

NO annual fee, NO FX fees and points worth 0.8 Avios per £1 Read our full review

Capital on Tap Pro Visa

10,500 points (=10,500 Avios) plus good benefits Read our full review

There is also a British Airways American Express card for small businesses:

British Airways American Express Accelerating Business Card

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

There are also generous bonuses on the two American Express Business cards, with the points converting at 1:1 into Avios. These cards are open to sole traders as well as limited companies.

The American Express Business Platinum Card

50,000 points when you sign-up and an annual £200 Amex Travel credit Read our full review

The American Express Business Gold Card

20,000 points sign-up bonus and FREE for a year Read our full review

Click here to read our detailed summary of all UK credit cards which earn Avios. This includes both personal and small business cards.

Rob

Rob

Comments (62)