Review: the Lloyds Bank World Elite Mastercard

Links on Head for Points may support the site by paying a commission. See here for all partner links.

This is our review of the Lloyds Bank World Elite Mastercard credit card.

It is part of our series of articles looking at the major UK loyalty credit cards and discussing whether or not they are worth applying for. These articles are linked to the relevant sections of the ‘Credit Cards‘ area in the menu bar. Our other UK airline and hotel credit card reviews can be found here.

Key link: Lloyds Bank World Elite Mastercard application form

Key facts: £15 monthly fee

You do NOT need to have a Lloyds Bank current account to apply.

Representative 55.0% APR variable based on an assumed £1,200 credit limit and £15 monthly fee. Interest rate on purchases 22.94% APR variable.

Travel-focused credit cards generally have high interest rates and are not suitable for anyone who does not pay off their full balance each month. If you do not clear your balance, you should look for a non-rewards credit card with a low interest rate.

This article was updated on 1st April 2025, and all of the information is correct as of that date. Ignore the original publication date shown.

About the Lloyds Bank World Elite card

The Lloyds Bank World Elite Mastercard is issued by Lloyds Bank.

It is a bit of an oddity amongst all of the other credit cards covered in this series because it does NOT earn miles or points. Instead, you receive cashback on your spending at an attractive rate.

We cover the card because it has two key features:

- it is the cheapest way to get a ‘full’ Priority Pass for two people, allowing you and a nominated second person to get free access to 1,400 airport lounges and £18 credits at many airport restaurants

- it has 0% FX fees for your first five years – there are NO ‘miles and points’ credit cards which offer 0% FX fees globally

What is the Lloyds Bank World Elite sign-up bonus?

The card does not come with a sign-up bonus.

There is an excellent airport lounge benefit

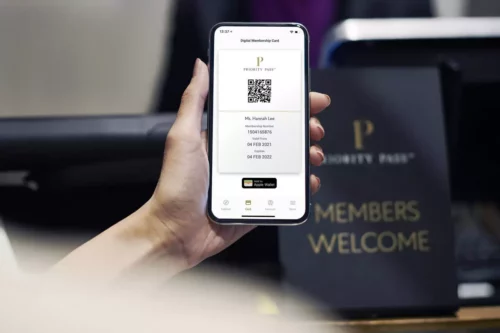

You will receive free, unlimited, access via the Priority Pass scheme to 1,400 airport lounges.

This is for you as the main cardholder. However, you can add a second free supplementary holder to your credit card who will also receive a Priority Pass.

Guests, including children, are charged at £24 per lounge visit.

The Lloyds Bank World Elite Mastercard is substantially cheaper than the HSBC Premier World Elite Mastercard if your goal is airport lounge access. Lloyds Bank is £15 per month (£180 per year) whilst HSBC is £350 with one supplementary cardholder.

Both are cheaper than The Platinum Card from American Express (£650 annual fee) although the Platinum package has far more benefits – Hilton Honors Gold, Radisson Rewards Premium, MeliaRewards Gold, Marriott Bonvoy Gold, Eurostar lounge access, £400 per year of dining credit etc (see my American Express Platinum review for details).

The Priority Pass issued by Lloyds Bank and HSBC is better than the American Express-issued version in one respect. Many airport restaurants give an £18 food and drink credit to Priority Pass holders, but American Express opts out of this benefit. Lloyds Bank and HSBC cards can access it. This article shows you the UK airport restaurants you can use.

If you have a Limited Company, the Capital on Tap Pro Visa credit card offers an identical Priority Pass benefit for a higher fee (£299) – read our Capital on Tap Pro Visa review here. It also comes with Radisson Rewards VIP status.

What other benefits are there?

You can take advantage of fast track security at selected airports. Gatwick, Luton and Stansted all participate, amongst others – see here for details.

You can access special offers via Mastercard’s Priceless website, including some especially for World Elite cardholders.

What is the Lloyds Bank World Elite annual fee?

£180, charged at £15 per month.

There is no requirement to bank with Lloyds Bank to apply.

What do I earn per £1 spent on the card?

Instead of miles and points, you receive cashback when you spend on your Lloyds Bank World Elite Mastercard.

You will receive:

- 0.5% cashback on your first £15,000 of spending in each card year

- 1% cashback on all spending above £15,000 in each card year

The breakeven point, when the cashback covers your £180 annual fee, is £25,500 of annual card spend.

Is this a good card to use when travelling?

Yes, very much so.

The Lloyds Bank World Elite Mastercard has 0% FX fees globally. This is guaranteed for the first five years of holding the card.

There are no credit cards with 0% foreign exchange fees worldwide which earn airline or hotel points. The best alternatives are the Virgin Atlantic credit cards which have 0% FX fees in the Eurozone.

If you travel outside the Eurozone and want a 0% FX option, this card will be cheaper to use than any ‘miles and points’ credit card you may have.

Conclusion

Unsurprisingly, it is very rare that Head for Points recommends a credit card which does not offer any miles or points!

However, the Lloyds Bank World Elite Mastercard has two things in its favour.

At £180 per year, it is THE cheapest way to get a Priority Pass for people for airport lounge access via a credit card. (Don’t even think of buying a Priority Pass directly – you will pay £838 per year for two ‘unlimited visits’ passes.)

With 0% FX fees globally, it also offers you an FX benefit that no ‘miles and points’ card in your wallet can match.

The application form for the Lloyds Bank World Elite Mastercard can be found here.

(Want to earn more miles and points from credit cards? Click here to visit our dedicated airline and hotel travel credit cards page or use the ‘Credit Cards’ link in the menu bar at the top of the page.)

Disclaimer: Head for Points is a journalistic website. Nothing here should be construed as financial advice, and it is your own responsibility to ensure that any product is right for your circumstances. Recommendations are based primarily on the ability to earn miles and points. The site discusses products offered by lenders but is not a lender itself. Robert Burgess, trading as Head for Points, is regulated and authorised by the Financial Conduct Authority to act as an independent credit broker.