Why I tried Revolut on my trip to New York – but should you?

Links on Head for Points may support the site by paying a commission. See here for all partner links.

EDIT March 2021: The free card offer is currently suspended due to coronavirus. You will NOT receive a free card if you use the link in this article.

This is my review of the Revolut payment card. Is it worth getting to save money on FX fees when you spend money abroad?

My purse does not contain any credit or debit cards that charge no foreign exchange fees. I know that I should have tackled this issue way sooner as I’ve wasted money on unnecessary FX fees in the past. Last month, with my New York trip coming up, I needed a quick solution.

Why did I try Revolut? Well, the honest answer to this question is that a friend, who works as cabin crew for British Airways, told me over a bottle of wine that it was a payment card (a reloadable Mastercard debit card) without any foreign exchange fees and she had been using one very successfully.

That said, Rob isn’t a fan of pre-paid cards such as Revolut (and Monzo, and Starling, and WeSwap), which is why he’s never covered it in the past. As he wrote in the HFP comments section to a reader a few weeks ago:

“I don’t want to be fiddling around topping up a card and worrying about my balance every time I want to buy something. You might as well get a free credit card with 0% foreign exchange fees – such as the Virgin Money Travel Credit Card – which would get you up to 56 days credit and lets you pay the bill for your foreign spend with your normal credit card bill. Why make life hard for yourself?”

But what does he know?! Here is what I found:

What is Revolut?

Revolut is an app that works as a digital wallet for British Pounds, Euros and US Dollars (amongst other currencies) letting you transfer money for free to friends or businesses.

An app isn’t any use in a shop, however. To use it in the real world, you need to order a physical card – branded as a Mastercard – which will give you 0% FX fees on your spending and money withdrawals abroad.

Revolut quotes a number of different figures about the currencies it uses. This is how I understand it:

You can physically hold a balance on the app in 16 currencies – USD, GBP, EUR, PLN, CHF, DKK, NOK, SEK, RON, SGD, HKD, AUD, NZD, TRY, ILS or ZAR. These are the only currencies you can pre-purchase and lock in an exchange rate in advance of your trip.

You can transfer money electronically in 26 different currencies. If the currency isn’t on the list above, it will be exchanged at the spot rate from another balance.

You can spend money in 120 currencies. If the currency isn’t on the list above, eg Thai Baht, Revolut converts it at spot rate and deducts it from another balance.

The company was founded in 2015 and has just raised $66m in a Series B funding allowing for more features to be added, with the goal of turning it into a fully fledged bank. If you were wondering how it makes money charging 0% FX fees, the answer is “it doesn’t”. The company announced a pre-tax loss of £7.1 in 2016 on just £2m of revenue.

How do I open a Revolut account?

You must be at least 18 years old to apply.

Firstly you need to open App Store or Google Play and download the Revolut app. You can also sign up on the Revolut website here.

You need to verify the account with your phone number and can start adding money from your bank account or using a credit card (Mastercard or VISA).

If you want a physical card, and if you’re planning to use Revolut for payments abroad you will need the card, you can order one via the app. This usually costs £5 but we have a special deal with Revolut for our readers.

If you order via our Revolut link here, you will get the physical card free of charge.

Insert your mobile number and click on the URL Revolut will send to your phone. This will open the Google Play or Apple App Store. Download the app, open it and create an account, which takes 30 seconds.

You need to top up £10 before you can select and order your free card (standard delivery). Verify your identity (tap more -> profile -> verify identity) and your card will be with you in a few days. If you want express delivery you do need to pay for this (£12) so stick with standard delivery, which saves you £5 via our link.

You need to verify your identity with your passport, driving licence or ID card if you want to spend more than a total of £500 with your Revolut card.

As well as the UK, you can also get a Revolut card if you live in: Aland Islands, Austria, Azores, Belgium, Bulgaria, Canary Islands, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, French Guiana, Germany, Gibraltar, Greece, Guadeloupe, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Martinique, Mayotte, Netherlands, Norway, Poland, Portugal, Réunion, Romania, Saint Helena, Slovakia, Slovenia, Spain, St. Martin or Sweden.

How does Revolut work?

You can top up your Revolut account by bank transfer, debit or credit card. There is a 1% fee for credit card top ups.

My TSB credit card treats Revolut top-ups as a ‘purchase’. Comment online suggest that some credit cards treat Revolut as a cash advance (no points, cash fee) and others as a purchase (would earn points, no fee). There could be potential here for ‘purchasing’ frequent flyer miles relatively cheaply if you had a very high earning Visa or Mastercard such as the Virgin Atlantic Rewards card although I haven’t tested Revolut with one of those.

The money will sit in your Revolut account in the currency you’ve topped up but you can move it in between your different currency accounts at the current spot exchange rate. If you have a bank account in the UK, are travelling to the US in a couple of weeks and the current exchange rate feels exceptionally good, you could exchange your money in advance to avoid a possibly worse exchange rate later. This works for the 16 currencies I listed above.

What does the Revolut app look like?

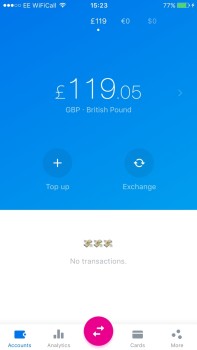

Below is a screenshot of the home screen.

As well as showing your British Pounds, Euro and US Dollar balances, the home screen shows your last transactions. Remember that Revolut can hold a balance in 16 currencies in total, not just these three.

At the bottom are further options: Accounts, Analytics, Transfer Options and Cards.

Spending money on Revolut

The main reason I decided to try Revolut was to use it in stores and restaurants in New York without paying FX fees.

Let’s get the annoying bit out of the way first: you pretty much need to know how much you will be spending before leaving the house / hotel / wifi zone, in order to ensure your Revolut card has a high enough balance. Outside Europe, you could be hit with a hefty mobile bill if you had to turn on data roaming just to top up your card.

Every store and restaurant accepted my card and I had no issues paying.

Sending money with Revolut

After my New York trip I had £119.05 left on my Revolut card. As it’s stupid to have money sitting on a card that doesn’t pay you interest – and probably helps the company make money with your money – I wanted to transfer the money back into my bank account.

I had to set myself up as a beneficiary by entering my bank details manually and was then able to select the amount of money I wanted to transfer. I got a notification that I’d receive my money the same day and within less than an hour the money was in my current account.

As well as paying money back into your own account you can also pay another person or a business with your Revolut app. Simply add the bank details and your money will be transferred.

Your Revolut account can also double as a regular UK and/or Euro bank account. Your card has its own sort code and account number. This is how the company sees the product developing. They hope that you will pay your salary into your Revolut account, use the card for all of your spending at home or abroad and also pay your bills with it.

The travel benefits being used to sell the card now are a loss leader to get you on board in order to offer you full banking later on, backed by the $66m they just raised. Revolut already offers personal loans at a high 9.9% APR, with the money dropped instantly onto your card.

What else should you know?

Revolut isn’t really free, although you are able to avoid all of the costs if you are savvy.

The £5 postage fee to order your plastic card is waived if you use our links on this page (which is a link that Revolut has made available to a lot of travel sites for their readers).

In theory all you need to do is top up your money and use Revolut as a normal payment card. It will exchange the currency automatically without adding fees.

At the weekend Revolut uses the exchange rate from Friday and adds a mark up depending on the currency, usually 0.5%. If you want genuinely free transfers, make sure you do them between Monday and Friday.

Free cash withdrawals are limited to £200 per month. After that you pay 2%.

For very heavy users, even spending on the card is not free. There is fee of 0.5% when you spend over £5,000 in any one month.

Here is an overview of the charges:

A spare Revolut card costs £5 + £5 delivery fee

Transfers to friends or businesses take two business days – you must pay £5 to get the money across in one business day

Transactions of up to £5,000 per month are free, thereafter the fee is 0.5%

At the weekend Revolut uses the exchange rate from Friday 23:59 and adds, for most currencies, a 0.5% mark up

Three currencies DO incur a fee when spending – Thai Baht (1.5%), Russian Ruble (1.5%), Ukrainian Hryvnia (1%)

You can withdraw up to £200 per month from an ATM without paying a fee, but you pay 2% after that

To increase the ATM limit to £400 per month, you need to pay £6.99 fee each month to become a ‘Premium’ cardholder. Premium cardholders also avoid the £5,000 per month cap on transactions.

Conclusion – is Revolut worth it?

My only alternative to Revolut on my New York trip would have been my American Express Preferred Rewards Gold charge card with a 3% FX fee. Even though I would have earned 2 Membership Rewards points per £1 spent (foreign transactions earn double points) the Revolut option was still cheaper, assuming I value a Membership Rewards point at 1p.

(If you don’t know much about the American Express Preferred Rewards Gold card, take a look at this article we wrote. You get 20,000 Membership Rewards points – worth £100 of shopping vouchers or many other things – for spending £3,000 within 90 days. The card is free for the first year and you get two free airport lounge passes. You can cancel at any point before the fee for the 2nd year comes around.)

Using Revolut instead of a credit card doesn’t hurt your credit record which is a good thing. Taking out a 0% credit card purely to use abroad may make it harder to get other credit cards unless you ask for a very low limit.

Obviously the FX rates are great and if you don’t mind the hassle of having to top up your money via an app in order to use the card, Revolut is a good solution when travelling abroad.

However,there are other options. Curve is a hybrid solution – you pay a 1% FX fee on purchases abroad but the transaction is recharged to any other Visa or Mastercard which could earn you up to 1% in rewards. (Curve is free and you will be paid £5 for trying it.)

I will definitely keep my Revolut card as it’s very useful if I have to send money back home to Germany (I had to pay a fee of £10 last time I did this thanks to Lloyds) and for now I will put up with the need to keep topping up and transferring money back.

Long term I think I will look into Currensea, which is free and charges overseas purchases directly to your bank account, taking only a 0.5% FX fee.

The Revolut website is here. This link will waive the £5 delivery fee for the plastic card if you follow the instructions above, topping it up with £10.

PS. If you are not a regular Head for Points visitor, why not sign up for our FREE weekly or daily newsletters? They are full of the latest Avios, airline, hotel and credit card points news and will help you travel better. To join our 70,000 free subscribers, click the button below or visit this page of the site to find out more. Thank you.

Want to earn more points from credit cards? – July 2025 update

If you are looking to apply for a new credit card, here are our top recommendations based on the current sign-up bonuses.

In 2022, Barclaycard launched two exciting new Barclaycard Avios Mastercard cards with a bonus of up to 25,000 Avios. You can apply here.

You qualify for the bonus on these cards even if you have a British Airways American Express card:

Barclaycard Avios Plus Mastercard

Get 25,000 Avios for signing up and an upgrade voucher at £10,000 Read our full review

Barclaycard Avios Mastercard

Get 5,000 Avios for signing up and an upgrade voucher at £20,000 Read our full review

You can see our full directory of all UK cards which earn airline or hotel points here. Here are the best of the other deals currently available.

SPECIAL OFFER: Until 15th July 2025, the sign-up bonus on the Marriott Bonvoy American Express Card is TRIPLED to 60,000 Marriott Bonvoy points. This would convert into 25,000 Avios or into 40 other airline schemes. It would also get you at least £300 of Marriott hotel stays based on our 0.5p per point low-end valuation. Other T&C apply and remain unchanged. Click here for our full card review and click here to apply.

SPECIAL OFFER: Until 14th August 2025, the sign-up bonus on the Hilton Honors Plus debit card is TRIPLED to 30,000 Hilton Honors points. You will also receive Gold Elite status in Hilton Honors for as long as you hold the card. Click here for our full card review and click here to apply.

American Express Preferred Rewards Gold Credit Card

Your best beginner’s card – 20,000 points, FREE for a year & four airport lounge passes Read our full review

British Airways American Express Premium Plus Card

30,000 Avios and the famous annual Companion Voucher voucher Read our full review

The Platinum Card from American Express

50,000 bonus points and great travel benefits – for a large fee Read our full review

Virgin Atlantic Reward+ Mastercard

18,000 bonus points and 1.5 points for every £1 you spend Read our full review

Earning miles and points from small business cards

If you are a sole trader or run a small company, you may also want to check out these offers:

The American Express Business Platinum Card

50,000 points when you sign-up and an annual £200 Amex Travel credit Read our full review

The American Express Business Gold Card

20,000 points sign-up bonus and FREE for a year Read our full review

Capital on Tap Pro Visa

10,500 points (=10,500 Avios) plus good benefits Read our full review

Capital on Tap Visa

NO annual fee, NO FX fees and points worth 0.8 Avios per £1 Read our full review

British Airways American Express Accelerating Business Card

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

Rob

Rob

Comments (206)