Get £300 of dining credit every year with American Express Platinum

Links on Head for Points may support the site by paying a commission. See here for all partner links.

American Express has launched a valuable new benefit for holders of The Platinum Card – £300 per year of restaurant credit.

This benefit is guaranteed to run until at least the end of 2024. It fundamentally changes the value calculation on whether you should get the card or not, especially when added to the £100 per year of Harvey Nichols credit launched earlier this year.

You could offset the £650 annual fee by £400 – £300 per year of dining credit and £100 per year of Harvey Nichols spend – which means that you are getting a lot of benefits for the balance of £250.

How does the new American Express Platinum dining credit work?

It’s not quite as simple as it could be, if I’m honest. The credit is split into two parts:

- you get £150 per year of dining credit at selected UK restaurants

- you get £150 equivalent per year of dining credit at selected overseas restaurants

Is there any onerous small print?

Not really:

- This is an ‘opt in’ offer. You MUST register before you start receiving cashback.

- You do NOT have to book via any special channel – simply pay for your meal with The Platinum Card.

- The offer is cumulative. You don’t need to spend the entire £150 in one meal or at the same restaurant.

- The credit runs per calendar year and resets on 1st January – this means that you could claim it twice during your first year of card membership

- Unused credit does not carry over to the next calendar year

- Supplementary cards are not eligible. Only the primary card receives the credit and payments must be made with the primary card.

- The offer is guaranteed to run until at least the end of 2024

What restaurants are taking part?

There are 1,400 participating restaurants in 20 countries.

To use the ‘international’ part of your credit, you need to visit:

- EUROPE: Austria, Belgium, Finland, France, Germany, Italy, Luxembourg, Netherlands, Spain, Sweden

- ASIA / OCEANIA: Australia, Hong Kong, Japan, New Zealand, Singapore, Taiwan, Thailand

- AMERICAS: Canada, Mexico, United States

The UK allocation is fairly well spread throughout the country. Taking Birmingham, for example, there are four participating restaurants:

- Opheem

- Simpsons

- Tattu

- The Ivy Temple Row

Whilst clearly you can’t please everyone, American Express does seem to have made an effort to provide a broad spread of restaurants. There are 13 towns and cities in the Netherlands with a participating restaurant, for example – it’s not just in Amsterdam.

How do I register?

Look in the ‘Offers’ section of your Platinum statement page, either online or in the app.

You must register TWICE – once for the UK offer and once for the international offer.

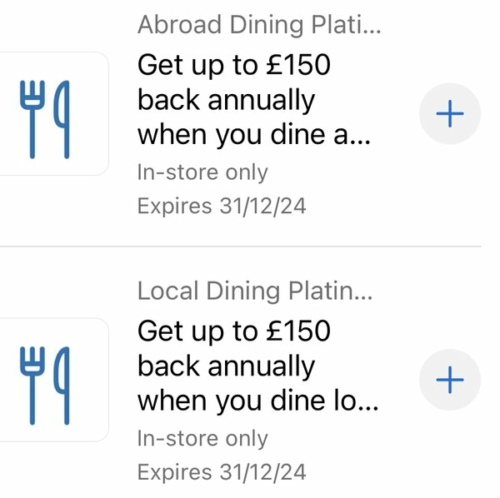

This is what you are looking for:

Conclusion

This is a very generous new benefit from American Express Platinum.

I think you can reasonably treat the £150 of UK credit as ‘free money’, given that there are over 160 restaurants taking part.

The £150 of international credit will be a little more restrictive to use and will require you to fit in meals around your travelling. On the other hand, it provides a great excuse to try out a local restaurant which you would probably have otherwise ignored. It could even be a good excuse to head over to Paris or Amsterdam for the day for a slap-up lunch.

As the credit is cumulative, there is no pressure for solo diners or couples to go unnecessarily crazy on the wine either. You can use the credit over multiple meals if you wish.

You can find out more about this new benefit, and see the list of participating restaurants, here.

You can find out more about the card, and apply, here.

The Platinum Card from American Express

40,000 bonus points and a huge range of valuable benefits – for a fee Read our full review

Rob

Rob

Comments (362)