Avios changes 2: understanding the new earning rates

Links on Head for Points may support the site by paying a commission. See here for all partner links.

My three articles today look at the headline changes announced by BA yesterday. I will follow this up with some deeper discussion tomorrow.

Key link: ‘Club Changes’ page on ba.com

Here are the other articles in this series you may have missed:

1. Understanding the new tier point rules

3. Understanding the new spending rates

4. What is an Avios point worth now?

5. Exploiting the ‘no repricing on date changes’ rule

6. Why are off-peak upgrades now more expensive than peak?

7. Save 43% of your Avios on long-haul redemptions if you fly Iberia

8. Partner redemptions may be cheaper if booked on iberia.com

9. What will happen to airline partner earning rates?

10. Are you a winner or a loser overall?

The changes only apply to tickets booked after April 28th. Tickets booked before then will be covered by the current rules, whenever the travel date.

This article looks at the changes to Avios earning rates.

If the bulk of your Avios points come from credit cards, Tesco etc then these earning changes will not impact you much. For others it will mean a massive change.

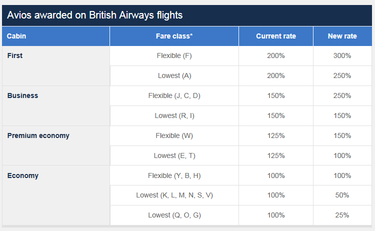

Here is a summary table of the old and new rates:

Earnings on cheap economy seats drop from 100% to 25%-50%. The minimum number of Avios earned per flight has also been adjusted to reflect this. Instead of earning at least 500 Avios per flight, you are now only guaranteed a minimum of 125 for the cheapest economy tickets.

In itself, I don’t blame BA for changing this in some way. The old system was too generous and this is only moving back to what existed pre 2011.

If this had been the only change made to the scheme, I would have shrugged it off as a shame but also as a return to commercial reality. Giving out 12,000 Avios for a flight to the US in deeply discounted economy did not make a lot of sense. They were giving away a European flight with every long-haul.

However, BA is also making changes at the top end. Fully flexible business class tickets jump from 150% to 250%. This is pointless.

How many people buy fully flexible business class tickets with their own money? Almost none. How many companies let employees pick their airline? Not many, as there are usually bulk deals in place. The banker who has no choice but to use British Airways because the airline has negotiated a deal with his employer sees his mileage jump sharply.

(No changes have been announced to earnings rates on partner airlines but that doesn’t mean that none will be forthcoming!)

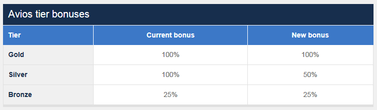

BA has also tampered with the status bonus for Silver members:

The Silver bonus drops from 100% to 50%. Again, if I’m totally honest, I could have lived with this if it had been the only change.

The impact of this on a fairly large sub-section of BA customers is huge.

Let’s assume you are a Silver member who flies to Cape Town in deeply discounted economy. Using 12,000 miles as a rough distance, you would earn 24,000 miles for the round-trip. After April 28th, you would only earn 9,000! That is an astonishing drop.

A successful scheme is about increasing marginal spend from EVERY customer. Not your top 10% of customers (who only use you because their employer tells them to) but from all your customers.

BA, on the other hand, has told about 70% of customers by volume that it really couldn’t care less if they continue to fly with them or not. The customers it does want to keep and will reward heavily are those who are effectively forced to buy their product by their employer, an employer who already receives large rebates from BA. If that sounds odd to you, it should.

Click for the next article – understanding the new spending rates

PS. If you are not a regular Head for Points visitor, why not sign up for our FREE weekly or daily newsletters? They are full of the latest Avios, airline, hotel and credit card points news and will help you travel better. To join our 70,000 free subscribers, click the button below or visit this page of the site to find out more. Thank you.

How to earn Avios from UK credit cards (July 2025)

As a reminder, there are various ways of earning Avios points from UK credit cards. Many cards also have generous sign-up bonuses!

In February 2022, Barclaycard launched two exciting new Barclaycard Avios Mastercard cards with a bonus of up to 25,000 Avios. You can apply here.

You qualify for the bonus on these cards even if you have a British Airways American Express card:

Barclaycard Avios Plus Mastercard

Get 25,000 Avios for signing up and an upgrade voucher at £10,000 Read our full review

Barclaycard Avios Mastercard

Get 5,000 Avios for signing up and an upgrade voucher at £20,000 Read our full review

There are two official British Airways American Express cards with attractive sign-up bonuses:

British Airways American Express Premium Plus Card

30,000 Avios and the famous annual Companion Voucher voucher Read our full review

British Airways American Express Credit Card

5,000 Avios for signing up and an Economy 2-4-1 voucher for spending £15,000 Read our full review

You can also get generous sign-up bonuses by applying for American Express cards which earn Membership Rewards points. These points convert at 1:1 into Avios.

American Express Preferred Rewards Gold Credit Card

Your best beginner’s card – 20,000 points, FREE for a year & four airport lounge passes Read our full review

The Platinum Card from American Express

50,000 bonus points and great travel benefits – for a large fee Read our full review

Run your own business?

We recommend Capital on Tap for limited companies. You earn points worth 0.8 Avios per £1 on the FREE standard card and 1 Avios per £1 on the Pro card. Capital on Tap cards also have no FX fees.

Capital on Tap Visa

NO annual fee, NO FX fees and points worth 0.8 Avios per £1 Read our full review

Capital on Tap Pro Visa

10,500 points (=10,500 Avios) plus good benefits Read our full review

There is also a British Airways American Express card for small businesses:

British Airways American Express Accelerating Business Card

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

There are also generous bonuses on the two American Express Business cards, with the points converting at 1:1 into Avios. These cards are open to sole traders as well as limited companies.

The American Express Business Platinum Card

50,000 points when you sign-up and an annual £200 Amex Travel credit Read our full review

The American Express Business Gold Card

20,000 points sign-up bonus and FREE for a year Read our full review

Click here to read our detailed summary of all UK credit cards which earn Avios. This includes both personal and small business cards.

Rob

Rob

Comments (32)