British Airways devalues Avios redemptions on Cathay Pacific and Japan Airlines

Links on Head for Points may support the site by paying a commission. See here for all partner links.

British Airways has, with no notice, devalued short-haul Avios redemptions on Cathay Pacific and Japan Airlines. Some flights have increased by 50%.

Don’t expect BA to tell you about this, because they won’t. Whilst they did confirm the devaluation when we asked, they refused to tell us exactly what has changed:

“Unfortunately we’re unable to provide that level of detail.”

Don’t worry – we have it anyway.

Avios originally had one reward chart covering both British Airways and partner airlines. It wasn’t exactly straightforward – BA, Iberia and Aer Lingus flights had peak and off-peak dates, partner flights were always peak – but at least you knew where to look.

(The exception was the little known ‘multi partner Avios redemption chart’ for trips involving 2+ airlines which are not BA. The real sweet spots in the programme are probably now here.)

The first change was back in January 2016, when Zone 1 (up to 650 miles) was abolished for flights within the United States. This was because it was, frankly, too attractive – a flight between New York and Boston was 12,500 American Airlines miles but only 4,500 Avios.

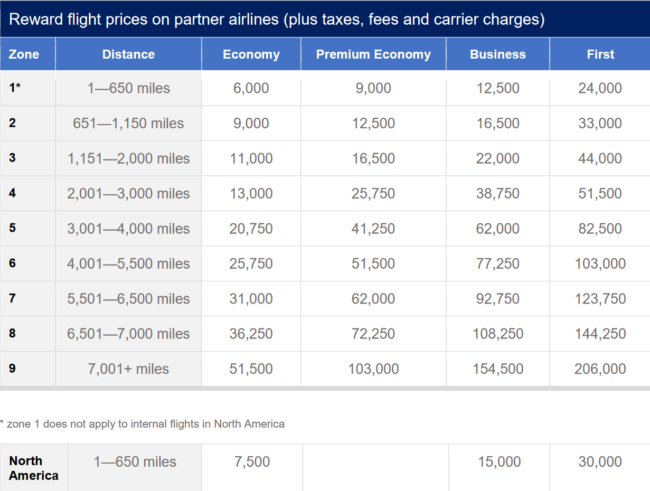

Skip forward to June 2019, and British Airways decided to launch an entirely separate reward chart for partner airlines – see here.

The only major change was to whack shorter redemptions. A Zone 1 flight went from 4,500 Avios to 6,000 Avios whilst a Zone 2 flight (651 to 1,150 miles) went from 7,500 Avios to 9,000 Avios. This is one-way economy pricing. Oddly, short domestic US flights did not change – these still price at the old Zone 2 pricing.

Here is how the partner chart looked up to last week:

Japan Airlines and Cathay Pacific have new pricing

Last week, British Airways rolled out higher Avios pricing for short flights on Japan Airlines and Cathay Pacific.

There are a few weird things about this:

- the changes are different across each airline

- Malaysia Airlines and SriLankan Airlines pricing is untouched

This is what has changed:

Japan Airlines

- Zone 1 Economy – up from 6,000 Avios to 7,500 Avios

- Zone 1 Business – unchanged

- Zone 2 Economy – up from 9,000 Avios to 10,000 Avios

- Zone 2 Business – up from 16,500 Avios to 24,000 Avios (ouch)

- Zone 3 Economy – unchanged

- Zone 3 Business – up from 22,000 Avios to 24,000 Avios

Cathay Pacific

- Zone 1 Economy – up from 6,000 Avios to 7,500 Avios

- Zone 1 Business – up from 12,500 Avios to 16,000 Avios

- Zone 2 Economy – up from 9,000 Avios to 10,000 Avios

- Zone 2 Business – up from 16,500 Avios to 25,000 Avios (ouch)

- Zone 3 Economy – unchanged

- Zone 3 Business – up from 22,000 Avios to 25,000 Avios

Perhaps the weirdest thing in all of this is why Zone 2 and Zone 3 Business Class flights have a) merged together with the same pricing and b) why Cathay is 1,000 Avios more than JAL.

I mean …. whatever the practical logic for the 1,000 Avios difference, common sense would imply that you equalise the two airlines for the sake of simplicity. If you want to fly from Hong Kong to Tokyo in Business Class, it is now 25,000 Avios one way on Cathay Pacific but 24,000 Avios one-way on Japan Airlines.

Conclusion

In truth, for most UK-based HfP readers, these changes are not going to have much of an impact.

You could even argue that we benefit slightly, as these redemptions were clearly becoming expensive for IAG Loyalty. Plugging the hole to make Asian-based flyers pay more, many of whom probably earned their Avios flying with partner airlines and not BA, will hopefully avoid the need for changes elsewhere.

You can’t deny that the programme is now becoming disturbingly complex, and complex is not clever. You can’t expect people to engage with a loyalty programme if they can’t even find a redemption price easily.

We now have separate redemption charts for:

- British Airways peak dates

- British Airways off-peak dates

- Iberia peak dates

- Iberia off-peak dates

- Aer Lingus (matches the BA chart but peak and off-peak dates differ)

- Japan Airlines

- Cathay Pacific

- American Airlines / Alaska Airways

- All other oneworld partners

- Multi-partner redemption chart

- Vueling when booked at vueling com

Oh, and don’t forget that most of these charts are not publicly available on ba.com any longer.

You also need to adjust further for differences in taxes:

- Aer Lingus flights have different taxes depending on whether they are booked on ba.com or avios.com

- Iberia flights have different taxes depending on whether they are booked on ba.com or avios.com

You might also have British Airways On Business points from the small business scheme. The On Business redemption chart isn’t published either – although we have it here – and for added complexity the multiple between Economy and Business is different to the multiple between Economy and Business when using Avios.

All of this confusion keeps the HfP team in a job, I suppose, but it really shouldn’t be necessary.

PS. If you are not a regular Head for Points visitor, why not sign up for our FREE weekly or daily newsletters? They are full of the latest Avios, airline, hotel and credit card points news and will help you travel better. To join our 70,000 free subscribers, click the button below or visit this page of the site to find out more. Thank you.

How to earn Avios from UK credit cards (July 2025)

As a reminder, there are various ways of earning Avios points from UK credit cards. Many cards also have generous sign-up bonuses!

In February 2022, Barclaycard launched two exciting new Barclaycard Avios Mastercard cards with a bonus of up to 25,000 Avios. You can apply here.

You qualify for the bonus on these cards even if you have a British Airways American Express card:

Barclaycard Avios Plus Mastercard

Get 25,000 Avios for signing up and an upgrade voucher at £10,000 Read our full review

Barclaycard Avios Mastercard

Get 5,000 Avios for signing up and an upgrade voucher at £20,000 Read our full review

There are two official British Airways American Express cards with attractive sign-up bonuses:

British Airways American Express Premium Plus Card

30,000 Avios and the famous annual Companion Voucher voucher Read our full review

British Airways American Express Credit Card

5,000 Avios for signing up and an Economy 2-4-1 voucher for spending £15,000 Read our full review

You can also get generous sign-up bonuses by applying for American Express cards which earn Membership Rewards points. These points convert at 1:1 into Avios.

American Express Preferred Rewards Gold Credit Card

Your best beginner’s card – 20,000 points, FREE for a year & four airport lounge passes Read our full review

The Platinum Card from American Express

50,000 bonus points and great travel benefits – for a large fee Read our full review

Run your own business?

We recommend Capital on Tap for limited companies. You earn points worth 0.8 Avios per £1 on the FREE standard card and 1 Avios per £1 on the Pro card. Capital on Tap cards also have no FX fees.

Capital on Tap Visa

NO annual fee, NO FX fees and points worth 0.8 Avios per £1 Read our full review

Capital on Tap Pro Visa

10,500 points (=10,500 Avios) plus good benefits Read our full review

There is also a British Airways American Express card for small businesses:

British Airways American Express Accelerating Business Card

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

There are also generous bonuses on the two American Express Business cards, with the points converting at 1:1 into Avios. These cards are open to sole traders as well as limited companies.

The American Express Business Platinum Card

50,000 points when you sign-up and an annual £200 Amex Travel credit Read our full review

The American Express Business Gold Card

20,000 points sign-up bonus and FREE for a year Read our full review

Click here to read our detailed summary of all UK credit cards which earn Avios. This includes both personal and small business cards.

Rob

Rob

Comments (58)