Should you take 7,000 Avios from Barclaycard instead of the annual upgrade voucher?

Links on Head for Points may support the site by paying a commission. See here for all partner links.

In April 2023 Barclays added an Avios alternative to the annual upgrade voucher you can earn from the two Barclaycard Avios credit cards and Barclays Premier current accounts.

Instead of the voucher, you can now choose to take a one-off lump sum of 7,000 Avios.

On the face of it, it doesn’t sound like much of a deal, but let’s look into it more closely.

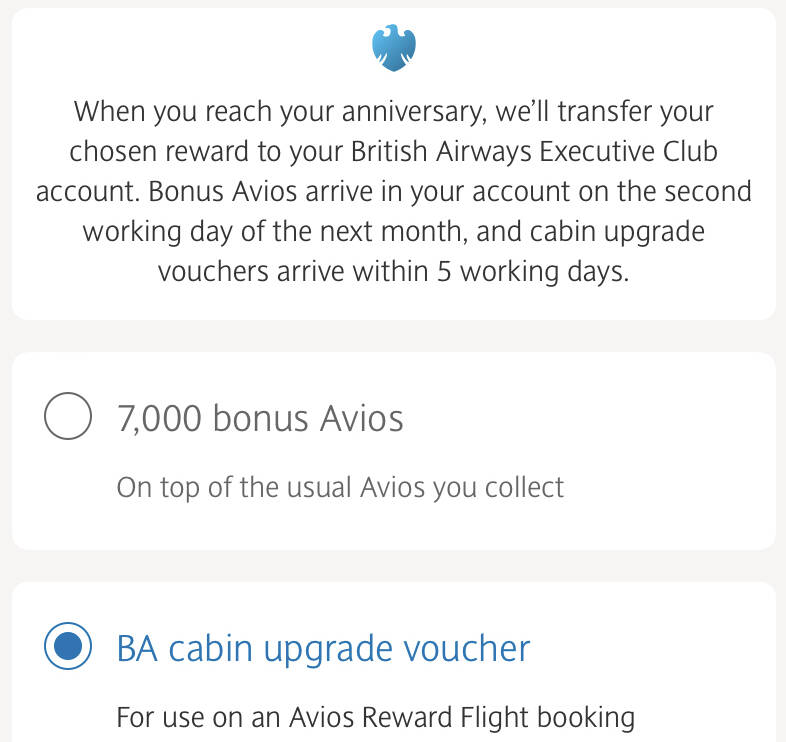

Once you have hit your spending target for the year on your Barclycard – either £10,000 or £20,000 – or reached your 12-month Barclays Premier anniversary you will see the following appear in the Barclays app:

Importantly, if you are a credit card holder, there is no rush to choose your reward.

If you don’t want the trigger the voucher immediately – which starts the two year clock on having to use it – you can wait. However, if you don’t make a selection before the end of your membership year, the upgrade voucher is issued by default.

You cannot swap existing, issued, upgrade vouchers for the 7,000 Avios bonus.

Is 7,000 Avios a good deal?

To answer that, we need to go back to how the upgrade vouchers work.

There are three ways of earning a Barclays upgrade voucher:

- have a Barclays Premier current account with Barclays Avios Rewards activated – you will receive an upgrade voucher every 12 months

- have the free Barclaycard Avios Mastercard credit card and spend £20,000 in your card year

- have the £20 per month Barclaycard Avios Plus Mastercard credit card and spend £10,000 in your card year

How the Barclays upgrade vouchers work

The full details are on this page of ba.com. If there is any divergence between that page and what I write below, trust ba.com.

Put simply, you receive a voucher which can be used to upgrade ONE return Avios flight for one person, or TWO one-way Avios flights, for two people

Let’s get one thing clear though. THIS. IS. NOT. AN. UPGRADE. VOUCHER.

I call it an upgrade voucher. Barclays calls it an upgrade voucher. It is NOT an upgrade voucher.

In practice, this is how it works.

You go to ba.com and book a flight using Avios. If you choose to apply the voucher, the Avios you are charged is the sum required if you had booked in the next lowest cabin on the aircraft.

Instead of an upgrade voucher, it is really a ‘book a flight but only pay the Avios you would have paid if you had booked in the next lowest cabin’ voucher. This isn’t very catchy, so we pretend it is an upgrade voucher.

This DOES make a difference, because:

- the taxes and charges due are the taxes and charges of the higher cabin, since that it what you are booking into (this bit should be obvious), and

- you do NOT need Avios availability in the lower cabin, only in the higher cabin (this bit is NOT obvious)

You are NOT booking 2 x World Traveller Plus seats on Avios and then upgrading them using the voucher. You are booking 2 x Club World seats on Avios and using the voucher to reduce the cost of the Avios component to that of the next lowest cabin.

Is it worth swapping the voucher for 7,000 Avios?

On the face of it, no. You can clearly get substantially more value out of it than 7,000 Avios.

However, I was slightly confused by some of the grumbling when this option was added last year. After all:

- Barclays was not obliged to offer an Avios alternative – it’s not as if Amex lets you swap a 2-4-1 Companion Voucher for an Avios boost – and anything is clearly better than nothing

- you are obviously not forced to swap your upgrade voucher for 7,000 Avios if you don’t want to

- the 7,000 Avios alternative will make sense for a lot of people, as we’ve seen over the last year

Who would benefit from taking 7,000 Avios instead of an upgrade voucher?

People who don’t use Avios for flights

The first, obvious, answer is ‘people who don’t use Avios to redeem for flights’.

Whilst the discussion becomes rather moot on Monday when the Avios to Nectar conversion rate is slashed, historically the free Barclaycard Avios credit card has been THE most generous cashback Visa / Mastercard in the UK, if you convert the Avios into Nectar points.

Here are some comparisons using the rate today (I am ignoring bonus points received when you spend at the ‘host’ retailer):

- £1 spent on the Barclaycard Avios Mastercard gets you 0.67p of Nectar points (if you convert 1 Avios) – this does not factor in the annual bonus

- £1 spent on the Sainsburys Nectar Mastercard gets you 0.1p of Nectar points

- £1 spent on the Tesco Clubcard Mastercard gets you 0.125p of Clubcard points, or 0.25p if spent on partner redemptions

- £1 spent on the Marks & Spencer Mastercard gets you 0.2p of M&S vouchers

- £1 spent on the John Lewis / Waitrose Partnership card gets you 0.25p of John Lewis / Waitrose vouchers

Interestingly, even with the devaluation on Monday, the new rate of 1 Avios = 0.5p of Nectar points still beats all of the cards above.

Anyone who has the Barclaycard Avios Mastercard to use as a general shopping reward card will be happy to take the 7,000 Avios alternative and swap it for, from Monday, £35 of Nectar points.

People who don’t earn enough Avios to use the annual upgrade voucher

The second group of people who may be happy to take the 7,000 Avios alternative are those who use a Barclaycard Avios Mastercard as their ‘back up’ card, with most of their spend going onto a British Airways American Express card.

If these people just about earn enough Avios each year to use their BA Amex 2-4-1 Companion Voucher, they may not have enough extra Avios left to make use of a Barclaycard upgrade voucher.

Taking 7,000 additional Avios from Barclaycard is a double-win – they swap an upgrade voucher they probably won’t use and get closer to the Avios they need to use their Amex voucher.

People whose flight patterns mean that the upgrade voucher doesn’t work for them

Let’s assume that you are happy redeeming Avios for long haul economy flights. Whilst the upgrade voucher might seem a no-brainer – because you can now fly in Premium Economy for the same number of Avios – this is not true. This is because:

- you can only upgrade if Premium Economy Avios seats are available, and these can be tricky to find in such a small cabin

- you are on the hook for substantially higher charges, even if the Avios required is the same as you need in Economy

The voucher is also not great value if used on short haul. This is because you are obliged to use the ‘most Avios, least cash’ redemption option and, on short haul, this is usually not the best value choice. It is different on long haul where the ‘most Avios, least cash’ option is the best choice.

Some Avios collectors are also members of the ABBA fan club (‘anyone but BA’) and would prefer to use their points to redeem on another airline.

If you take 7,000 Avios, the earn rate on the Barclaycard Avios cards is huge

Someone on the free Barclaycard Avios Mastercard who spends exactly £20,000 in a year will earn 20,000 Avios from base spend and 7,000 Avios if they choose the bonus in lieu of the upgrade voucher. This is 1.35 Avios per £1 spent – an exceptional return for a free credit card.

Someone with the paid Barclaycard Avios Plus Mastercard who spends exactly £10,000 in a year will earn 15,000 Avios from base spend and 7,000 Avios if they choose the bonus in lieu of the upgrade voucher. This is 2.2 Avios per £1 spent!

That said, the logic in paying for the Avios Plus card if you are going to take the 7,000 Avios as an annual bonus is slim.

The paid card works best for someone who can easily spend £10,000 to trigger the upgrade voucher but cannot spend £20,000 (or has a better plan for that extra £10,000 of spend, such as triggering a bonus on another card) and has a plan to maximise the value of the voucher.

Conclusion

For the last year, Barclaycard and Barclays Premier have given you a choice about whether to take your annual reward as an upgrade voucher or a 7,000 Avios lump sum.

Whilst on the face of it 7,000 Avios may not seem a generous swap, it isn’t meant to be. It is there to offer an alternative to people who, for one of the reasons I suggested above, do not see value in the upgrade voucher.

To learn more about the cards, read our Barclaycard Avios Mastercard credit card review here and our Barclaycard Avios Plus Mastercard credit card review here.

You can apply for the paid card here (25,000 Avios bonus) here.

The representative APR is 80.1% APR variable, including the annual fee. The representative APR on purchases is 29.9% variable.

You can apply for the free card here (5,000 Avios bonus).

The representative APR is 29.9% variable.

PS. If you are not a regular Head for Points visitor, why not sign up for our FREE weekly or daily newsletters? They are full of the latest Avios, airline, hotel and credit card points news and will help you travel better. To join our 70,000 free subscribers, click the button below or visit this page of the site to find out more. Thank you.

How to earn Avios from UK credit cards (July 2025)

As a reminder, there are various ways of earning Avios points from UK credit cards. Many cards also have generous sign-up bonuses!

In February 2022, Barclaycard launched two exciting new Barclaycard Avios Mastercard cards with a bonus of up to 25,000 Avios. You can apply here.

You qualify for the bonus on these cards even if you have a British Airways American Express card:

Barclaycard Avios Plus Mastercard

Get 25,000 Avios for signing up and an upgrade voucher at £10,000 Read our full review

Barclaycard Avios Mastercard

Get 5,000 Avios for signing up and an upgrade voucher at £20,000 Read our full review

There are two official British Airways American Express cards with attractive sign-up bonuses:

British Airways American Express Premium Plus Card

30,000 Avios and the famous annual Companion Voucher voucher Read our full review

British Airways American Express Credit Card

5,000 Avios for signing up and an Economy 2-4-1 voucher for spending £15,000 Read our full review

You can also get generous sign-up bonuses by applying for American Express cards which earn Membership Rewards points. These points convert at 1:1 into Avios.

American Express Preferred Rewards Gold Credit Card

Your best beginner’s card – 20,000 points, FREE for a year & four airport lounge passes Read our full review

The Platinum Card from American Express

50,000 bonus points and great travel benefits – for a large fee Read our full review

Run your own business?

We recommend Capital on Tap for limited companies. You earn points worth 0.8 Avios per £1 on the FREE standard card and 1 Avios per £1 on the Pro card. Capital on Tap cards also have no FX fees.

Capital on Tap Visa

NO annual fee, NO FX fees and points worth 0.8 Avios per £1 Read our full review

Capital on Tap Pro Visa

10,500 points (=10,500 Avios) plus good benefits Read our full review

There is also a British Airways American Express card for small businesses:

British Airways American Express Accelerating Business Card

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

There are also generous bonuses on the two American Express Business cards, with the points converting at 1:1 into Avios. These cards are open to sole traders as well as limited companies.

The American Express Business Platinum Card

50,000 points when you sign-up and an annual £200 Amex Travel credit Read our full review

The American Express Business Gold Card

20,000 points sign-up bonus and FREE for a year Read our full review

Click here to read our detailed summary of all UK credit cards which earn Avios. This includes both personal and small business cards.

Rob

Rob

Comments (114)