How does the Priority Pass airport lounge card work?

Links on Head for Points may support the site by paying a commission. See here for all partner links.

What is Priority Pass? Is Priority Pass worth the money? How can you get one for free?

We mention the Priority Pass airport lounge card quite a bit on Head for Points, but we very rarely go into the nuts and bolts for new readers about how it works.

Today I want to review Priority Pass in detail by showing you:

- the different types of Priority Pass available

- how you can get one for free with The Platinum Card from American Express, The American Express Business Platinum Card and other selected UK credit cards and premium bank accounts

- which UK airport lounges are part of the scheme

You can find out more, and buy a Priority Pass, on its website here.

What is Priority Pass?

Priority Pass is a card membership scheme which gives you access to 1,400 airport lounges worldwide.

A full list of UK airport lounges which accept Priority Pass is at the bottom of this article. There are only a handful of independent (non-airline run) UK airport lounges which do not take part.

Priority Pass lounges are generally independently owned, not airline owned. In the UK they tend to be run by brands such as No1 Lounges, Plaza Premium and Aspire or directly by the airport.

There are many places where a Priority Pass gets you access to an ‘official’ airline run lounge. In the US, for example, Virgin Atlantic lets cardholders use its lounges during the day as Virgin Atlantic flights tend to be in the evenings.

Priority Pass is owned by a UK-based group called Collinson. Collinson also owns a number of insurance businesses and a major loyalty consultancy, and runs the online shopping portals for many hospitality groups including BA and Virgin Atlantic.

Priority Pass offers restaurant and ‘airport experiences’ too

Priority Pass also has deals with selected airport restaurants and other service providers.

Some airport restaurants will offer a £18 credit against a meal if you show a Priority Pass. There are also deals for free treatments with some airport spas or free visits to airport gaming centres.

These offers are NOT available to you if your Priority Pass comes free with an American Express card. Cards provided by other banks such as HSBC do provide restaurant credits.

If you bought your Priority Pass for cash, the £18 restaurant credits are a terrible deal. You are likely to have paid more than £18 per card use based on the number of visits included.

What do the airport lounges offer?

Facilities vary by lounge, as does the quality and scale of those facilities.

As a minimum, you should expect comfortable seating, free wi-fi, free drinks (usually including alcohol, premium drinks may be chargeable) and free snacks. In the better lounges you will find a full buffet with hot and cold food and showers.

Above is a picture of the buffet at the Vienna Lounge at Vienna Airport which recently won the Priority Pass ‘Lounge of the Year’ award (click to enlarge). The photo below is also from the Vienna Lounge.

Are you guaranteed entry to a lounge?

In theory, you can just turn up at a participating airport lounge, have your Priority Pass card or app scanned, and you will be allowed in.

You can visit multiple lounges on the same day if you wish if you are in an airport which has multiple options.

Some lounges in major UK airports become full at peak times and will not accept ‘walk up’ Priority Pass guests. However, you can now pay a £6 per person fee to reserve a slot in most UK Priority Pass lounges. This will guarantee you entry when you arrive.

You can book a reservation via the Priority Pass app or, for No1 Lounge / My Lounge / Clubrooms / Club Aspire, via this website.

What are the different types of Priority Pass membership?

Priority Pass has three different levels of paid membership as you can see on its website here.

Here are the tiers:

- Standard membership (£69) – no free visits included, you and your guests pay £24 each time

- Standard Plus membership (£229) – 10 free visits then £24 for every additional visit or for every guest visit

- Prestige membership (£419) – all your visits are free, your guests pay £24 each time

When there is an additional charge indicated, you do NOT pay this to the lounge on the day you fly.

What happens is that, when you enter a lounge, your Priority Pass card is swiped and the number of guests marked down. If payment is required, your stored credit card is charged by Priority Pass at a later time. No money changes hands in the airport.

Which Priority Pass membership tier is best?

There is no ‘right’ answer here. It depends on how often you fly and whether you are using airports which have lounges which accept Priority Pass. You can search the Priority Pass website by airport to find participating lounges.

The Standard Plus membership is the most attractive option for most people. As long as you hit 10 visits within your membership year, you will only be paying £22.90 each time. My personal value benchmark is how much a bowl of pasta and a glass of wine would cost in a terminal restaurant versus the lounge access cost – so £22.90 seems OK to me.

It is possible that the Prestige card could be a better deal, but you need to do the maths. You would need to do 18 lounge visits per year before the Prestige card became better value than Standard Plus.

Standard membership is not huge attractive. If you made seven or more lounge visits per year you would be better off with Standard Plus. If you are doing fewer than seven lounge visits, the ‘cost per visit’ of the Standard plan would be so high – given the £69 flat fee and the £24 payment per visit – that I doubt you would be getting value for money.

Does Priority Pass have an app?

Yes, and it is a good one, allowing you to easily find participating lounges.

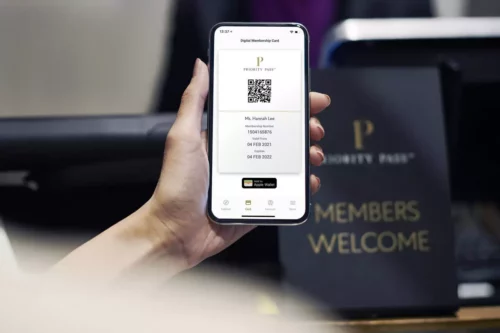

Priority Pass has a digital membership card inside the app which saves you from carrying your plastic card with you.

Can I get a Priority Pass via a UK credit card?

This is the interesting bit.

The Platinum Card from American Express comes with TWO free Priority Pass cards. One is in your name, and one is in the name of whoever you give your supplementary Platinum card to.

Each Priority Pass card admits two people to a lounge for free. This means that, if you travel with your partner and your partner is your nominated supplementary Platinum cardholder, you can get four people into a lounge between you.

I will repeat this point because it is a little odd:

- you CANNOT buy a Priority Pass direct from the company which lets you bring in a guest for free, but

- you CAN get a free Priority Pass via The Platinum Card from American Express which does give you one free guest on every visit!

American Express Platinum also comes with other lounge benefits. You can access Delta airport lounges when flying Delta, selected Lufthansa lounges when flying Lufthansa and, more usefully for UK residents, you can access Eurostar lounges for free. American Express also has its own ‘Centurion’ airport lounges in selected airports, although Heathrow Terminal 3 is the only UK site.

The Platinum Card is not cheap but comes with a LOT of travel benefits. There is also a fat sign-up bonus for new cardholders.

You can find out more in our The Platinum Card from American Express review here. You can apply for The Platinum Card here.

SPECIAL OFFER: Until 14th October 2025, the sign-up bonus on The Platinum Card from American Express is increased to 80,000 Membership Rewards points. This would convert to 80,000 Avios! The spend target is changed to £10,000 within SIX months of approval. T&C apply. Click here to apply.

If you are a small business owner, the same rules apply to The American Express Business Platinum Card.

You can find out more in our The American Express Business Platinum Card review here. You can apply for The American Express Business Platinum Card here.

SPECIAL OFFER: Until 14th October 2025, the sign-up bonus on The American Express Business Platinum Card is increased to 120,000 Membership Rewards points. This would convert to 120,000 Avios! The spend target is changed to £12,000 within three months of approval. T&C apply. Click here to apply.

Get four free airport lounge visits with ‘free for a year’ Amex Gold

If you are a light traveller, you might find The American Express Preferred Rewards Gold Credit Card a better deal.

For a start, this card is FREE for your first year but comes with four free Priority Pass airport lounge visits. You can either use these all for yourself across four visits or for you plus three guests for one visit (or, of course, you plus one guest over two visits).

You can four additional free lounge visits each year if you keep the card, albeit there is a £195 annual fee from Year 2. Lounge visits above your four free ones are charged at £24 which is usually a big saving on booking directly with the lounge.

SPECIAL OFFER: Until 14th October 2025, the sign-up bonus on the American Express Preferred Rewards Gold Credit Card is doubled to 40,000 Membership Rewards points. This would convert to 40,000 Avios! The spend target is changed to £5,000 within SIX months of approval. T&C apply. Click here to apply.

Other options which come with a Priority Pass or its competitor DragonPass include:

- Barclaycard Avios Plus Mastercard (you pay £20.50 per lounge visit, or get four free visits per year if you also have a Barclays Premier account)

- The American Express Business Platinum Card (same deal as the personal card above)

- HSBC Premier credit cards (free entry for World Elite, £24 for the free card)

- NatWest Black current accounts

Conclusion

If you are fed up of sitting in airport terminals but do not have airline status or do not fly Business Class, Priority Pass is the easiest way to access airport lounges across the world.

You need to think carefully about which of the three membership tiers is best for you. If you always travel with your partner, you may find The Platinum Card from American Express or The American Express Business Platinum Card to be a cheaper option.

Of course, you can’t beat the four free airport lounge visits which come with The American Express Preferred Rewards Gold Credit Card, especially as your first year is free.

You can find out more about Priority Pass, and buy one, on their website here.

Appendix – Which UK airport lounges are in Priority Pass?

Here is the full list of UK airport lounges which accept Priority Pass, along with links to our reviews. There are another 1,400 lounges outside the UK too.

We have NOT listed restaurants at UK airports which give a £18 meal credit to anyone who does not get their Priority Pass from American Express. However, you can find the list in this article.

- Aberdeen International – Northern Lights Executive Lounge (review)

- Belfast City – Aspire lounge (review but now refurbished)

- Belfast International – Causeway lounge (review)

- Birmingham – Aspire lounge (review), Aspire Lounge South (review), No1 Lounge (review), Clubrooms lounge (review)

- Bristol International – The Escape lounge (review)

- Derry – Amelia Earhart lounge (review)

- East Midlands – The Escape Lounge (review)

- Edinburgh International – Aspire lounge (review), Aspire lounge #2 (review), Plaza Premium lounge (review)

- Exeter – The Executive Lounge (review)

- Glasgow International – UpperDeck (review), The Lomond Lounge (review)

- Humberside International – Aspire lounge (review)

- Inverness – Aspire lounge (review)

- Isle of Man Ronaldsway – Rendezvous Executive Lounge (review)

- Jersey – The Executive Lounge (review)

- Leeds Bradford International – The Yorkshire Lounge (review)

- Liverpool John Lennon – Aspire lounge (review)

- London Gatwick (North) – Plaza Premium (review), No1 Lounge (review), Clubrooms (review), The Gateway (review)

- London Gatwick (South) – No1 Lounge (review), Club Aspire (review), My Lounge (review)

- London Heathrow (Terminal 2) – Plaza Premium lounge (review)

- London Heathrow (Terminal 3) – Club Aspire Lounge (review), No1 Lounge (review)

- London Heathrow (Terminal 4) – Blush by Plaza Premium (review), Plaza Premium lounge (review)

- London Heathrow (Terminal 5) – Club Aspire Lounge (review), Plaza Premium lounge (review)

- London Luton – No1 Lounge (review), My Lounge opening June 2024

- London Southend – Skylife lounge (review, currently closed)

- London Stansted – The Escape Lounge (review)

- Manchester International (Terminal 1) – Aspire lounge (review), The Escape Lounge

- Manchester International (Terminal 2) – The Escape Lounge (review), Aspire lounge, 1903 (review)

- Manchester International (Terminal 3) – The Escape Lounge (review)

- Newcastle International – Aspire lounge

- Newquay Cornwall – Executive Lounge (review)

- Norwich International – Executive Lounge (review)

- Southampton International – Spitfire Lounge (review)

- Teesside International – Rockliffe Lounge

Sign-up bonus and earn rate:

- Get 80,000 Membership Rewards points when you spend £10,000 in your first six months

- This is a special offer which runs to 14th October 2025

- Earn 1 Membership Rewards point per £1 spent

- Points transfer at 1:1 into Avios and Virgin Points

- You can also convert to other airlines, Eurostar and hotel schemes

Other information:

- Two Priority Pass cards, each allowing two people into 1,400 airport lounges

- Elite status in four major hotel loyalty programmes

- Comprehensive travel insurance

- £400 per year of restaurant credit

- Annual fee: £650

- T&C apply to the bonus and all benefits

Representative 691.7% APR variable based on an assumed £1,200 credit limit and £650 annual fee. Interest rate on purchases 29.7% APR variable.

You will receive 80,000 American Express Membership Rewards points as a sign-up bonus on The Platinum Card if you spend £10,000 within six months of the date you are approved.

80,000 points is a special offer which is only available until 14th October 2025. The standard offer is just 50,000 points.

Membership Rewards points are hugely flexible. You can transfer them into Avios, Virgin Points or other airlines (usually at 1:1) or into various hotels schemes, into Club Eurostar or use them for shopping vouchers.

This is the ONLY personal American Express card where you still qualify for the bonus if you already hold a British Airways American Express card.

To qualify for the bonus, you must NOT, currently or in the previous 24 months, have held any other personal American Express card which earns Membership Rewards points. This includes The Platinum Card and Preferred Rewards Gold.

You are OK if you had a supplementary card on someone else’s American Express account.

You are OK if, currently or in the previous 24 months, you have held any other American Express card, including the British Airways, Marriott and Nectar cards.

For clarity, you can still apply for The Platinum Card even if you do not qualify for the bonus. You would still benefit from the long list of other benefits.

The Platinum Card from American Express comes with an unrivalled list of benefits for the keen traveller.

Your personal travel patterns will determine which of these is the most valuable. The key benefits are:

Full comprehensive travel insurance for you, your family and the family of your supplementary cardholder, subject to enrolment

Two Priority Pass cards, each of which allows the holder and a guest unlimited free access to 1,400 airport lounges

Free pre-booking of selected UK Priority Pass lounges to guarantee entry (four credits for 2025 and eight credits for 2026 and 2027, one credit allows pre-booking for one person on one visit)

Elite status in four major hotel loyalty schemes: Marriott Bonvoy (Gold), Hilton Honors (Gold), Radisson Rewards (Premium), MeliaRewards (Gold)

Access to Eurostar lounges, irrespective of travel class

£200 per year to spend in over 170 UK restaurants (credited as £100 per half year)

£200 per year to spend in over 1,500 international restaurants (credited as £100 per half year)

Terms and conditions apply to all of the benefits above.

You need a minimum personal income of £35,000 to apply for the card.

The American Express Business Platinum Card

Sign-up bonus and earn rate:

- Get 120,000 Membership Rewards points when you spend £12,000 in your first three months

- This is a special offer which runs to 14th October 2025

- Earn 1 Membership Rewards point per £1 spent

- Earn 10,000 bonus points in every month you spend £10,000+

- Points transfer at 1:1 into Avios and Virgin Points

- You can also convert to other airlines, Eurostar and hotel schemes

Other information:

- Get £200 per year to spend at Amex Travel

- Two Priority Pass cards, each allowing two people into 1,400 airport lounges

- Elite status in four major hotel loyalty programmes

- Get £150 per year to spend at Dell

- Get £300 per year to spend at job ads site Indeed

- Comprehensive travel insurance

- Annual fee: £650

- T&C apply to the bonus and all benefits

This is a charge card, not a credit card. You must clear your balance in full each month. Annual fee £650.

You will receive a sign-up bonus of 120,000 American Express Membership Rewards points if you spend £12,000 in three months from the date of approval.

120,000 points is a special offer which is only available until 14th October 2025. The standard offer is just 50,000 points.

Membership Rewards points are hugely flexible. You can transfer them into Avios, Virgin Points or other airlines (at 1:1) or into various hotels schemes, into Club Eurostar or use them for shopping vouchers.

There are no longer any rules on qualifying for the sign-up offer on this card, subject to hitting the spend target. If you are accepted and spend the required amount you will receive the bonus, irrespective of what other cards you hold or have recently held.

The American Express Business Platinum Card comes with an unrivalled list of benefits for the keen traveller.

Your personal travel patterns will determine which of these is the most valuable. The key benefits are:

£200 of Amex Travel credit per membership year

Full comprehensive travel insurance for you, your family and the family of up to five complimentary cardholders, subject to enrolment

Two Priority Pass cards, each of which allows the holder and a guest unlimited free access to 1,400 airport lounges

Free pre-booking of selected UK Priority Pass lounges to guarantee entry (four credits for 2025 and eight credits for 2026 and 2027, one credit allows pre-booking for one person on one visit)

Elite status in four major hotel loyalty schemes: Marriott Bonvoy (Gold), Hilton Honors (Gold), Radisson Rewards (Premium), MeliaRewards (Gold)

Other benefits include:

£150 of Dell statement credit per year – you receive £75 credit on Dell purchases betweeen January and June and £75 credit on purchases between July and December

£300 of credit to run job advertisements at indeed.com (£75 per quarter)

Digital subscription to The Times and The Sunday Times, worth over £300

You need a minimum personal income of £35,000 to apply for the card.

Terms and conditions apply to all card benefits.

Rob

Rob

Comments (91)